According to the latest report by the LEDinside research division of TrendForce, titled 2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System, Over 10 types of high-end smartphones are expected to use 3D sensing solutions and some of them will expand the use of 3D sensing in the front and rear cameras in 2020, which will further increase the VCSEL market value. According to TrendForce, the VCSEL market scale used for 3D sensing in mobile devices will be likely to grow by 30% in 2020.

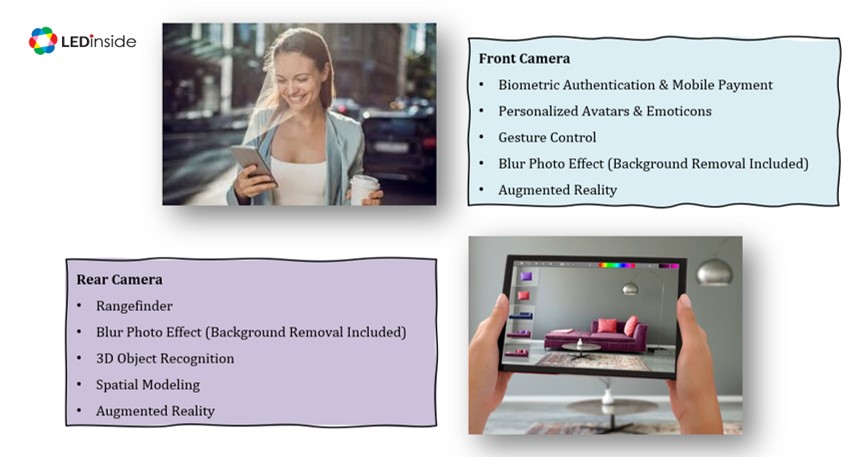

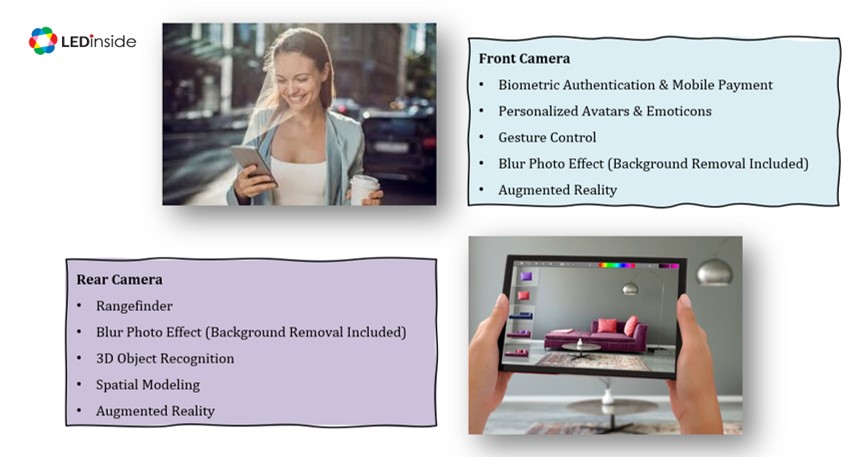

Smartphone brands will be engaging in a 'specs -contest' with their flagship devices, and 3D sensing will become an important feature in that race. 3D sensing used with front camera will provide the features include biometric authentication & mobile payment, personalized avatars & emoticons, gesture control, blur photo effect (background removal included) and augmented reality (AR). Since 2H19, 3D sensing has been equipped with rear camera to provide features like rangefinder, blur photo effect (background removal included), 3D object recognition, spatial modeling and augmented reality. 3D sensing combined with 5G transmission and AR function with gesture control to realize interactive augmented reality will welcome an indeed big opportunity.

“ Over 10 types of high-end smartphones are expected to use 3D sensing solutions and some of them will expand the use of 3D sensing in the front and rear cameras in 2020, which will further increase the VCSEL market value. According to TrendForce, the VCSEL market scale used for 3D sensing in mobile devices will be likely to grow by 30% in 2020.” says TrendForce Research Manager Joanne Wu.

The 3D sensing solutions currently used in the consumer market are structured light, time-of-flight (ToF) and active stereo vision.

1. Structured Light acquires the image through projected light patterns, and is able to determine depth with extreme precision, though it comes with a high cost and computational complexity. Moreover, APPLE holds the patent for the technology, forming a formidable patent barrier. The product trend of structured light VCSEL will move toward for providing larger field of view, more uniform image, small package size, so the screen-to-body ratio further improves.

2. Time of Flight does not enjoy the precision and depth that structured light does, but its fast reaction speeds and detection range make up for it. TOF cameras may be divided into front-facing and world-facing versions, with front-facing ToF costing more and world -facing cameras using the higher power VCSELs. Currently, indirect ToF sensing solution is widely used. Direct ToF is going to become the trend in the future, the major advantage is to save energy. Time of Flight technology will be used in APPLE, Samsung Electronics, Huawei, SONY, etc.

3. Active Stereo Vision calculates depth information by using two or more than two cameras to collect images simultaneously and comparing the differences between images got at the same time. Google Pixel 4 adopts active stereo vision, which can be seen that Google overcomes the precision problem of hardware module with higher software calibration ability compared to other competitors in the industry. Likewise, active stereo vision uses dot projector and flood illuminator, but the technical complexity and cost of VCSEL are greatly reduced compared to structured light technology.

As APPLE owns comprehensive structured light patent of hardware and software to provide the highest safety. Regarding facial recognition, the effect of Front Facing ToF is not as good as that of Structured Light. Thus, some mobile vendors are looking for the best solutions in the market.

Major VCSEL-related companies currently include Lumentum, Finisar, OSRAM's Vixar, ams, Lite-on Technology, WIN Semiconductors Corp., Advanced Wireless Semiconductor Company (AWSC), Visual Photonics Epitaxy Co., Ltd. (VPEC), etc. But the new supplier is likely to appear as function applications increase from front camera to rear camera.

According to the latest report by the LEDinside research division of TrendForce, titled "2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System," in 2020, market attention will focus on infrared sensing applications including mobile devices 3D sensing, LiDAR, driver monitoring system, optical communication, SWIR and broadband IR market potential, 1D ToF and proximity sensor and more.

LEDinside concentrated on major infrared sensing application markets mentioned above, discussed and analyzed market size, opportunity and challenge, product specification and supply chain from the prospective of terminal application requirements, with an aim to provide a more comprehensive understanding of IR sensing application markets for readers.

2020 Infrared Sensing Application Market Trend- Mobile 3D Sensing, LiDAR and Driver Monitoring System

Release Date: 01 January 2020

Language: Traditional Chinese / English

Page: 153

Chapter I. Infrared Market Scale and Application Trend- IR LED, VCSEL and LiDAR Laser

Scope of the Report- Infrared Sensing Market Applications

Infrared Sensing Market Applications- Power and Sensing Distance

Scope of the Report- 3D Sensing Market Applications

2019-2020 3D Sensing Module Market Scale- Mobile Devices 3D Sensing, Automotive LiDAR and Industrial LiDAR

1.1 Infrared LED Market Scale and Application Trend

2019-2020 IR LED Market Scale

2019-2020 IR LED Market Scale- Segment Market Analysis

IR LED Product Performance and Price Analysis

1.2 VCSEL vs. EEL Market Scale and Application Trend

2019-2020 VCSEL Market Scale

2019-2020 EEL Market Scale- LiDAR Laser

VCSEL Manufacturing and Product Strengths

>1,000nm VCSEL Manufacturing Challenge Analysis

EEL Manufacturing and Product Strengths

VCSEL Players M&A and Investment for 3D Sensing Market

VCSEL vs. EEL Player List

Global 30 Players Production Capability and Target Market Analysis

2020 VCSEL / EEL Player Target Market Analysis

2018-2020 VCSEL Product Performance and Price Analysis

Chapter II. Mobile Devices 3D Sensing Market Trend

Major Biometric Method Pros and Cons

2020 Mobile Sensing Market Penetration Analysis

2.1 Mobile Devices 3D Sensing

3D Sensing Technology Overview

3D Sensing Technology Comprehensive Analysis on Cost and Computation Complexity

3D Sensing Technology- Strategic Alliance and Player Status

Mobile 3D Sensing Function- Front Camera vs. Rear Camera

Structured Lighting Depth Camera Cost and Supply Chain

Structured Lighting Depth Camera Structure and Potential Supply Chain

Time of Flight Depth Camera Cost- Front Facing

Time of Flight Depth Camera Cost- World Facing

Time of Flight Depth Camera Structure and Potential Supply Chain

Active Stereo Vision Depth Camera Cost

Active Stereo Vision Depth Camera Structure and Potential Supply Chain

VCSEL Chip and Package Technology Analysis

2020 Structured Light VCSEL Technology Evolution

2020 Direct and Indirect ToF VCSEL Technology Evolution

VCSEL Burn in and Test Requirements in All Phases

2019-2020 Mobile 3D Sensing Value Chain Analysis

2019-2020 Mobile 3D Player Competitive Landscape Analysis

2019-2020 Mobile and Mobile Devices 3D Sensing Timeline and Landscape Analysis

2019-2020 Mobile Devices 3D Sensing Module Market Scale

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume

2019-2020 Mobile Devices 3D Sensing VCSEL Market Value and Volume- By 3D Sensing Solutions

2.2 Fingerprint Recognition vs. 2.5D Facial Recognition

2019 Optical and Ultrasonic FOD Penetration Rate and Cost Analysis

Optical and Ultrasonic FOD Technology Analysis

2.5D Face ID Principles and Product Advantages

2.5D Face ID Market Demand and IR LED Product Requirements

Chapter III. LiDAR Market Trend

LiDAR Product Definition

Global LiDAR Player List- By Region

Scanning LiDAR Execute Process

Flash LiDAR Execute Process

Scanning LiDAR vs. Flash LiDAR Technology Analysis

Scanning LiDAR vs. Flash LiDAR Analysis

Scanning LiDAR vs. Flash LiDAR Player Analysis

3.1 Automotive LiDAR Market

2020-2024 Automotive LiDAR Market Value

Autonomous Car Market- Merge, Investment, Strategic Alliance Analysis

Autonomous Vehicle vs. ADAS

Automotive Sensing Analysis- LiDAR, Radar and Camera

2020-2024 Passenger Car Market Trend

Passenger Car- Autonomous Vehicle L3 vs. L5 LiDAR and Senor Requirement

2020-2024 Autonomous Bus Market Trend

Autonomous Bus Market Landscape Analysis

Autonomous Bus- Autonomous Vehicle L4 LiDAR and Senor Requirement

Automotive Grade LiDAR Product Overview

Automotive LiDAR Market Restriction Factors

Pros and Cons of the Integration of LiDAR and Headlamp

3.2 Industrial LiDAR Market

AGV and AMR Product Advantages Analysis

AGV vs. AMR Market Landscape Analysis

AGV vs. AMR LiDAR and LiDAR Laser Product Requirement

3.3 LiDAR Laser Market Requirements and Key Players

LiDAR Three Basic Components and Market Requirements

LiDAR End Product Requirements and Light Source Analysis

LiDAR Laser Product Portfolio and Player Analysis

905nm vs. 1,550nm LiDAR Laser Advantages and Applications

LiDAR Photodetector Product Trend Analysis

2020-2024 LiDAR Laser Market Value

LiDAR Laser and Photodetector Player List

Chapter IV. Driver Monitoring System Market Trend

Driver Monitoring System

Truth and Data of Car Accidents

Will Driver Monitoring System Become Vehicle Safety Standard?

Driver Monitoring System Product Design- OE and AM

IR LED vs. VCSEL Product Requirement

Driver Monitoring System Market Landscape Analysis

Chapter V. SWIR LED and Broadband IR LED Market Trend

Short Wave InfraRed (SWIR) Product Definition and Market Strength

5.1 SWIR LED Market Trend

SWIR Application Market Overview

SWIR Application Markets - By Wavelength

SWIR Application Market Opportunities

SWIR Application Cases Analysis

SWIR LED Player and Product Analysis

3-5μm SWIR Market Opportunities and Potential Suppliers

SWIR IR LED Market Opportunities and Potential Customer List

5.2 Broadband Infrared LED Market Trend

Broadband Infrared LEDs Application Market Overview

Broadband Infrared LED Product Definition and Market Advantages

Broadband Infrared LED Player and Product Analysis

Chapter VI. 1D Time of Flight vs. Proximity Sensor

Mobile vs. Wearable Device Sensing Market Trend

2019-2020 Mobile vs. TWS Shipment Forecast

2019-2020 Mobile Devices- Proximity Sensor vs. 1D ToF Market Trend

2019-2020 TWS and Smart Home Appliance Sensing Market

1D ToF vs. Proximity Sensor Market Landscape Analysis

Chapter VII. Optical Communication Market Trend

Optical Communication Market Definition

2020 Key Factors of Optical Communication Market Growth

Major Optical Communication Player and Product Plan

2020-2022 Data Center Ethernet Port Market Scale

2020-2022 Optical Communication Trend in DataCom Market

100Gbps vs. 400Gbps Product Trend

VCSEL vs. Silicon Photonics vs. EEL Product Analysis

2019-2023 Optical Communication VCSEL Market Trend

Optical Communication Market Landscape Analysis