(Author: Skavy Cheng, Editor, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)

Royal Philips Lighting finally sold its 80.1% stake in Lumileds for US $2 billion to Apollo Global Management, retaining only a 19.9% stake in its former LED component business.

Will Lumileds sale result in a new owner of CSP LED technology? As a “senior stalker” of CSP LEDs, a stroll down the memory lane indicates the technology was launched by Lumileds nearly a decade ago, leading international players control the key technologies. However, Chinese manufacturers have also taken off in recent years.

In an exclusive interview with LEDinside, Haibin Zheng Vice President of Energy Efficiency at Shenzhen MTC shed light on CSP LED technology, and future trends in addition to the early emerging flash light market.

1) Solving the pain point of thick direct type-backlit LED displays, CSP LED market penetration rises in high-end market.

|

|

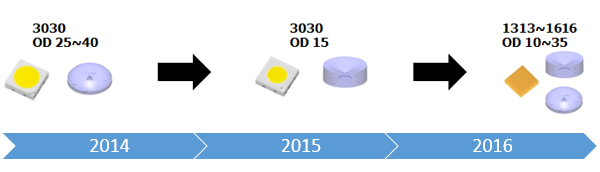

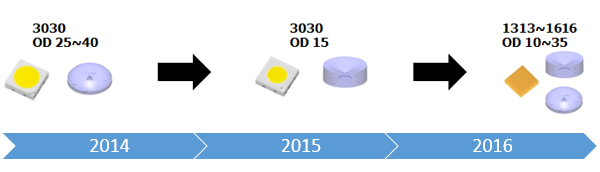

Backlight component trends. (All images courtesy of LEDinside)

|

The trend of lowering costs among display manufacturers led to decrease in LED usage volume in direct-backlit LED TVs, which further pushed down backlight costs. In turn TV market share gradually increased, but the chubby appearance of the direct-type backlit TV has always been a pain point for manufacturers.

Direct-type backlit TVs slimmed down following the adaption of smaller CSP LEDs, the higher efficiency of the LEDs further drove down costs and resulted in much thinner TVs.

Shenzhen MTC (SMTC), a company that commercialized CSP LED production in China told LEDinside, the company’s CSP LED products already reached mass scale production, and is further expanding in lighting applications.

CSP LEDs are still mostly used in high-end brands, due to the premium prices in the sector, but a majority of its costs are on the chip end, said Zheng. Low yield rates has been the main cause behind CSP LED chips higher price.

For LED package manufacturers, if product prices are limited at the chip end, it becomes difficult for the LED to compete in price/performance ratio. However, the CSP LED has inherent advantages in the high end backlight market. Compared to backlight modules, direct-type cannot be as thin as side-view type, but the emergence of CSP LEDs broke this delicate balance, which lowered the costs of the LEDs. This is also why CSP LEDs have taken off in the backlight application sector.

2) CSP LED starts to takeoff in lighting market, with ample opportunities in light engines and smart lighting

|

|

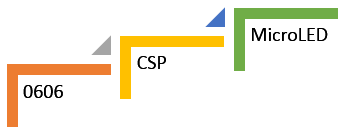

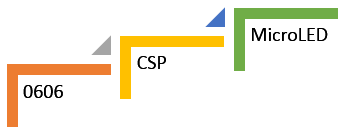

CSP LED lighting roadmap develops from CSP LED chip,CSP LED module, light engines to smart lighitng products. |

CSP LEDs small size increased design flexibility in luminaires, and is recognized as a contributor to the development of LED miniaturization and increased brightness. However, CSP LED has completely different application field in lighting and backlight, having a completely different share ratio in lighting and backlight module applications.

CSP LED backlight can increase a TV set cost anywhere from RMB 80 to thousands of Chinese Yuan, but in lighting the magnitude of the price difference moves to a whole new value because of the sheer volume. Hence, the solution for lighting applications cannot be simply solved by supplying CSP LEDs, it requires more module applications, where module makers process the product to increase the LEDs added value.

So why cannot CSP LEDs for lighting applications follow the same development roadmap as conventional LEDs.

First off, CSP LEDs are too small for traditional surface-mount technology, and cannot be easily facilitated by lighting manufacturers.

Moreover, manufacturers have to invest massive funds into SMD machines to increase manufacturing capacity, while this might a moderate investment for large manufacturers such as Foshan Lighting, there are higher risks associated for SMEs.

For LED package manufacturers surface-mount technology (SMT) requirements of CSP LEDs require specialized eutectic bonding machines for precise positioning, industrial SMT equipment cannot achieve the precision required for chip scale sized surface mounting.

Moreover, if LED package and modules are able to produce light engines in the future, then the lighting application sector will be split into asset-light lighting design manufacturers and OEMs. Manufacturers will be able to then produce single lighting solutions based on their current lighting designs, such as smart lighting, smart homes and other periphery lighting design companies.

3) Micro-LED technology arrives as fine-pitch LED display market enters suspected oversupply situation

Compared to backlight lighting, CSP LEDs are not being directly manufactured into displays, but there has been an emergence of many fine pitch COB LED displays. Some senior display manufacturers told LEDinside, there are many COB displays on the market that have received positive feedback.

COB displays basically place a LED package on a Printed Circuit Board (PCB), since thermal dissipation takes place directly on the board and can be easily disseminated, it does not cause serious lumen depreciation. Hence, there are fewer dead pixels, and substantially increases in the display’s lifetime.

Traditional SMD LED products eutectic bonding occurs in a cup, which is not in direct contact with the PCB. SMD LED designs dissipate heat through adhesives and four soldered pads, the area for thermal dissipation is much smaller resulting in thermal concentration in the center of the LED chip. Long hours of usage results in severe lumen depreciation, dead pixels, and results in plummeting display lifetime and quality.

Most COB displays on the market use a SMD LED, but if this was replaced with flip chip or CSP LEDs it could significantly raise thermal dissipation and reliability. However, higher costs have deterred manufacturers from adopting the technology.

Can CSP LEDs enter the display market? Zheng mentioned in numerous interviews with LEDinside, CSP LEDs will eventually adopt a similar roadmap as COB, where the issue of repairing single LEDs will no longer exist. Instead the entire LED module will be scrapped, which ensures CSP module’s reliability. Similar to COB LEDs earlier manufacturing process, controlling the early stages of production during the initial phase will be more important than after sales maintenance.

From this perspective, CSP LEDs can be used to make lighting modules, but can it be used directly by LED package manufacturers for display module applications? This will depend on LED display manufacturers and LED package manufacturers latest findings.

Every enterprise has different perspectives when evaluating the pros and cons of a technology, for instance some say there is an oversupply of fine pitch displays and there is no point in further shrinking the size of the display. LEDinside would like point out to readers none of the display technologies from CRT, LCD to OLED displays were eliminated because of perfection. Hence, we should never underestimate people’s greed and high visual quality demands.

|

|

LED display component roadmap. |

4) CSP LED market penetration increases in aftermarket automotive lighting market, but still working on OEM sector

Low to mid power LED chip applications are maturing in China, according to data compiled by LEDinside. Price sensitivity in the LED automotive segment has spurred interior automotive lighting and taillight specs to be similar to lighting or backlight, leading to introduction of higher volumes. Daylight Running Lamps (DRL) are closely related to automotive brand recognition, rapid domestic developments over the past few years has spurred some Chinese automotive manufacturers to rely on low power LEDs in DRL applications. As a result, China’s DRL market penetration peaked to 47% by 2016. However, Chinese manufacturers still have low market penetration rates in automotive lighting with higher technology entry level, such as high power LED headlights with low or high beam functions and fog lights, while mid-power LED developments have been rather sluggish.

Large international brands including Osram, Nichia and Lumileds are still mainly directing developments in automotive LED components, and are also the biggest suppliers. Majority of headlights OEM utilize top international brands LED components, while Chinese manufacturers are mainly competing in the aftermarket. Even though big lighting brands have a lions share in the automotive lighting market, many CSP LED manufacturers products are targeting the AM, for instance many pioneers in the CSP LED market are using this package type to enter the automotive repair and maintenance market.

The most common LED headlight component spec in the the OEM automotive lighting market has been 2016-LEDs, a type of flash LED light, said Gang Li, Dean of Nanshan Industrial Technology Research Institute, Shenzhen University. The beam angle for automotive lightings is usually kept around 120 degrees to maintain luminous efficiency when driven under high power conditions, which also provides excellent thermal dissipation and other features that have spurred 2016-LED to adopt large flip chip LEDs, vertical LEDs or thin film flip chip LEDs packages with sapphire substrates.

CSP LEDs are also applied in automotive headlights, but since phosphor adhesives envelope flip chip LEDs surroundings in a 3D structure, the adhesiveness is usually worse. During the eutectic bonding and reflow soldering process, any impact from machines, the melted solder and coefficient of linear expansion will cause the phosphor adhesive to detach from the flip chip and become ineffective. This is why many industry insiders think CSP LEDs are unsuitable for headlight applications where reliability is the priority, but many companies still think CSP LEDs have a market in the OEM automotive lighting sector.