(Author: Figo Wang, Senior Analyst, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)

Introduction:

Epistar announced it will be raising certain LED chip costs by 15% in mid- May 2016, which excited certain media and investors, who projected LED chip prices would soar. There is nothing to support this theory, though. More than a month has gone by, and none of the other manufacturers have raised prices. A closer inspection raises questions on the LED chip pricing strategy, and whether it will reach the aim of reducing the company’s revenue losses requires further observations, however, the company is at risk of losing clients.

Good strategies do not always achieve results, and a bad one might appear wonderful but ignore real-life situations, resulting in completely opposite outcomes.

This article attempts to analyze Epistar’s pricing logic over the past year using a simple game theory model, and explores logic and rationality behind its pricing theory. Using the pricing game theory experience, the company can make wiser pricing decisions.

The classical pricing and prisoner dilemma model

Conventional pricing game theory is a typical prisoner dilemma model.

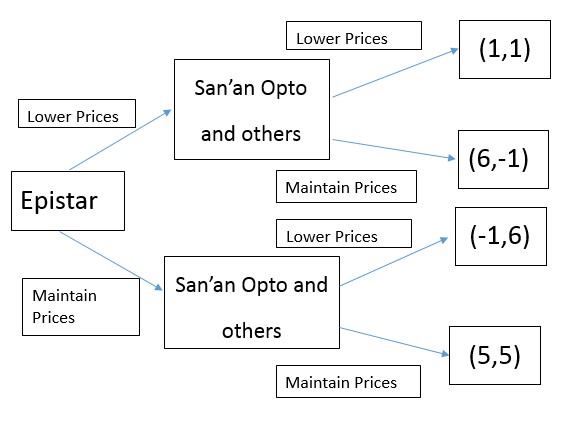

|

|

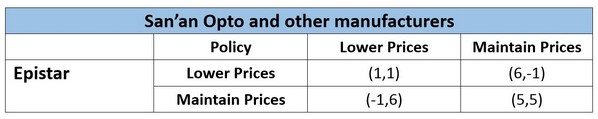

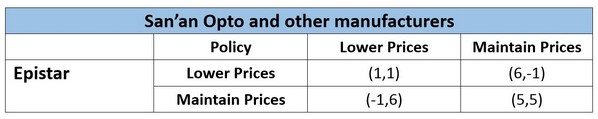

Game theory outcome of Epistar and San'an Opto. (All tables and images courtesy of LEDinside) |

In this game, we assume Epistar is player one, and the second player is simplified to San’an Opto, who also represents other manufacturers in the market. The numbers in the parenthesis is the payoff that we assume each player receives from different scenarios. The first number in the parenthesis represents Epistar’s payoff, the second San’an Opto and so forth.

Each players payoff reasoning assumes the outcome will be internecine if both players lower prices, if everyone receives only minimal profits of (1,1) than no one will lower prices, nor form a higher-priced alliance resulting in Pareto optimality (5,5). If one manufacturer refuses to lower prices, than the price decline will escalate, or if manufacturers insists on keeping prices than the company might lose the market to (-1, 6) or (6, -1).

Based on classical Nash equilibrium theory, the game’s equilibrium would be (1,1), in which both players will chose a price down strategy to give them an advantageous edge. The result is tragic, where everyone’s earnings is mediocre.

In reality tit-for-tat pricing strategies are retaliative

In the real word, logic does not always work that way. Even the craziest price slasher in the industry might not enjoy lowering prices or be courageous enough to do so.

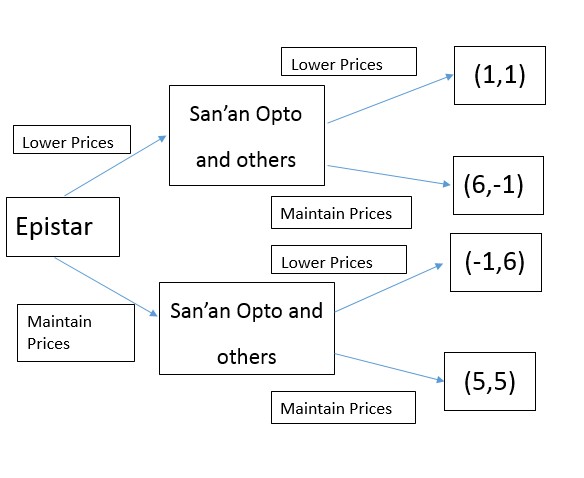

This is mainly because most enterprises are not strictly in a prisoner dilemma decision making model, and usually will take action after evaluating competitors strategy, before choosing a strategy with the greatest advantages. This changes the game from a single prisoner dilemma to a quadratic game, which becomes a classical tit-for-tat policy.

The tit-for-tat policy put simply is a revenge model that is determined by the course of actions of the opposite party, when player one’s action provokes the second player, the second player counter-attacks. However, if the first player projects the second players will become vengeful, than it might avoid harming the second player. Social peace and rationality is maintained using this model.

Throw in LED chip prices into the game theory, if Epistar chooses to lower prices than there is no doubt San’an Opto will also cut prices. Hence, Epistar has chosen lowering prices in the decision tree, but if San’an Opto’s payoff choses to lower prices is represented by 1, and keeping current prices symbolized by -1, than San’an Opto’s dominant decision is still lowering prices, and will implement a tit-for-tat policy against Epistar.

If Epistar chooses to maintain its current prices, than in theory San’an Opto will also do the same. If San’an Opto chooses to lower prices out of the two options, than it would be delaying the game theory into a later round. If San’an Opto is in Epistar’s position, and the Taiwanese company’s dominant decision will be to lower prices to retaliate against San’an Opto, hence, the Chinese LED enterprise will still be restricted by the tit-for-tat policy.

A rational San’an Opto will choose to maintain prices in response to Epistar’s pricing strategy, and the two parties will maintain an equilibrium payoff (5, 5). However, tit-for-tat strategies still exist, which is why Epistar and San’an Opto were able to sustain a balance of terror situation from 2013 till second quarter of 2015.

Collapsing price model following disequilibrium

Even if tit-for-tat policies exist, Epistar is fully aware that LED chip price down could result in price collapses. Despite of this, Epistar initiated a price war in mid-2015 which caused a six month price collapse in the LED chip market. The waning economy is also a key factor, but the balance of terror is no doubt the main reason behind the collapsing prices and price slashing policies.

Analyses of Epistar’s strategy logic reveals its acquisition of FOREPI in 2015 caused immense pressure on its operations, and when the acquisition did not turn out as expected, the excessive production capacity forced Epistar to grab more market shares, which results in prioritizing price down policies.

Is there anything different from the former analyses? If we make some adjustments in the tit-for-tat policy then we will find certain changes in the decision making process.

After acquiring FOREPI, Epistar had to get rid of massive production capacity, if it does not lower prices than utilization capacity rates will drop to lower levels, and the company would not be able to maintain a payoff of (5). If the lower returns from idle production capacity is equivalent or much lower than returns from tit-for-tat strategy, than price down strategies become more advantageous.

If manufacturers took on chances, and it is estimated the competitor will not respond or quickly react then the payoff might become (6, -1). This is a much more advantageous outcome for Epistar than a situation of not lowering prices (1, 5), under this condition Epistar is losing money while watching competitors’ revenues increase. Additionally, the companies will work on distancing themselves from each other with their respective strengths to weather out the difficult circumstances, if one company losses money everyone will lose too.

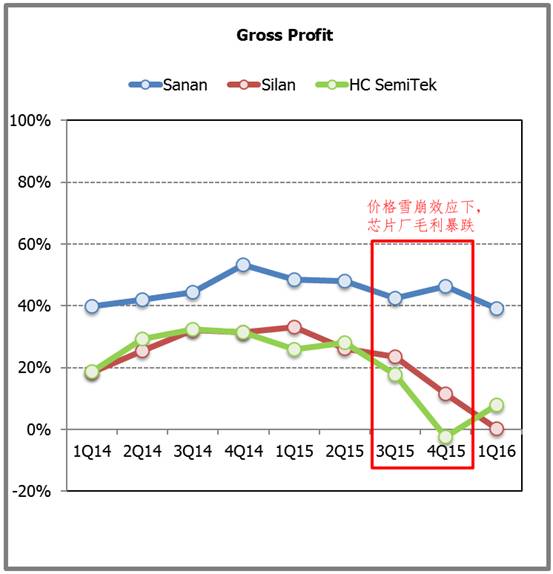

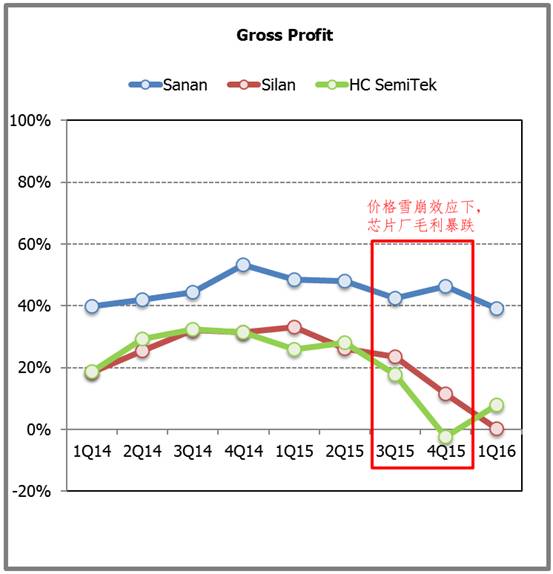

Hence, it is not difficult to observe Epistar incurred significant losses in 2015, while top Chinese LED chip players including San’an Opto, HC Semitek, Changlight gross margin took a sharp turn from third quarter onwards. HC Semitek and Changlight each reported respectively nearly RMB 100 million (US $15.17 million) net loss in 2015, and Epistar had to shut down some of the older factories. In reality, the outcome is still the result from tit-for-tat policy, where everyone’s performance was dragged down by Epistar resulting in two losses (1,1).

|

|

LED chip gross margins plummet due to the price avalanche. (Source: LEDinside Gold+ Member Report,2Q16) |

However, from a rational decision making angle, Epistar’s previous pricing strategies were fairly reasonable, but whether it should slash prices significantly requires further discussions.

If lowering prices is the wrong strategy than is raising prices the correct one?

Epistar’s price slashing strategies have caused significant suffering among those in the industries, even earning the notorious profitability destroyer nickname. So would raising prices be the right solution?

When Epistar announced it will raise prices by 15%, many competitors were overjoyed, but we’ve yet to see any LED chip manufacturer follow up. Is raising prices a really good strategy for Epistar? Will the industry arrive to a tacit agreement when everyone lowered prices, and return to a state of Pareto optimality where everyone can profit?

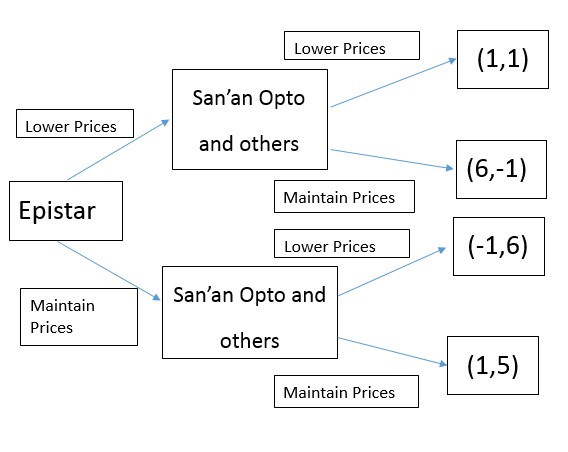

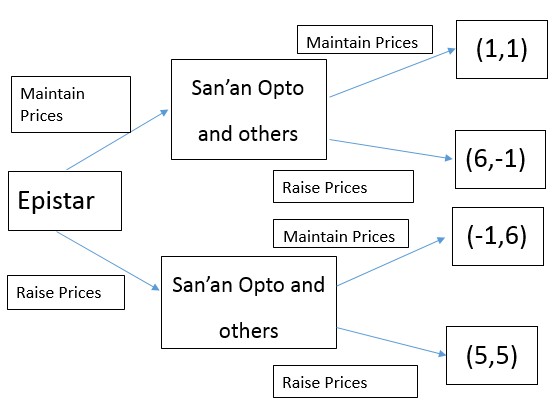

In theory raising, maintaining prices, or even lowering prices is a pair of symmetrical decision sets. In the primordial model, we just replace lowering prices to not raising prices, and lowering prices to raising prices, which results in this new model.

If Epistar chooses the option of raising prices in its decision tree than we will find San’an Opto’s will not increase prices. Hence, San’an Opto’s optimized profitability will be(-1,6). Additionally, restraints from tit-for-tat strategies does not exist, unless Epistar abandons raising prices, and reconsiders strategies of keeping prices at current state. Yet, this would indicate its new pricing policy had failed and impact future policies credibility.

This is also why everyone in the industry were secretly happy when Epistar raised prices, but few followed the trend. This can be explained by everyone waiting for Epistar clients to transfer their orders, additionally the number of LED chip manufacturers significantly declined, but the absolute number is still fairly large. The possibility of general price uptick is very low, and no one is willing to face the risks of being a fellow price hiker.

Due to the above mentioned motives, Epistar’s LED chip price raise might end as a one-man show, where no one else in the industry will pursue the same strategies. Media and investors hoping for the reversal of LED chip price downward trends might not see the day, but there is a high probability that LED chip prices will be stable for a while. LED chip manufacturers destroyed by price wars will receive a moment of respite.

Preventing ratchet effects, companies need to be careful in price wars

LED chip industry is not the only exception, most industries are unlike the petrochemical industry where a handful of enterprises monopolize the market and adjust prices at will. In comparison, price hikes are as difficult as moving a mountain and lowering prices resembling dam releases. This is exactly the logic of pricing game theory, where pricing activities are a single direction ratchet effect. This is also why raising prices can be so difficult, hence manufacturers should avoid initiating price wars, which is usually the worst strategy. When companies find it difficult to bear the losses from low prices, it might be impossible to raise prices again.