(Author: Judy Lin, Chief Editor, LEDinside)

Osram announced Tuesday the sale of its general lighting lamp business, LEDVANCE, to a Chinese investment consortium headed by strategic investor IDG for EUR 400 million (US $439.58 million), Chinese leading LED package manufacturer MLS was named among a key member of the consortium, as well as financial investor Yiwu.

MLS’s General Manager Lawrence Lin mentioned on multiple occasions about ongoing acquisition talks between the two organizations, dating back as early as November 2015. Following the conclusion of the talks, MLS might take on a dual brand strategy of using both LEDVANCE and its own Forest Lighting brand. Moreover, the dual branding strategy will have a minimal impact on MLS’s existing LED chip suppliers.

|

|

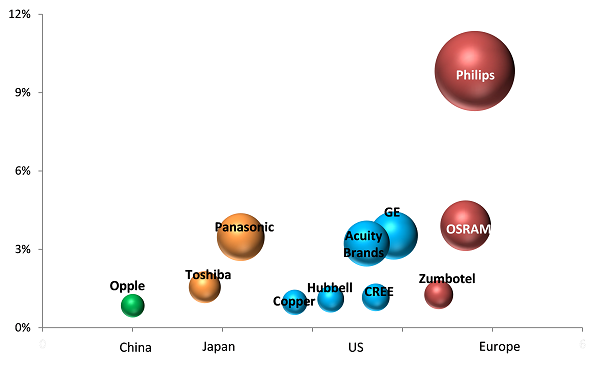

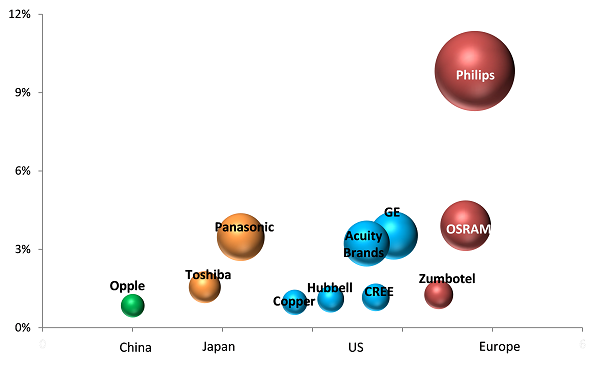

Global lighting manufacturers market shares. (Source: LEDinside) |

LEDVANCE to complement MLS lighting product range

Based on LEDinside’s observations, MLS would be branding low to mid end LED bulb and luminaire products with its Forest Lighting brand, while branding advanced lighting solutions and higher quality LED lights with LEDVANCE. One benefit for the Chinese manufacturer after the acquisition is completing its lighting solution offerings from low to high end luminaires, and successfully shaking off its market image as a cheap LED bulb manufacturer.

One example of how the acquisition will complement MLS product line-up is absorbing LEDVANCE’s smart LED bulb asset, Lightify. MLS traditional focus has been in basic lighting commodities in the replacement lighting sector, and positioned itself in the low to mid end market. Lin told LEDinside in previous interviews that the company found it impractical to develop smart lighting products, since its priority was providing low priced LED bulbs and tube lights to make LED lighting affordable to the masses.

The acquisition of LEDVANCE and use of Osram’s trademarks would bolster MLS brand image, which would be helpful in promoting its Forest Lighting brand in U.S. and European markets. MLS’s general lighting brand Forest Lighting, would be able to tap into LEDVANCE’s distribution networks in Europe and U.S.

MLS existing LED chip suppliers unlikely to be affected with LEDVANCE deal

A dual brand strategy approach would be adding LEDVANCE business as a new business arm under the MLS group umbrella, which would create minimal impact on its existing LED chip suppliers. In Osram’s statement, MLS agreed to procure white LED chips from its newly constructed fab in Kulim, Malaysia. Once Osram’s Malaysian fab enters mass production phase, MLS would be obliged to buy LED chips manufactured at the site.

“Following the acquisition, Osram and MLS will be able to reach a strategic supply chain agreement,” said Roger Chu, Director of Research, LEDinside. “Osram has secured its LED chip export market by selling its lighting business to Osram, while MLS will be able to use Osram's pateneted LED chips for its new LEDVANCE business. In addition, MLS cost advantages in LED packaging combined with Osram’s Sylvania brand would enable to acquire larger market share in the lighting market hence accelerating MLS market share growth in the lighting market, thus creating a win-win situation for both organizations.”

Under a dual branding approach, MLS would continue to buy LED chips from Epistar, HC Semitek, Auckson Opto, and others for its Forest Lighting brand products, while using Osram’s white LED chips for LEDVANCE brand. Even if MLS decides to fully convert to Osram’s Malaysian fab LED chips for its lighting products, it would only impact certain general lighting LED chip suppliers. LED lighting is only a part of MLS’s overall LED business, which is still mainly rooted in LED packaging.

Another positive development, is MLS existing business partners, such as Taiwanese LED luminaire manufacturer YACG are expected to benefit from the Chinese LED package manufacturer’s concluded deal with LEDVANCE.

LEDinside estimates further details of MLS future market strategies will become clearer after 2017, when the acquisition business transaction between the Chinese investment consortium and Osram is completed. There is no doubt that MLS product strategy deployment will become the most comprehensive among Chinese counterparts specializing in general lighting business, and that its oversea distribution network reach will be the widest after absorbing LEDVANCE.

For further reading:

-

[Breaking News] Chinese Consortium Including MLS Acquires Osram's LEDVANCE Business for EUR 400M

-

MLS and IDG Form Bidding Consortium for Osram’s Lighting Business

-

MLS Strategies in LED Package and Outlook for U.S. Market

-

MLS Aims to Do More than Expand Distribution Channels by Acquiring Osram's Lighting Business

-

[Breaking News] MLS Intends to Start Bid for Osram’s Lighting Business

-

Ledvance Officially Becomes Legal Entity

-

Details of Osram Carve out of LEDVANCE to be Announced by May 2016

-

[Breaking News] Osram Renames Lamps Business as LEDVANCE, Aims to Conclude Sale in April 2016

-

[Breaking News]: Osram Spins Off General Lighting Business