(Author: Skavy Cheng, Editor, LEDinsidehttp://Translator: Judy Lin, Chief Editor, LEDinside)

Osram announced Wednesday that a Chinese investment consortium headed by IDG that comprised of MLS, and Yiwu State-Owned Assets Operation Center (Yiwu) acquired the German manufacturer’s general lighting business Ledvance for EUR 400 million (US $439.58 million).

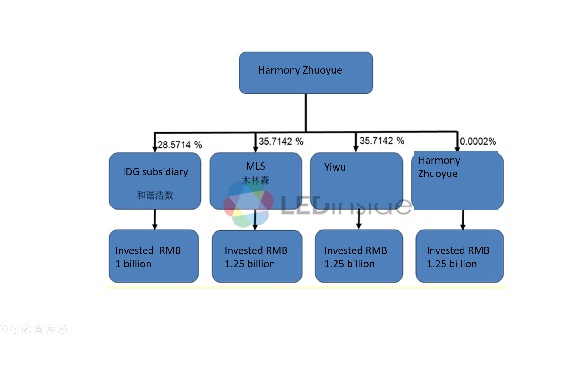

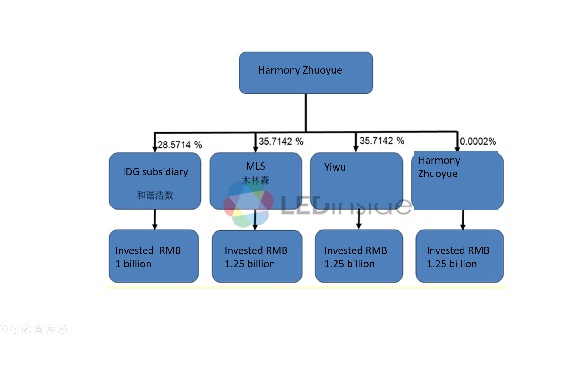

MLS announced on the same date it signed a new partnership agreement with Zhuhai Harmony Zhuoyue Investment (Harmony Zhuoyue), and under the new agreement its investment in the company would scale up from RMB 178.57 million (US $26.83 million) to RMB 1.25 billion, while its total subscribed capital contributions would remain unchanged.

|

|

A diagram of Harmony Zhuoyue investors and amount invested. All figures are in RMB (1 RMB= US $0.15). (All images courtesy of LEDinside) |

MLS also stated it is a limited partner (LP) of Harmony Zhuoyue, and will not participate in daily operations and management including investment policies. In other words, the main buyer of Ledvance is Harmony Zhuoyue and not MLS, who is just a collaborating partner.

MLS is just a LP in LEDVANCE acquisition

Tracing back to Nov. 6, 2015, MLS announced it intended to strengthen its market competitiveness by optimizing resource integration, and the board approved joining the bid for Osram’s general lighting business, authorizing MLS Chairman Sun Qinghuan to engage in acquisition talks and sign related papers.

MLS announced it fully utilized its advantages to achieve a win-win solution on May 16, 2016, and signed “a partnership agreement letter of intent” with IDG and the financial institute’s subsidiary Harmony Haoshu (unofficial translation of 和谐浩数) and other related industries. The enterprises and other investors involved in the agreement will jointly establish a new Limited Partner (LP) company. Harmony Haoshu and its related enterprises were listed as General Partners, while MLS and other investors were LPs.

According to the statement, LPs need to invest RMB 500 million, while general investors will mostly be investing through means of increasing capital investment, transferring shares and other methods to acquire excellent LED enterprises shares and assets.

As of May 17, 2016, MLS stated it would form a consortium with other investors in its bid for Osram’s general lighting business. MLS then appointed Harmony Zhuoyue as the new strategic partner as of July 16, 2016, and invested RMB 178.57 million in the company, which amounted to 35.71% of the subscribed capital contributions. This announcement exponentially accelerated its existing RMB 178.57 million investment to RMB 1.25 billion.

Whether MLS acquires LEDVANCE single handedly or as a consortium member, the end benefactor is still LEDVANCE. Hence, MLS and Yiwu’s stake in the consortium is about the same, and have the same shareholder rights and right of discourse. Additionally, MLS is also the only member in the enterprise that has business partnerships with Osram’s lighting business. Lastly, since MLS is only a LP in this acquisition it will not have to consolidate its financial statement, which would speed up the acquisition process, no matter how you look at it the Chinese LED packager emerges as the biggest benefactor.

|

|

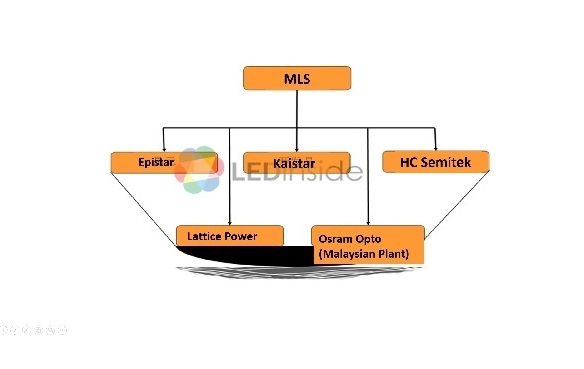

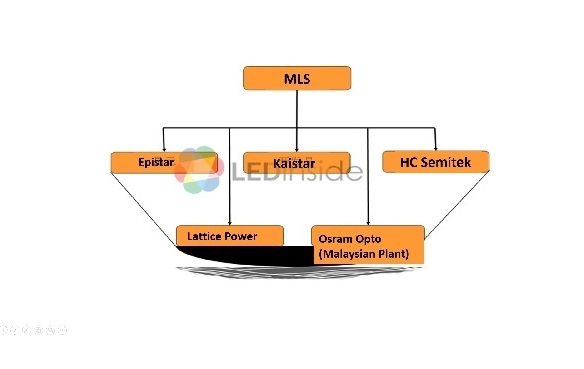

MLS's LED chip suppliers. |

What will happen after Harmony Zhuoyue acquires LEDVANCE?

Since MLS is Harmony Zhuoyue’s largest shareholder, it will acquire Osram’s patented LED chips after absorbing LEDVANCE, which would boost its LED chip volume.

Before MLS became a listed company it was coined as the “price slasher” in the industry, as a shareholder of LEDVANCE it completed the long term gap in high-end lighting product brands and portfolio. A sector that MLS never possessed, additionally the upgraded brand would further accelerate MLS global market deployment.

Compared to other members in the consortium that only acquired LEDVANCE’s shares and future income, MLS received stakes in the company and added value from the deal.