2018 just began but we already knew before that new technologies such as 3D sensing are going to be huge this year after the launch of Apple’s iPhone X last September. Using faces to unlock phones and personalize expressive Animojis are probably the two most memorable features that make 3D sensing widely known of among consumers. Surely, other phone makers will not let go of a chance to sport their products with similar capabilities, hence we learn the projection that the total value of the global market of mobile 3D Sensing is anticipated to grow at a CAGR of 209% from USD 1.5 billion in 2017 to USD 14 billion by 2020.

Apart from mobile devices, 3D sensing is actually applied in a myriad of applications, including AR/VR, automotive technology, drones, biometrics, robotics, gaming, laptops, and home applications. It means a lot of companies are participating in the development, whether it is about components, modules, systems, or algorithms. Here LEDinside lists out some names in these fields that have either already been brought up many times or have been spending years on relevant developments which are now worthy of note in 2018.

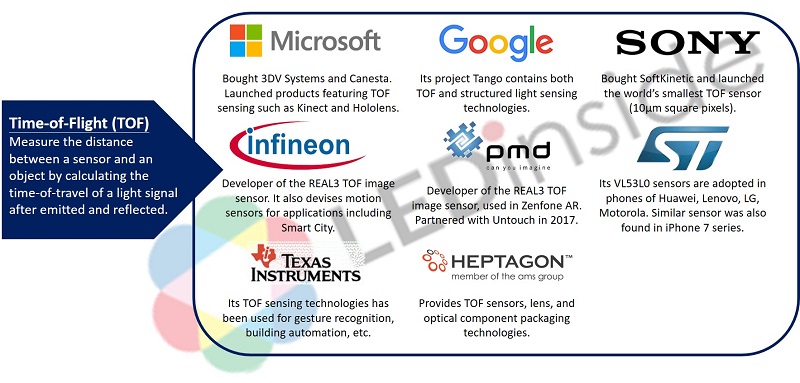

Time of Flight: Microsoft, Sony, Infineon, PMD Technologies, TI

3D Sensing can be realized through several technologies, including Structured-Light, Time of Flight (ToF), Light coding, and stereo vision. Major tech companies put their efforts in the first two methods.

Time-of-flight sensing is conducted by calculating the speed of light travelling between a range image camera system and an object to measure the distance. Key components required in ToF camera modules are illumination units, usually LEDs or laser diodes to provide light pulses, and image sensors. The technology keeps evolving and grows advanced after years of development from companies such as Microsoft, Sony, Infineon, and PMD Technologies.

The first exposure of Microsoft’s 3D sensing development perhaps can be traced back in 2009 when it acquired 3DV Systems for USD 35 million, followed by another acquisition of 3D sensor chip manufacturer Canesta. It launched motion sensing device Kinect for Xbox One that had TOF sensing features enabling users to play games with gestures and audio commands.

Sony in 2015 bought SoftKinetic, a Belgian gesture recognition technology developer known for its technology DepthSense consisting of CMOS sensor-based TOF systems. In 2017, it announced it has developed the world’s smallest TOF sensor with an extreme size of 10µm square pixels. Small as it is, the back-illuminated TOF image sensor is able to carry out highly accurate distance measuring.

Meanwhile, two German-based semiconductor companies Infineon and PMD Technologies are also developing 3D time-of-flight sensors for various applications, which includes the REAL3 TOF image sensor, co-developed by both of them, in Asus’s Zenfone AR. The 3D modules in Google’s Tango and the Lenovo Phab 2 Pro are also from PMD. In July, PMD Technologies also announced to choose the Riemann Platform, a new 3D gesture recognition solution developed by Chinese AI startup Untouch, as the middleware for its CamBoard pico flexx to create intuitive human-computer interaction for mobile devices.

Texas Instrument is also on the list. The US-based firm develops a series of TOF technologies for building automation systems and robotics.

In general, as the sensing process and calculation method of Time-of-Flight technology enables fast and true distance measurement, it is usually adopted in applications that are more 'detection-oriented’ and might require data of distance measurement.

Structured Light: the Apple Supply Chain

By comparison, judging by products currently being exposed to the public, structured light 3D sensing is applied in more ‘recognition-oriented’ applications. With various algorithms, in one case, it can be used to tell if features of an object or a person match those preset in a computer to identify or define whether it is allowed to access a specific device. That is the iPhone X’s face ID. The Apple supply chain must be mentioned here.

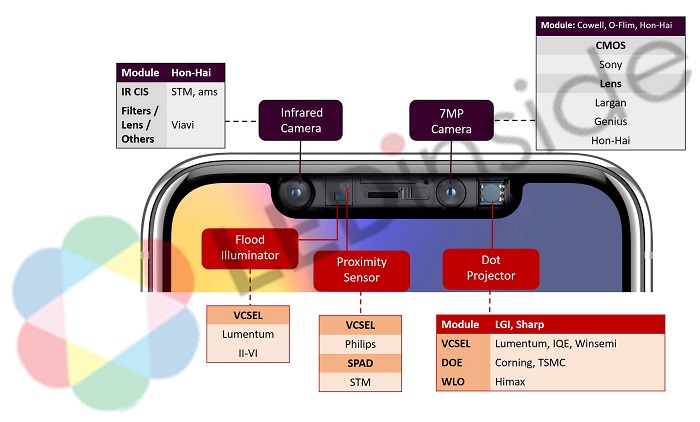

A structured light module basically consists of an emitter and a receiver to project a pattern onto an object and receive signals of the deformed light pattern, based on which the depth can be inferred via algorithms. In particular, VCSELs are used in the module to make sure the light projected is concentrated enough and can be evenly distributed on the subject through a wafer level lens and a diffractive optical element.

In the emitter module of Apple’s TrueDepth Camera, the dot projector, flood illuminator, and proximity sensor represent a collection of advanced semiconductor-level optical technologies. The VCSELs are produced with Lumentum and II-VI’s design, IQE’s know-hows of epitaxial growth, and dicing and packaging technologies from Winsemi and AWSC. TSMC manufactures the DOE that structures the output light with materials provided by Corning, while VisEra and Xintec complete the back end of line (BEOL).

On the other hand, in the receiver module are the Cupertino company’s existing 7MP camera and the infrared camera carrying technologies from companies such as Largan, STM, and Tong Hsing.

Apple in December 2017 also announced to offer Finisar USD 390 million to boost its laser chip production and secure a part of Finisar’s VCSEL production for its Airpods. Finisar is expected to ship out products starting in the second half of 2018.

Highlights Waiting Ahead in 2H18: Qualcomm & Himax

In 2018, another 3D sensing supply chain is also shaping up—Qualcomm and Himax (and possibly with Lumentum and Princeton Optronics). It is also building a module with Himax’s proprietary WLO and DOE to operate with chips and computing solutions from Qualcomm. The source of VCSELs is likely to be Princeton, wholly-owned by sensor solution provider ams, or Lumentum, both of which have the capability to manufacture 6-inch VCSEL wafers. The 3D Sensing solution of this supply chain is likely to roll out in 2H18 and will be adopted in Android phones.

The technologies required to realize 3D sensing capabilities, across algorithms, chip processors, and optical components, need to be highly reliable and efficient. Companies partaking in this realm are way more numerous than the ones mentioned here, but you will get the idea that the number will just be incremental and that the companies will diversify in the next few years.