One of the main LED industry indicators to look into in 2014 is manufacturers exponentially growing production volume.

LED chip and package industry boom and decline

Where did this production capacity come from? Production capacity seen in 2014 mostly came from 2Q13 LED package expansions. A cloud of doom crept over the industry in 2012, as the industry’s oversupply situation triggered price wars and bankruptcy tsunami. Yet, in 2Q13 severe LED package shortages emerged as the slumping lighting market abruptly boomed. Many LED package manufacturers shared an optimistic market outlook at the time, some even doubled production capacity in a relatively short period.

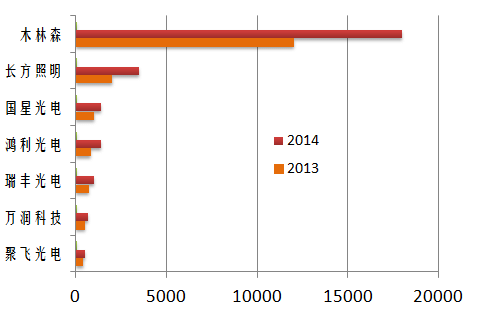

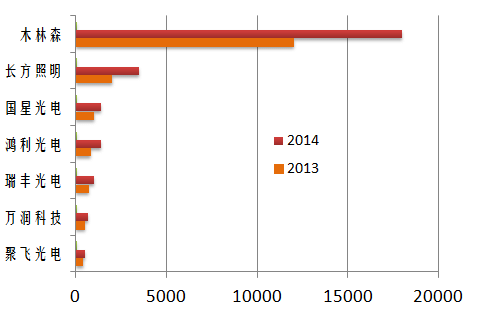

Chinese LED manufacturers, such as MLS’s LED package’s annual production capacity soared to 3,000KK during this time frame. To illustrate how much 3,000 KK production capacity is, it is equivalent to four to five times the production capacity of Honglitronics, which was listed on the bourse on 2013. MLS production capacity expansion at the time was also way ahead of other Chinese rivals including Refond Optoelectronics and Jufei Optoelectronics.

|

|

Chinese major LED package manufacturers production capacity (KK/M). Top to bottom: MLS, Chanfang Lighting, Nationstar, Honglitronics, Refond, Mason Technologies, and Jufei Opto. (Source: LEDinside package market report) |

However, the expanded production capacity could not be immediately utilized. This led to LED package shortages throughout 2013, and minimal price cuts in LED package prices that year. Strong market demands and LED package supply further attributed to the positive LED package market price trends, but this did not spread to the upstream LED chip market.

Compared to 2012 when LED chip demands soared, chip manufacturers were only freeing up production capacity in 2013. LED chips are still far from reaching production shortages, hence 2013 has been the best period for LED package manufacturers. The market demand is very tight, while LED chip supplies remained steady.

This is very different from the past, where LED chip shortages led to LED package manufacturers’ supply shortages. This time round there were enough LED chips and orders, but production capacity gaps remained a technology bottleneck. Meanwhile, manufacturers with sufficient production capacity, such as MLS, Refond and MTC LED package business showed evident growth in 2013. Even more importantly LED chip prices remained flat, despite LED package price upticks, thus successfully keeping the package industry profitable.

Returning to the topic of LED package production capacity expansions. “Good times always fly by” is the best way to describe LED package manufacturers situation this year. LED package manufacturers begun expanding from 2Q13 to 4Q13, and the newly added production capacity were gradually released in 1Q14. The added production capacity in 4Q13 was to meet production shortages, but the exponential production expansion capacity released in 1Q14 disastrously impacted the market, and pushed LED package prices into another price decline cycle. The classical 0.2W 2835 LED for instance was priced at RMB 0.1-0.12 in early 2014, but was halved to RMB 0.04-0.06 by 4Q14.

However, for LED chip manufacturers 2014 has been a belated period of bliss. In 1Q14, LED chip demands grew exponentially, which caused severe LED supply shortages in the industry during the first half of 2014. HC Semitek started to release production capacity in Zhangjiagang project, located in Jiangsu Province, China. ETI also started expanding production capacity during this time period, the company’s LED chip quarterly revenue also grew exponentially during this time period. In the meantime, San’an Opto emerged as the pricing leader in the LED market. Other competitors have been closely monitoring San’an Opto’s every move and have adjusted their own pricing strategies accordingly. LED package manufacturers were also aware of LED chip manufacturers production shortages, with many manufacturers signing supply agreements with San’an Opto to secure chip supply.

The capital market expected stock prices to reflect these changes. Major LED package manufacturers Jufei Opto, Refond, and Honglitronics largest price surges occurred in 1H13. However, most LED chip prices soared during 2H13, reflecting the rebounding supply chain, which was in turn reflected in the company stock prices.

Following tumbling LED company stock prices, LED package manufacturers’ pessimistic future revenue outlook became evident. Although, it will be difficult for replicate exponential growth in 2H13, uncompetitive LED package manufacturers will gradually exit the market as LED industry restructure intensifies. For instance Juliang Electric Technology Group’s sudden bankruptcy announcement, caused a landslide shift in clients and suppliers resources to listed LED manufacturers. More manufacturers will become aware of China’s LED industry growth slowdown as it enters maturation. It will be increasingly difficult for manufacturers to operate companies using opportunistic and unsophisticated business management models. To receive more business resources, manufactures will need to have clear business strategies, management regulations, and credibility. The entire LED package industry will have an opportunity to return profits to norm, and outstanding manufacturers will have greater room for development.

San'an Opto's eonomics of scale strategies edge out uncompetitive rivals

Even under this model, manufactures especially those similar to San’an Opto will find it difficult to leave the competitive application markets. LED market supply shortages during 1H14 revived many zombie LED chip manufacturers. However, during 2H14 oversupply pressures have forced LED chip manufacturers to lower prices.

Furthermore, San’an Opto’s procurement of 50 Aixtron’s AIX R6 and 50 Veeco’s EPIK700 MOCVD reactors is equivalent to acquiring 200 MOCVD equipment with 54 PCS production capacity. This is equivalent to San’an Opto’s production capacity expansion of 1.2 times. With the added production capacity and new machines efficiency, San’an Opto’s average costs are expected to be 30% lower than industry average. The Chinese manufacturer has raised the industry’s entry level through economics of scale.

If San’an Opto further lowers prices by 20%, it can remain profitable, while most competitors will be forced to sell below average costs. By using this type of competitive strategy, San’an Opto has driven many manufacturers to abandon plans of acquiring finances for further production expansions, or exit the LED industry. These turn of events will return the LED chip industry competition back to norm.

Many second tier LED manufacturers may have insufficient MOCVD equipment, and minimal impact on San’an Opto’s market share. Yet, these manufacturers still have influence over LED chip prices, which is threatening San’an Opto’s profitability. Only by acquiring absolute advantages will San’an Opto be able to force small LED chip manufacturers from exiting the market.

(Author: Figo Wang, Senior Analyst, LEDinside/Translator: Judy Lin, Chief Editor, LEDinside)