According to the latest report “2019 Chinese LED Chip and Package Industry Market Report” from LEDinside, a division of the market research firm TrendForce, in 2018, the scale of Chinese LED package market was USD 10.5 billion, enjoying an increase of 4.5% YoY. Looking into 2019, since LED lighting industry has entered the mature period, manufacturers are expecting a larger market demand for high-end lighting, like professional lighting and healthy lighting. In addition, UV-LED, automotive lighting and digital display (video wall) will be the major driving forces for LED industry development in the future.

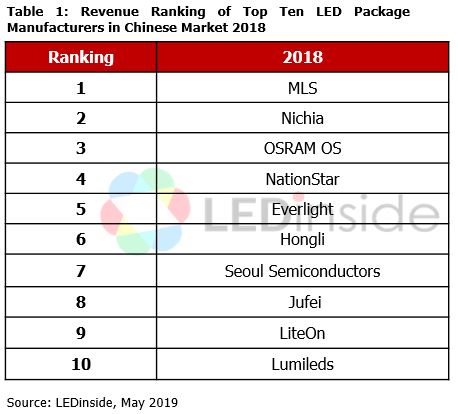

In respect of the overall development of Chinese LED industry, benefiting from production capacity and OEM orders, LED makers from mainland China have all obtained rank improvement in 2018 and manufacturers like MLS, NationStar, Jufei and Hongli, kept achieving increased revenue. In terms of international firms, with its proprietary technologies in high-end applications like backlight, automotive lighting, Nichia Corporation has remained in the second place. OSRAM Opto Semiconductors was third relying on its advantages in markets like automotive lighting and landscape lighting. Besides, manufactures in Taiwan, mainland China and in other areas also showed strong competitiveness in the high-end field. In 2018, top 10 LED manufactures took up 47% of market share, slightly declining from last year. The major reason was that emerging makers managed to catch up with these top manufacturers. Emerging makers like Dongshan Precision (DSBJ) and Lightning Opto, which saw descent revenue growth in 2018, are expected to enter in the top 10 list within 2 years.

Specific Market in LED industry - Automotive Lighting, Display, Backlight and Lighting Markets

Automotive Lighting Market

As the popularization of new energy vehicle accelerated, the demand for automotive LED lighting has increased year by year. In addition, the penetration of LED lighting for traditional fuel vehicles also rose. The acceptance for automotive LED has improved significantly, especially in PM, which promoted the stable development of the automotive LED industry. Thus, there are more and more LED makers went into this field. Besides OSRAM Opto Semiconductors, some other international manufacturers, like Nichia, Lumileds and Seoul Semiconductors also strengthened their business operation in this market. Makers in mainland China and Taiwan, such as Hongli, NationStar, Lattice Power, and Everlight, are following closely. However, the automotive lighting industry is strict with products and the switching costs for suppliers is pretty high, so the original suppliers still have strong advantages and play dominant roles.

Digital Display (Video Wall) Market

Given the increased proportion of fine pitch display, the market demand for LED grew rapidly. Thus LED manufacturers, including mainland Chinese NationStar, Dongshan Precision (DSBJ), and Kinglight, expanded production capacity. At the beginning of 2019, LED manufacturers have gone on launching

Backlight market

In respect of small-sized backlight, its market scale kept declining due to the impact of OLED market. But some Chinese makers still got increased revenue. There were mainly 2 reasons: One was that Chinese mobile phone sales improved, stimulating the shipment of domestic supply chain; the other one was that international firms placed OEM orders to Chinese makers, leading to a result that the manufacturing process gradually concentrated on the larger companies.

In terms of medium and large-sized backlight market, it is expected to apply Mini LED product design as HD display and HDR market develop. Though it was just in the early stage in 2018, its future will be prosperous. Both brand vendors and LED makers in China pay highly attention to this market and undertake a great deal of R&D and investment.

General Lighting and Architectural Lighting market

As a production base of global LED lighting end products, international well-known companies, including Signify, OSRAM and IKEA, all look for OEM in China. Benefiting from the sound growth of retrofit lamps orders, like bulbs and tubes, lighting LED saw an obvious trend of standardization. Packaging factories like MLS, Hongli and Lightning Opto developed against trend. The advantage of production scale and competitiveness of cost continually strengthened. The second-tier companies have gradually withdrawn from lighting market, which accelerated the concentration of OEM orders in the leading makers. In addition, international high-power lighting orders and architectural lighting require high luminous efficacy, high power and high reliability for lighting LED products, CREE can still maintain sound growth in lighting LED market, ranking top 4.

For further more information, please consult LEDinside Report on 2019 Chinese LED Chip and Package Industry Market Report

2019 Chinese LED Chip and Package Industry Market Report

Release:June 2019

Format:PDF+EXCEL

Language:Traditional Chinese/English

Page:200

Chapter I. Chinese LED Package Industry Trend

♦2019-2023 Chinese LED Package Market Scale

♦2019-2023 Chinese LED Package Market Scale- Market Segments

♦2019-2023 Chinese LED Package Market Scale- Market Camps

♦2019-2023 Chinese LED Package Market Scale- Product Power

♦2017-2018 Global Top Ten LED Players in China

♦2017-2018 Top Ten Chinese LED Players

Chapter II. Chinese LED Industry Market Segment Trend

Mobile Backlight and Flash LED Market

♦2018-2023 Chinese Mobile Backlight and Flash Market Scale

♦2019 Flash LED Supply Chain

♦2018 Chinese Mobile Backlight and Flash LED Player Ranking

TV Backlight Market

♦2018-2023 Chinese Large-sized Backlight LEDs Market Scale

♦2019 TV Backlight LED Supply Chain Analysis

♦2018 Chinese Large-sized Backlight LED Player Ranking

General Lighting and Architectural Lighting Market

♦2018-2021 Chinese General Lighting LED Package Market Scale

♦2018-2023 Chinese Architectural Lighting LED Market Scale

♦Chinese General Lighting LED Market Supply Chain Analysis

♦2018 Chinese Lighting LED Player Ranking

Automotive Lighting Market

♦2018-2023 Chinese Automotive LED Market Scale

♦2019 Chinese Automotive LED Value Chain

♦2018 Automotive LED Player Ranking

Digital Display Market

♦2018-2023 Chinese Digital Display LED Market Scale

♦2018 Display LED Supply Chain Analysis Application Market

♦2018 Chinese Display LED Manufacturer Ranking

UV LED Market

♦2018-2023 Chinese UV LED Market Scale

Mini/Micro LED Market

♦2018-2023 Chinese Mini/Micro LED Market Scale

♦Mini/Micro LED Manufacturer Progress

Chapter III 2019 LED Industry Main Focus and Analysis

Topic One: The US-China trade frictions led to the downturn in market demand of Chinese LED industry.

♦The process that the US-China trade conflicts happened

♦Analysis on the influence of the US-China trade conflicts on LED industry

Topic Two: Opportunity for Chinese Lighting Market - Healthy Lighting and Architectural Landscape Lighting

♦Many Chinese manufacturers launched new products of healthy lighting after international enterprises.

♦As healthy lighting receives attention, the era of full-spectrum lighting is around the corner.

Topic Three: New Display Captures Attention and Mini LED is Expected to Achieve Mass Production in 2019.

♦Analysis on key factor of Mini LED mass production

♦Analysis on the development situation of Mini LED manufacturers

Chapter IV. China Major LED Package Player Analysis

♦17 Chinese LED Package Manufacturers Operation Performance, Capacity Plan and Business Strategy

Chapter V. International LED Manufacturer Business Strategy in China

♦16 Oversea LED Package Manufacturers Operation Performance and Business Strategy

Chapter VI. Competitiveness of Chinese LED Package Industry

♦Major LED Manufacturers Global Revenue

♦Major LED Manufacturers Revenue from China Market

♦Major Manufacturers Revenue from China

♦Concentration of Production Value

♦Key Drivers and Restraints in Chinese LED Package Industry

♦2018 Chinese Package Maker R&D Expenditure Analysis

Chapter VII. Chinese LED Chip Market Analysis

♦2011-2018 Government Subsidy for Chinese LED Chip Industry

♦2016-2018 Chinese Chip Market Supply Change- By Camp

♦2018-2023 Chinese Chip Market Scale

♦2018 Chip Manufacturer Revenue Ranking in China

♦11 Major LED Chip Manufacturers Operation Performance, Capacity Plan and Business Strategy

Further information, please contact:

|

Global Contact:

|

Taipei:

|

|

Shenzhen:

|

|

Grace Li

|

Eric Chang

|

Paula Peng

|

Perry Wang

|

|

Graceli@trendforce.com

|

Eric.chang@trendforce.com

|

Paulapeng@trendforce.com

|

perrywang@trendforce.cn

|

|

+886-2-8978-6488 ext.916

|

+886-2-8978-6488 ext.822

|

+886-2-8978-6488 ext.820

|

+86-755-8283-8931 ext.6800

+86-13825284100

|