Apple has done it again. In 2013, the company drove up sapphire substrate smartphone demands with the adoption of the material in iPhone 5 and iPhone 5S home buttons and camera lens covers. It does not stop there, though. The company’s recent patent applications reveal intentions of introducing sapphire substrate onto flexible wearable OLED device covers, which is likely to ignite new sapphire demands in 2014.

General sapphire substrate market overview

Although LED lighting demands remain the biggest drive behind sapphire substrate demands, smartphone applications will emerge as the fastest growing sector. Sapphire substrate smartphone application demands will reach 31% in 2014, according to a recent LEDinside sapphire substrate report. Apple’s has been the leader in the smartphone industry’s adoption of sapphire substrate material. Since the company introduced material in iPhone 5 and iPhone 5S home buttons, camera lenses and fingerprint identification in 2013, smartphone application demands have boomed. Notably, global sapphire substrate home button applications are expected to triple in 2014 to 12% compared to 4% in 2013. Sapphire substrate camera lens applications are expected to double in 2014 to 8% in contrast to 4% in 2013.

LEDinside analyst team observations are backed by sapphire substrate industry leaders. Both GT Advanced Technology (GTAT) and Monocrystal shared the same outlook noting smartphone applications will be a major drive for sapphire substrate demands in 2014 and help prices rebound during the LEDforum 2013 in Taipei, Taiwan.

It was previously believed sapphire substrate shortages would be unlikely in 2014, since sapphire smartphone display covers were nowhere in sight. LEDinside Research Director Roger Chu remarked that sapphire substrate smartphone display covers held the biggest potential for smartphone application demands in our earlier sapphire substrate feature published on Dec. 6. In the past, high manufacturing costs have prevented manufacturers from adopting of sapphire substrate smartphone display. Recent developments from Apple, though, have shown technological breakthroughs that might overturn these observations.

|

|

Apple's iPhone 5S finger recognition enabled home buttons use sapphire substrates. (LEDinside/Apple) |

Apple patents show new possibilities for sapphire substrate panels

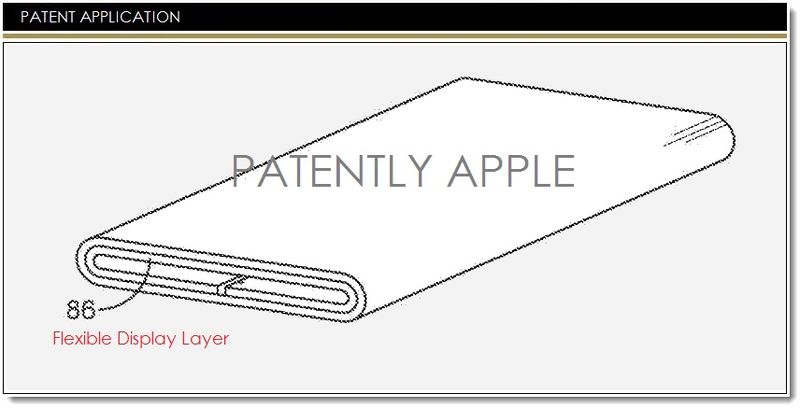

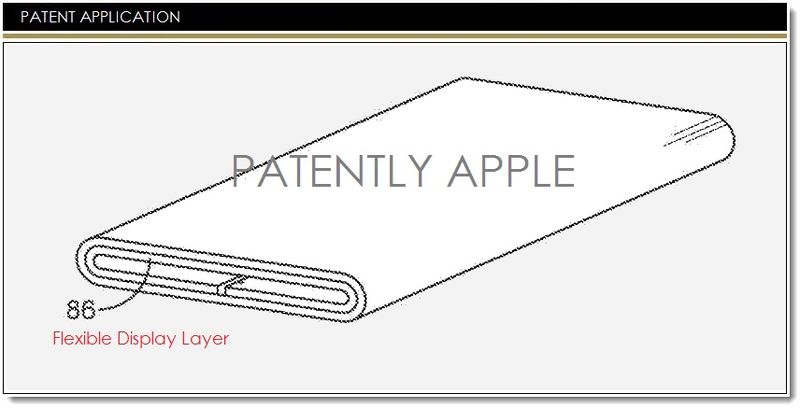

With its two recent sapphire substrate patent applications and hefty investment in GTAT, Apple has clearly shown its ambition of introducing sapphire substrates into smartphone and wearable device displays. The company’s sapphire laminate patent application has shown a method of overcoming cost barriers. The new patent reduces sapphire substrate costs by laminating small strands of sapphire substrates with sapphire or on top of glass substrates together to form larger sized sapphire, according to a TechCrunch report. The report also noted GTAT was the developer of human hair sized sapphire substrate that is laminated on top of glass. There are already market rumors that iPhone 6 to be released possibly in Oct. 2014 might be equipped with sapphire substrate display covers.

|

|

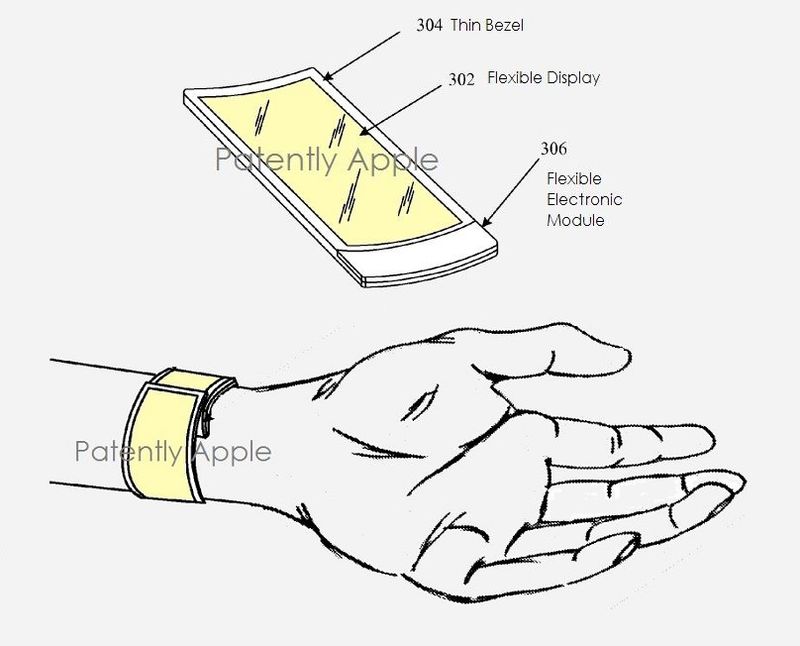

Apple's flexible display layer with sapphire substrate display cover patent. (Photo Courtesy of Patently Apple) |

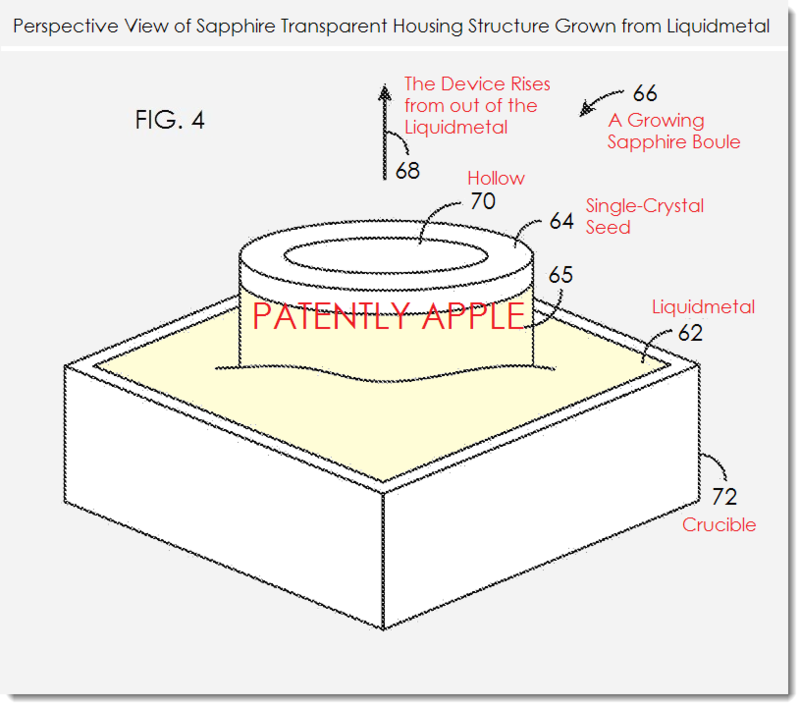

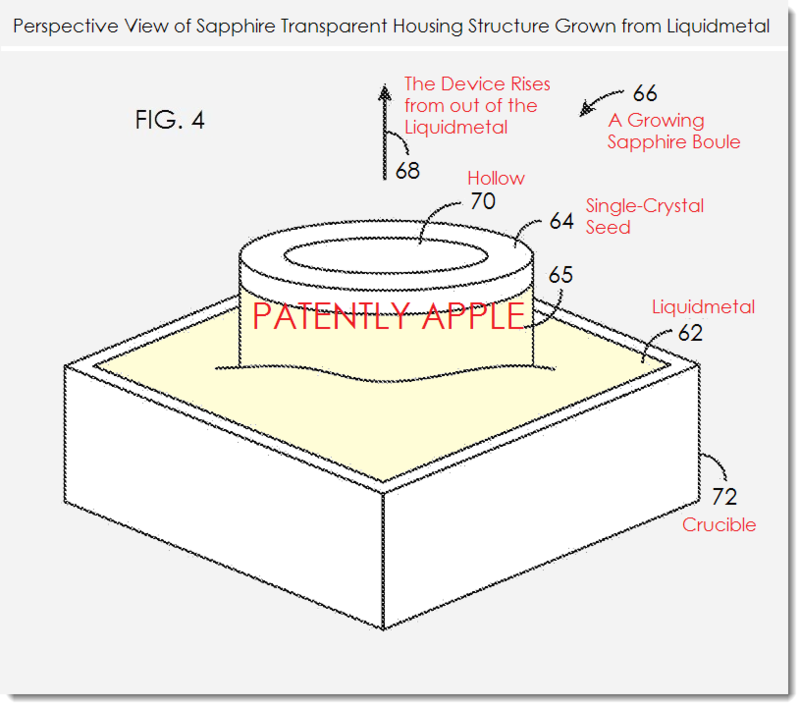

Another Apple patent application issued on Dec. 19, 2013 will probably excite sapphire substrate manufacturers even more. The company’s European arm filed a patent for a transparent and flexible device covered with sapphire substrate, according to a report by Apple Patently. The new patent grows sapphire from molten material known as liquidmetal to directly mold the sapphire into the desired shape. Sapphire display cover structures can be grown as single crystals by pulling a boule of sapphire from the melt. The shape of the seed crystal determines the shape of the display cover.

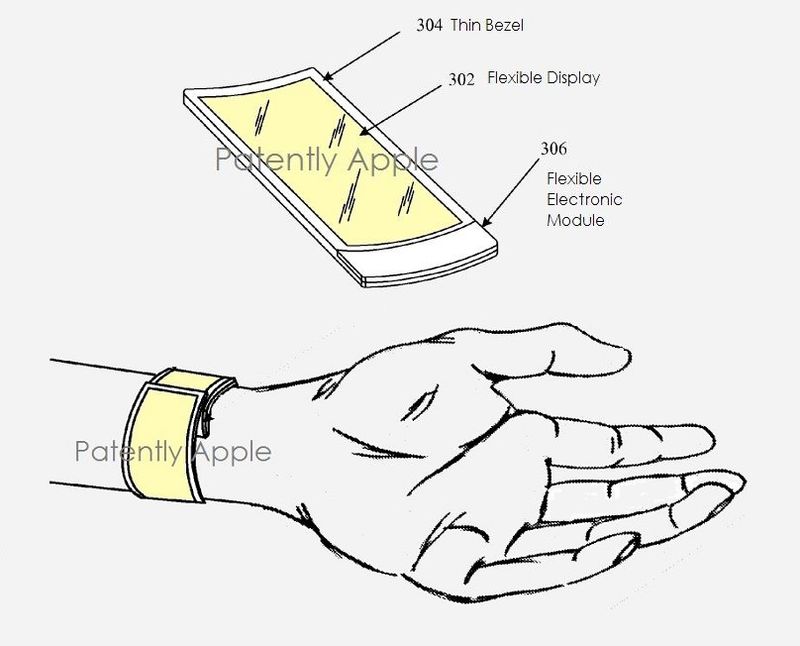

The significance of the patent is it can further lower costs for making sapphire substrates by directly growing them into the cover shape. This might be more efficient than laminating small pieces of sapphire together. A new application market for sapphire substrate will also emerge, as the new technology will be applied in wearable devices. Apple Patently has speculated this technology would probably be ideal for a wearable device, such as the Apple iWatch to be released sometime this year. Other media have speculated the new technology might be applied in iPhone 6 display covers, since it is rumored to be a flexible OLED screen.

|

|

Apple's patent for growing sapphire substrates using liquid metal methods. (Photo Courtesy of Apple Patently) |

|

|

A recent OLED patent filed by Apple shows possible usage for iWatch or smartphones. (Photo Courtesy of Patently Apple) |

In addition, Apple has secured a sapphire substrate supplier. Apple’s investment in GTAT has helped it secure steady sapphire substrate supplies, said Chu. Apple invested US$ 580 million in GTAT to set up a new sapphire substrate factory in Arizona in Nov. 4, 2013. GTAT will have full ownership over the ASF used in the new plant, and is expected to reimburse Apple over a five year period. The agreement between GTAT and Apple will ensure the latter will have steady sapphire substrate supply during this period.

Sapphire substrate manufacturers that have not signed a deal with Apple should not worry too much since the company’s product designs are often mimicked by competitors. LEDinside analysts have already observed LG following Apple’s footsteps and introducing sapphire substrate into its newest smartphone LG G2. It is likely that other companies will also pitch in to follow Apple’s lead for future products as well.

Aside from smartphones and wearable devices the tablet market will also present many opportunities for sapphire substrate market in 2014, said Chu. The iPad will no doubt benefit from Apple’s investments in sapphire substrates, as the technology can easily be integrated into iPad home buttons. Yuanta financial analyst Andrew Chen also noted that demands for sapphire substrate home buttons is likely to soar as fingerprint recognition might become a standard spec for tablets.

To sum up, Apple’s new technological breakthroughs will spur development in the sapphire substrate industry by: 1) lowering sapphire substrate production costs for sapphire display covers. The two new sapphire substrate patents filed are likely a prerequisite for mass production of sapphire smartphone display covers. 2) Creating new sapphire substrate applications, as seen in Apple’s patent for flexible device with sapphire substrate cover and possible application sapphire substrate home button applications in tablets. 3) Other manufacturers will follow Apple’s designs, indirectly creating large sapphire substrates demands. Already, some sapphire substrate manufacturers are expecting prices to go up by 10-15% in Jan. 2014 because of Apple’s new demands.

For more on the sapphire substrate industry in 2014 please see:

(Author: Judy Lin, Editor, LEDinside)