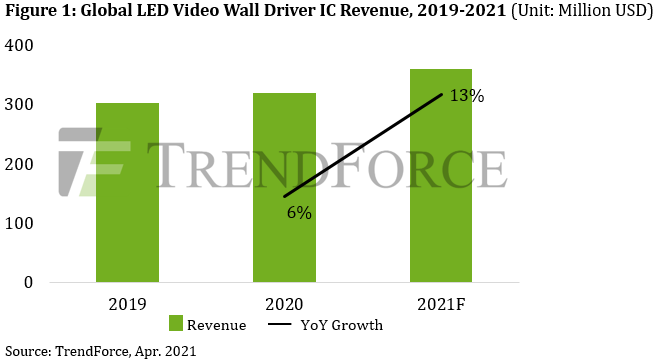

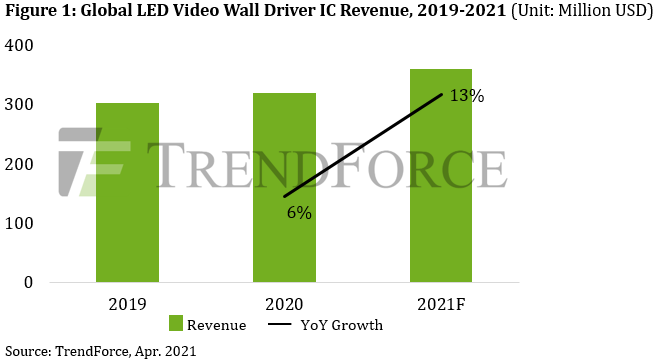

Apr. 15, 2021 ---- The LED video wall driver IC market has been suffering from insufficient production capacities on the supply side since 2020, according to TrendForce’s latest investigations. In order to ensure a sufficient level of wafer capacities at foundries, LED video wall driver IC suppliers therefore began raising prices for certain driver IC products by about 5-10% at the end of last year, and this price hike is expected to persist through 2021 as well. On the demand side, various commercial activities and sporting events have been successively resuming as the COVID-19 pandemic is gradually brought under control. The resumption of these activities is expected to drive global LED video wall driver IC revenue for 2021 to US$360 million, a 13% growth YoY.

Chipone takes leadership position among suppliers in the highly oligopolistic LED video wall driver IC market

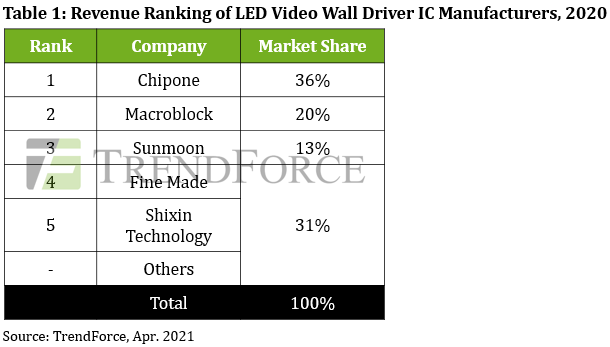

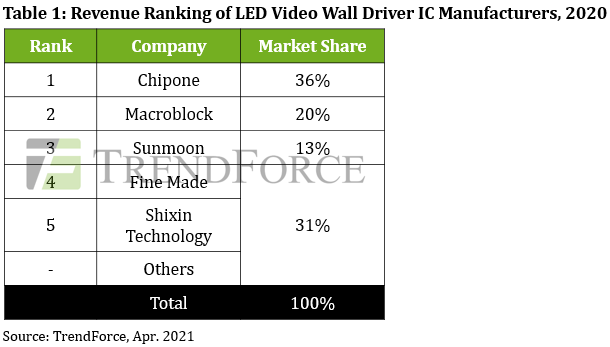

TrendForce indicates that that the LED video wall driver IC market is highly oligopolistic, as the top five suppliers collectively possessed more than 90% market share by revenue last year. With regards to the performances of the individual suppliers, Chipone took leadership position with a 36% share in the LED video wall driver IC market and dwarfed the other suppliers in terms of both revenue and shipment. On the other hand, Taiwan-based Macroblock, which primarily focuses on the high-end segment and holds relatively advanced technologies in its portfolio, took second place with a 20% market share. Sunmoon took third place last year with a 13% market share. The company went public in December in an effort to raise more capital and strengthen its market position. Sunmoon has since become listed on China’s SSE STAR Market as a public company. Rounding out the top five list are Fine Made and Shixin Technology, which took fourth and fifth place, respectively. These two companies, along with others such as Developer Microelectronics, Sumacro, MY-Semi, and Xm-Plus, together constituted a 31% market share.

Tight 8-inch wafer capacities have led to noticeable price hikes for entry-level LED video wall driver ICs

Although the foundry industry expanded its 8-inch wafer capacities in 2021, driver IC demand for applications such as 5G smartphones, 5G base stations, automotive power devices, PMICs, and large-sized panel driver ICs remains strong. Incidentally, wafer capacities for driver ICs used in these aforementioned applications overlap with wafer capacities for LED video wall driver ICs to an extensive degree. At the same time, as small pixel pitch and ultra-fine pitch displays (LED video walls) become the market mainstream, LED video wall driver IC demand will likely undergo a corresponding growth as well. However, in 2021, production capacities for LED video wall driver ICs will continue to be constrained by the demand for other products due to their low profitability. As a result, TrendForce expects prices of high-end LED video wall driver ICs to once again undergo a 5-10% increase in 2Q21, while entry-level ones will undergo a price hike of about 20-30% for the same period.

2021 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: September 2020 ( [Update] 7th January 2021 )

Language: Traditional Chinese / English

Format: PDF

Page: 202

|

For further information about the report, please contact:

|

|

|

|

|

Global Contact: |

ShenZhen: |

Grace Li

Tel : +886-2-8978-6488 ext 916

E-mail :Graceli@trendforce.com |

Perry Wang

Tel : +86-755-82838931 ext.6800

E-mail : Perrywang@trendforce.cn |