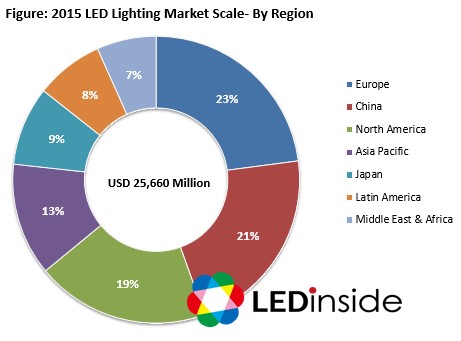

Nov 4, 2014 ---- The global LED lighting market will reach $25.7 billion dollars and its market penetration will increase to 31% in 2015 as the overall lighting market grows to $82.1 billion, according to a new report by LEDinside, a division of the Taiwan-based market intelligence firm TrendForce.

Europe is the largest LED lighting market. It comprises 23% of the global LED lighting market despite its high electricity prices and lack of large-scale subsidies for LED lighting users, said Joanne Wu, an assistant manager at LEDinside, adding that Europe’s demand for LED lighting for commercial and architectural lighting applications is increasing.

China comprises 21% of the overall LED lighting market. As the manufacturing base of most LED lighting producers, China boasts a complete LED supply chain and many cost advantages. Traditional lighting manufacturers, lighting OEMs, emerging LED lighting manufacturers, and LED packaging manufacturers all are expanding their LED lighting businesses. This year, developing viable channel distribution is a top priority for vendors in China. Looking ahead to 2015, the lighting market in China should continue to grow on the back of stable demand for lighting. However, since the market is highly competitive and there is little variation in product quality among different manufacturers, vendors will compete mainly on price, making the probability of a price war high, Wu said. At the same time, without proper distribution channels, manufacturers will be forced to exit the market, she added.

The United States holds 19% of the overall LED lighting market. Currently, there is a push in the industry to obtain certification from the US Environmental Protection Agency Energy Star and the DesignLights Consortium (DLC), a US-based non-profit organization. Firms which receive certification from these organizations are eligible for subsidies from local utilities providers. Additionally, LED lighting product quality is improving, helping commercial LED lighting in the US grow. The fastest-growing segment is light tubes.

Japan has just 9% of the global LED lighting market. Indeed, the Japanese LED lighting market is relatively mature. LED commercial lighting is already common in Japan’s schools, hospitals and retail chain stores. Still, the outdoor and industrial LED lighting segments have considerable potential to expand.

Emerging markets, including Asia Pacific, the Middle East, and Latin America, comprise 28% of the global LED lighting market. Looking ahead to 2015, growth prospects in these markets are especially promising because of rapid population growth, favorable government policies and an abundance of private-sector LED lighting projects.

Topic 1: 2015 LED Market For Lighting Application and LED Lighting Market Outlook

LED Market For Lighting Application

-

Executive Summaries

-

LED Lighting Still at High Growth Phase in 2014-2018

-

Standard & Mid Power LEDs Become Mainstream in Lighting Market

-

2835 and 3030 LEDs Most Price Competitive in Standard- and Mid-Power LED Market

-

2835

-

2835 LED: 0.2-0.5W LED Has Relatively High C/P Ratio

-

Chinese Package Manufacturers Raise 2835 Strength Through Standardization and Domestic Production

-

2835 LED Price and Power Distribution Graph

-

3030

-

New 3030 LED with EMC Leadframe Released on the Market, Value High Luminous Efficacy

-

3030 LED with EMC Leadframe Raises LED Power and Reduces LED Usage Volume

-

3030 LED with Ceramic Substrate Released by EU / US Companies to Emphasize Better Thermal Dissipation Features

-

3030 LED Price and Power Distribution Graph

-

COB

-

LED Manufacturers Speed Up COB Product Development

-

LED Manufacturers Speed Up COB Developments, Upholds Optimistic Outlook for Chinese Market

-

COB LED Price and Power Distribution Graph

-

Different LED Luminaires Corresponding LED Components

Global LED Lighting Market Trend

-

Executive Summaries

-

European Lighting Market Trends

High Utility Prices, Maturing Lighting Culture, Formation of Standards—Spur LED Lighting Market Developments

-

North American Lighting Market Trend

The Promotion of Energy Star and DLC Standards Have Led to Strong Growths in the Commercial and Residential Lighting Market

-

North America Lighting Market Trend

Benefited From Subsidies, Manufacturers are Actively Acquiring Energy Star Certification. OEMs Are Actively Developing U.S. Development Strategies

-

Japanese Lighting Market Trend

Residential and Commercial Lighting Market Increasingly Mature, and Shifting Towards Industrial and Outdoor Lighting Markets

-

Chinese Lighting Market Trend

Too Many Suppliers, Complicated Distribution Channels

Global LED Lighting Market Trend

-

Projected Lighting Business Opportunities in Emerging Markets

-

Global LED Lighting Penetration Rate Generally Increasing

-

Global LED Lighting Market Scale By Region

-

2013-2015 Global LED Lighting Market Scale By Region

-

2013-2015 Global LED Lighting Market Scale By Product

-

2014 Global LED Lighting Market Scale- Region v.s. Product

-

2014 Global LED Lighting Market Scale- Region v.s. Product

Lighting Manufacturer Strategies

-

Global Lighting Market- Too Many Manufacturers in the Market, Fragmented Market Shares

-

2013 Revenue Ranking and Estimated 2014 Revenue Ranking

-

Global LED Lighting Market- Lighting Manufacturers LED Strategies Will Determine the Market Share

-

2013 Revenue Ranking and Estimated 2014 Revenue Ranking

-

2014 Lighting Manufacturer Strategies

-

European Lighting Manufacturers Strategies -

Traditional Manufacturers Aggressively Raise LED Professional Lighting Business

-

North American Lighting Manufacturers Strategies -

Brand Vendors, Emerging Lighting Manufacturers, and Package Manufacturers To Grab Larger Market Share

-

Japan’s Lighting Manufacturer Strategies -

Sufficiently Raise LED Lighting Penetration

-

Japanese Lighting Market Share By Application

-

Panasonic

-

Toshiba

-

Iris Ohyama

-

Endo

-

Chinese Lighting Manufacturer Strategies -

Brand Vendors and OEMs Quickly Enhanced LED Lighting Penetration Rate; Package Manufacturers Entered into the Lighting Market and Consolidated Market Channels

-

Opple

-

Yankon

-

Ocean’s King

-

MLS

Topic 2 Backlight Market

Smartphone Market Trend

Trend 1: Bigger Smartphones and High PPI

Trend 2: Flash LED Shifts From Niche to Highly Competitive Market

Trend 3: Phablet Market Emerges

Trend 4: iPhone Leads Market Trends

Trend 5: Smart Wearable Device

List of Smartphone Technologies

Technology 1: Flash LED Designs

Technology 2: Ambient Light Sensor

Technology 3: Universal Remote Control

Tablet Market Trend

Trend 1: Slow Tablet Market Growth Momentum

Trend 2: Tablet Resolution Increased Entirely Driven By Apple

TV Market Trend

Trend 1: Direct-type LED TV Becomes Mainstream Product on the Market

Trend 2: Centralize TV Backlight LED Specification

Trend 3: Edge-type LED TV Technology Will Still Be Seen in Thin TV Models in the Future

Trend 4: Rise of 4K2K TV Becomes New Growth Momentum for LED Usage in TV Backlight Market

Trend 5: The Rise of Chinese Package Manufacturers

Trend 6: More Energy Efficient LED TV to Acquire Energy Efficient Subsidies

Trend 7: Smart TV

Trend 8: High Color Gamut

Trend 9: LED Backlit Curved TV

Appendix Mainstream LED TV Specs and LED Roadmap

Mainstream product specs

LED Roadmap

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@trendforce.com