“Market uncertainties” are corporates top concern when entering any new market. Local regulations, cash flows and logistics are all essential information foreign companies need to acquire.

Aside from language barriers (since some Russians do not understand English very well), enterpriese are mainly concerned with the following key issues:

Policy

The Russian government has been highly supportive of “green energy” industries, and several key government projects include “Strategy 2020” and Russian Ministry of Economic Development’s Document No. 229 and Document No. 155 published in 2014. Both documents clearly state a certain ratio of LED products must be applied in “national or city constructions.” Additionally, the Russian government has rolled out incandescent bulb ban in 2014, which will speed up the adoption of LED products. As for lighting regulations, Russian lighting products tend to follow the IEC and national GOST R standards, which is mainly based on IEC regulations, and do not have special product standards.

Logistics

Manufacturers seeking access to Russia’s market can turn to traditional logistic service providers, but there are also many “consultancies” that assist foreign manufacturers product distributions in the local market, and act as another form of logistics. These consultancies usually have control over order sources, and provide solutions to assist local Russian distributors. Once the consultancy finds a suitable solution overseas, it will procure the product and ship it to Russia. Hence, it can also be viewed as a distributor.

LEDinside findings from the Russian market indicate many of these “consultancies” are backed by Chinese investors, and the Russian offices are usually just shell companies. This is also a unique situation only seen in Russia. In short, LED products entry threshold to the Russian market is fairly low, since the country has gradually lowered tariffs since joining World Trade Organization (WTO) in 2012. LED components are even expected to enter a “zero tariff” period in September 2015, while luminaire tariffs will fall by about 12% to 15%.

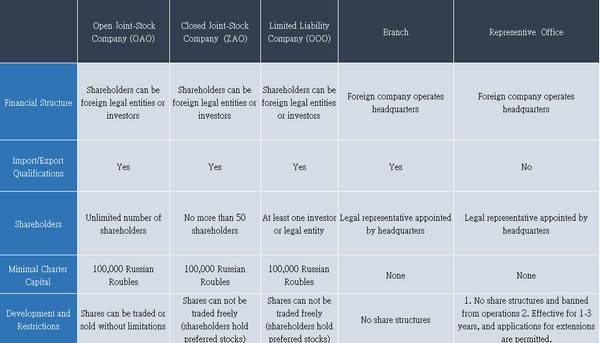

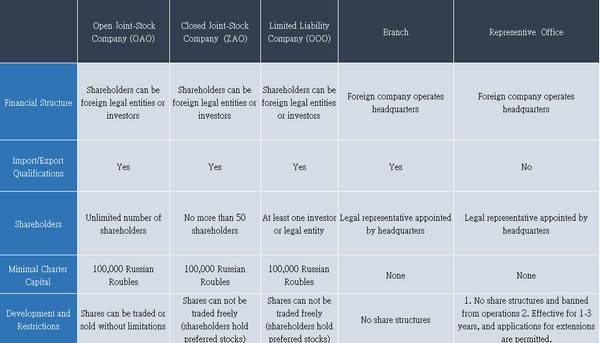

There are no particular cash flow regulations for “entering the market”, this is mainly dependent on the type of company established, and there are some differences in the lowest cash flow.

As for cash wired abroad, the Russian government has not implemented any Foreign Exchange Control regulations. In other words, foreign manufacturers can wire cash back to their home countries freely without facing monetary regulations. To sum up, Russia may appear as a closed-market, but the market is actually more liberal than many Asian countries when it comes to channeling finances and wiring money abroad.

|

|

(LEDinside) |

The Russian market is very friendly towards foreign companies, with few policy regulations or cash flows restrictions, thus foreign manufacturers can more flexibly establish companies and business models. The key to success and increasing local sales will be how manufacturers create value, and find local companies to build long term partnerships.

(Author: Clive Yen, Project Manager, Research Division, LEDinside/ Translator: Judy Lin, Chief Editor, LEDinside)