The LiDAR market encompasses such applications as ADAS, autonomous vehicles, industries, deliveries, and smart cities; while these applications are estimated to have driven the LiDAR market to reach US$682 million in revenue in 2020, total LiDAR revenue is projected to further expand to $2.932 billion in 2025, a 34% CAGR, according to TrendForce’s latest investigations.

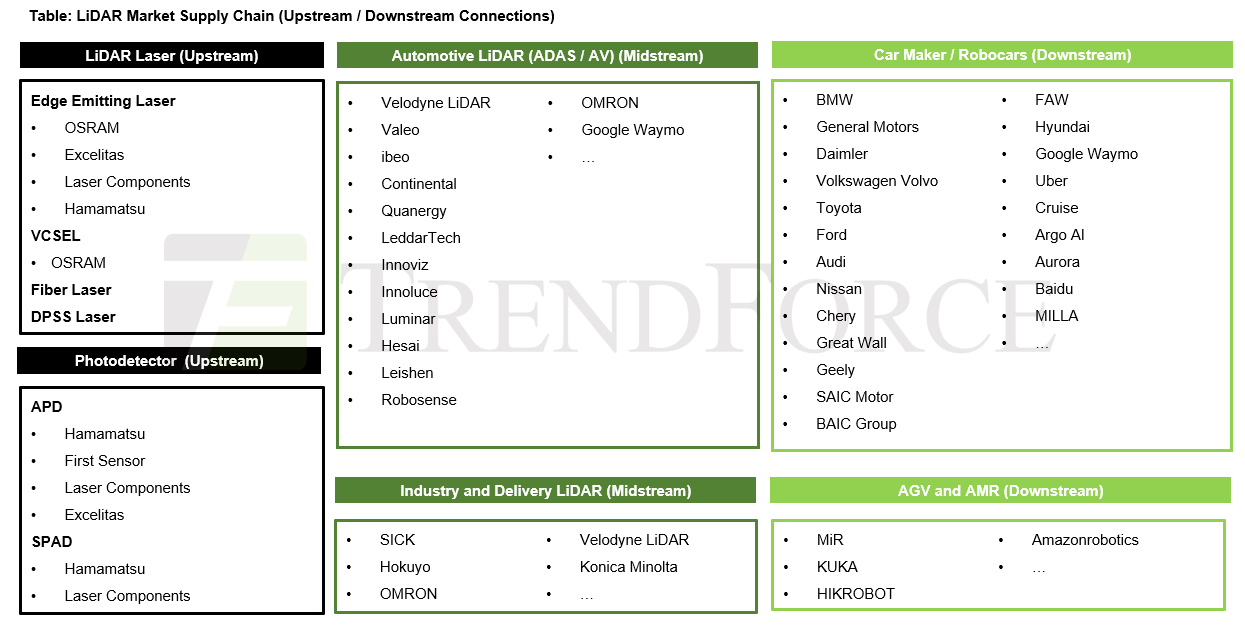

TrendForce indicates that, with regards to automotive LiDAR applications (ADAS and autonomous vehicles), automakers have continued to release NEVs in spite of the COVID-19 pandemic’s negative impact on the global automotive industry in 2020. Furthermore, these automakers are also equipping ADAS on high-end conventional gasoline vehicles and NEVs alike. As an essential component in SAE levels 4-5 autonomous vehicles, LiDAR systems are used by automakers to both build their databases and increase vehicle location accuracy. In addition to the aforementioned vehicles, automotive LiDARs are also featured in autonomous buses, robo-taxis, and self-driving trucks. Total automotive LiDAR revenue is expected to reach $2.434 billion in 2025. At the moment, major automotive LiDAR suppliers include Velodyne, Valeo, Quanergy Systems, Inc., ibeo, Continental, LeddarTech, INNOVIZ, HESAI, LeiShen, and Luminar, while major LiDAR laser suppliers include OSRAM, Laser Components, Excelitas, and Hamamatsu.

With regards to delivery and logistics, the rising popularity of e-commerce has prompted online vendors and delivery companies to lower their last-mile delivery costs by performing deliveries with autonomous delivery robots, bicycle couriers, and self-driving trucks, thereby leading to an increased demand for delivery robots with self-navigation and autonomous decision-making capabilities. Major e-commerce companies that have been promoting these delivery methods include Alibaba, Amazon, FedEx, and Jingdong (also known as JD.com).

Likewise, the growth of the industrial automation market has been lackluster due to the pandemic, with most companies having deferred their previous expansion plans in consideration of budgets, although certain companies wary of potential future shortages in human labor are investing additional capital into industrial automation development against the market downtrend. Having undergone various deferred developments throughout 2020, the European and North American markets are expected to see surging demand for industrial automation applications starting in 3Q21. On the whole, TrendForce forecasts a $469 million revenue for the industry and delivery LiDAR markets in 2025. Major LiDAR suppliers in these markets currently include SICK, Hokuyo, OMRON, and Velodyne. With increasing market demand on ADAS, autonomous vehicles and industrial automation, LiDAR market value will be encouraged by rising LiDAR usage volume.

2021 Infrared Sensing Market Trend- 3D Sensing, LiDAR, SWIR LED

Release: 01 January 2021

Format: PDF

Language: Traditional Chinese / English

Page: 175

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|