Five Chinese LED manufacturers have been competing head-to-head in the bid for Osram’s lighting business, after the German company announced it would be spinning-off its less profitable general lighting business in April 2015. The five listed Chinese companies in the race for Osram’s lighting business include MLS (also known as Forest Lighting), ETI, Tsinghua Tongfang, Felio Acoustics and Foshan Lighting. All the potential Chinese buyers have the needed financing platforms, but for the German lighting company price is just one of the decisive factors, another main concern is the synergetic effect from the resulting partnership. In the article below, LEDinside evaluates the chances of the five companies’ succeeding in the acquisition of Osram’s general lighting business.

Introduction to the five manufacturers background:

MLS (Forest Lighting)

MLS was founded in 1997, and listed on the Shenzhen bourse in early 2015. Initially, the company was mostly specializing in LED package component manufacturing for lamp applications. At the time, the company was eyeing the decorative landscape LED lighting market, and aimed to raise its cost/performance ratio to boost its market shares, so it would eventually become a leading LED package manufacturer in China’s landscape LED lighting market. Following rapid lighting market developments in 2011, the company which had built a strong foundation in landscape lighting started to enter the lighting market. As part of its strategy to enter the lighting market, MLS continued to expand its SMD LED package production line, which proved to be a successful strategy. The company currently ranks as the largest LED package manufacturer in China. In 2014, the company’s LED package revenue reached RMB 3.2 billion in China with Nationstar trailing in at second with merely RMB 1.3 billion. Additionally, MLS expanded its product supply chain into LED lighting market to promote its own lighting brand, and has deployed its distribution channels in China and international markets. LED packaging has become MLS main business revenue source, and it has aggressively developed its LED lighting business.

ETI

ETI was formerly known as Zhuhai Huarun Electronics Company (珠海華潤電器有限公司), when the company was founded in May 1996. In 2001, the company changed its name to Elec-Tech International (ETI), and initially was focused on making small electronic appliances including toasters, small ovens, and electric deep fryers. The company’s main retail markets were in the U.S. and European markets, where it targeted small electric appliance brands or large retailers. In 2008, the company entered the LED package market by acquiring Guangdong Jiang Longda (健隆達), and later entered the LED display market after absorbing Retop LED Display (深圳銳拓). In 2009 and 2011, the company invested in LED epiwafer production through two financing projects, and imported in total 92 MOCVDs. In 2013, the company acquired a stake in NVC Lighting, which was largely invested in LED lighting. ETI’s foundation in the LED industry was built upon its upstream LED chip technology, and entered the LED package industry through vertical integration. It is has since become a fully vertically integrated company.

Tsinghua Tongfang

Tsinghua Tongfang business incorporates Internet services, end market, and environmental energy efficiency businesses. In 2014, the company’s revenues reached RMB 26 billion (US $4.01 billion) in the LED industry. The company’s LED business can be split into LED chips and lighting businesses. The LED chip business is mainly managed by the group’s subsidiary Nantong Tongfang Semiconductor, while Tongfang Lighting Group is largely responsible for the LED lighting business operations. Nantong Tongfang main products are LED chips for lighting applications, and currently has 59 MOCVDs. In 2014, Tongfang Lighting acquired Neo-Neon Holdings Limited and started to expand its international LED lighting market.

Felio Acoustics

Felio Acoustics was listed on China’s A-share market in 1990, and is one of the pioneering eight companies that were listed on the local bourse. In 2002, the company acquired 100% of Shanghai Yaming Lighting (Yaming) shares to enter the lighting industry. Yaming was one of the oldest lighting companies in the Chinese market that was founded in 1923. The company was one of the earliest incandescent bulb manufacturers in the Chinese lighting market. In 2010, the company sold 66.2% shares in Shanghai Felio Acoustics, and from February to May in 2011, sold its 100% stake in Shanghai Pujiang Smart Card System. In 2015, the company acquired Indian company Havells stake in European lighting brand Sylvania (or Havells Sylvania), and its distribution channels. The company has gradually abandoned its IC business, stereo business and shifted its focus on developing LED lighting business, and has formed a lighting business development strategy centered around Yaming and Beijing Shenan Lighting.

Foshan Lighting

Foshan Lighting was founded in 1958, and listed on China’s A-share market in 1993. The company is one of the leading lighting manufacturers in China. In 2006, Foshan Municipal State-Owned Assets Supervision and Administration Commission (SASAC) sold its stake in the lighting company, following the completed transaction Hong Kong Osram Prosperity and Prosperity Lamps and Components respectively held 13.47% and 10.54% shares in Foshan Lighting and became its largest shareholder. In September 2015, Osram’s stake in the Chinese lighting company was transferred to Guangdong Electronics Information Industry Group, a subsidiary of Guangdong Rising Assets Management (GRAM). Additionally, the SASAC has acquired Foshan Lighting shares through other channels. As of December 2015, GRAM’s stake in Foshan Lighting has reached about 18.4%, making it the largest shareholder. Foshan Lighting is a traditional luminaire manufacturer that transformed its business model to enter the LED lighting market. In 2014, the company’s total revenue reached RMB 3.07 billion, with LED lighting amounting to a 30% stake in the company.

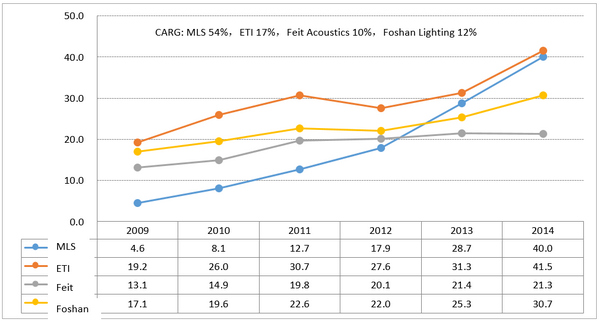

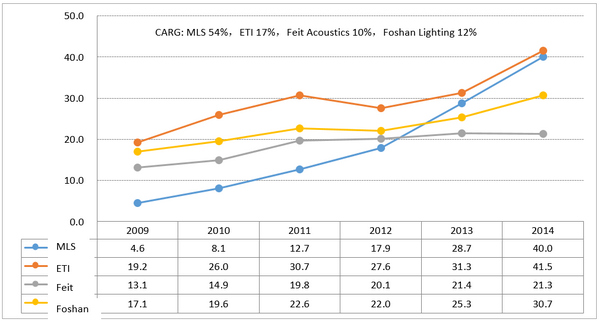

Comparison of different companies revenue shares

A comparison of the different companies revenue shows as of 2014, ETI topped the list in revenue income to reach RMB 4.15 billion. Through a series of mergers and acquisitions, ETI’s lighting revenue soared. In 2014, the company’s lighting revenue exceeded kitchen appliances for the first time to amount to 51% of the company’s revenue share. However, if we look at LED lighting alone, MLS RMB 4 billion revenue makes it the top ranking Chinese LED company. MLS has been rapidly expanding its production scale, and raising its price/performance ratio to improve its market competitiveness. From 2009 to 2014, the company’s Compound Annual Revenue Growth (CAGR) reached 54%. Felio Acoustics LED lighting revenue reached RMB 1.93 billion in 2014, while Foshan Lighting’s 2014 revenue peaked to RMB 3.07 billion. Tsinghua Tongfang’s two lighting subsidiaries also estimated their combined lighting revenue would reach RMB 1.4 billion. In the next few years, MLS will continue to expand its production capacity, and the company size has grown exponentially through mergers. The company’s LED package growth is expected to slowdown in the future.

|

|

|

A comparison of manufacturers overall revenue performance. All units in 100 million Chinese Yuan (approximately US $15.20 million per unit). (Source: Companies financial reports and organized by LEDinside)

|

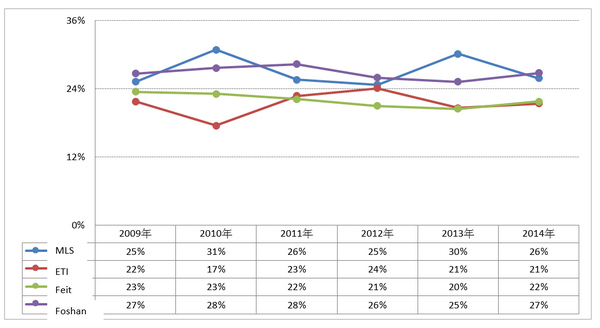

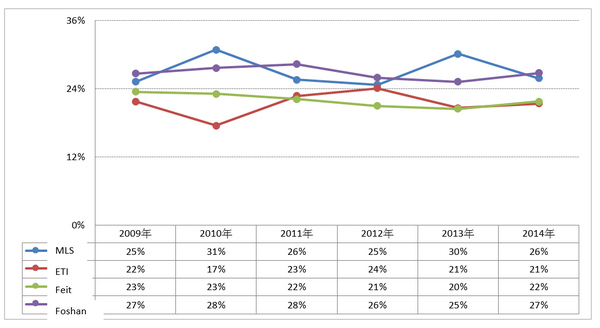

Comparison of different manufacturers profitability

MLS has been the most profitable among the five LED manufacturers from 2009 to 2014, on average the company’s gross profit ratio each year reached 27%. Foshan Lighting’s gross margin was also stable throughout this period. On the other hand, ETI and Felio Acoustics both reported lower gross margin ratio, due to impact from none-LED lighting businesses.

By singling out LED lighting business profitability, it can be observed ETI’s gross margin reached 26% in 2014, while Felio Acoustics LED business gross margin peaked to 23%. Tongfang Lighting gross margin ratio was a dismaying 9% after it absorbed Neo-Neon Lighting in 2014. It is projected ETI’s LED chip business in 2015 will rebound, and its gross margin is expected to increase. Although, MLS gross margin has temporarily slid, due to market competition, advantages from its large production scale is expected to become increasingly obvious in the near future. The company is projected to maintain its profitability at a certain level in the near future.

|

|

|

Manufacturers gross margin situation from 2009-2014. (Source: Company financial reports organized by LEDinside)

|

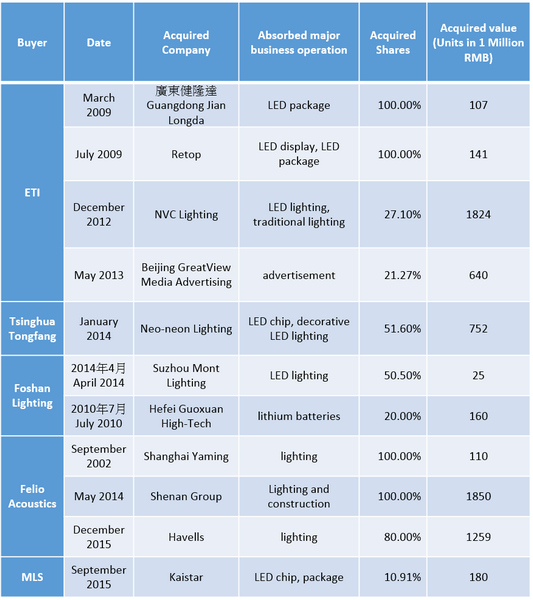

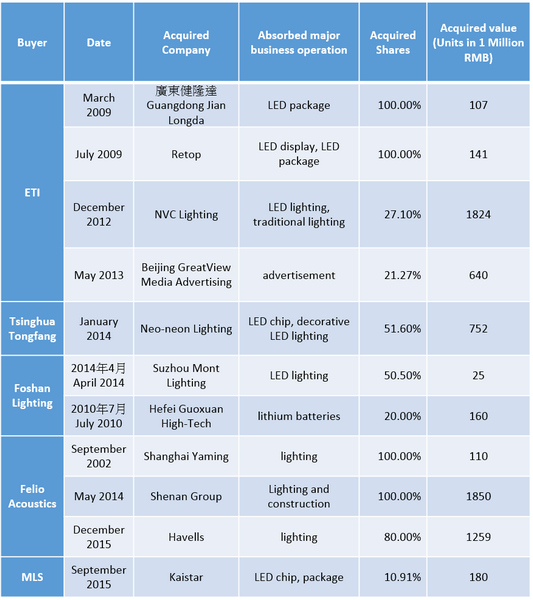

Comparison of the five companies past acquisitions

In the last few years, ETI has acquired the most companies out of the five manufacturers, and the pace and number of acquisitions has not waned since it entered the LED industry in 2009. ETI entered the LED industry through its acquisition of Jian Longda in that year, and paved its entry in the LED display market by absorbing Retop LED Display. To expand LED display exports, it has also invested in Beijing GreatView Media Advertising. To further expand its LED lighting distribution channel, the company also chose to invest in NVC Lighting, and its total transaction value reached RMB 2.7 billion.

Other mergers in the industry include Tongfang Lighting’s acquisition of Neo-Neon Lighting brand in 2014 to expand its international market. Felio Acoustics acquisition of Shenan Group in 2014 was mostly aimed at enlarging its scale, and strengthening its LED engineer lighting distribution channels. Foshan Lighting has not been involved in any major LED lighting mergers. Epistar for instance has a stake in Kaistar, and even MLS has invested in the Chinese LED company in September 2015, which has strengthened its cooperation with Kaistar. Even though the above listed mergers have expanded companies production capacity, the acquisitions synergy effects has been barely visible. In certain cases, the results from the merge has resulted in 1+1<2. The main cause has been the newly absorbed management team’s goal and interest conflict with the existing management group. For instance, ETI and NVC Lighting’s legal dispute between senior management after ETI’s management took over, which has negatively impacted NVC Lighting’s business development.

|

|

|

(Source: LEDinside)

|

Analyses of MLS and Osram’s synergy effect

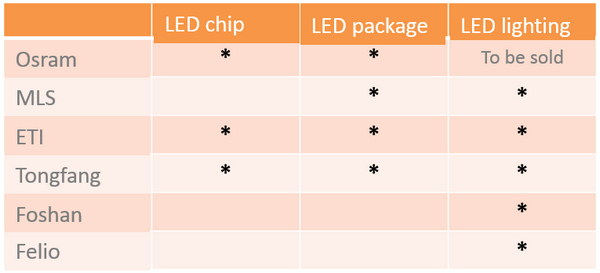

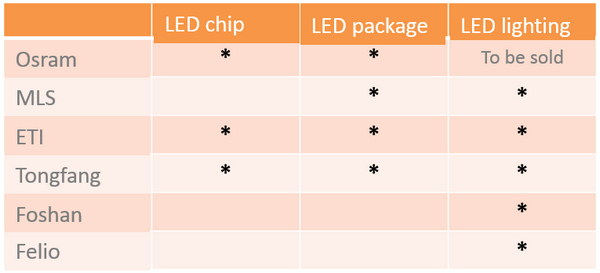

Osram is mainly selling its general lighting and related businesses, including Classic Lamps and Ballasts (CLB) and LED Lighting Solutions (LLS). The above five listed Chinese manufacturers all value Osram’s oversea lighting distribution channels, brand advantages, and any of the companies that successfully absorbs Osram would be able to boost its international lighting business.

For Osram, the company not only has to take into consideration the offered pricing, but also the two companies long term partnership. Market competition has been intense since entering the age of LED lighting, and lighting product’s gross margins have fallen below traditional light sources. Additionally, swiftly changing product specs on the market has challenged Osram’s existing manufacturing models. The German company that has prided itself as a high quality lighting manufacturer, usually has several product quality inspection stages that by the time the finished product reaches store shelves it is several generations behind competitors’ products. Chinese LED manufacturers possess flexibility and cost advantages, which makes them an ideal candidate for Osram’s general lighting business.

After Osram sells it lighting business, it will be left with Osram Opto LEDs, special lighting applications, and automotive lighting. Looking into its long term development plan, aside from investing large resources in R&D to achieve a competitive technology edge, expanding its LED component business size will also become a development focus in the future. Even though it is the leading global manufacturer in the automotive LED lighting sector, it still aims to expand its LED component business. Bypassing lighting applications will be unable to support Osram’s long term business goals. As a result, Osram announced it will construct a 6-inch sapphire substrate LED chip foundry in Malaysia, which will be focused on lighting applications.

Partnerships between international companies and Chinese manufacturers has mostly been based on OEM or outsourcing models. As price competition intensifies, Osram has not ruled out increasing the volume of products outsourced to Chinese OEMs. It is hoped the buyer of its lighting business could collaborate and achieve synergy effects in this area, hence Osram will select the potential buyer candidate based on raising its luminaire cost competitiveness and future LED chip outsource partnership.

The above listed manufacturers all possess certain cost competitiveness advantages that could achieve Osram’s goal of optimizing its lamps cost competitiveness. Among the listed manufacturers, MLS and Foshan Lighting especially stand out, since both companies are renowned for their precise cost control and mass production capacities.

Yet, from a LED OEM partnership angle, Foshan Lighting and Shanghai Felio Acoustics do not have any upstream LED chip production capacity, and could directly use Osram’s LED components in the new lighting products. ETI and Tsinghua Tongfang have large LED chip production capacity, which clashes with Osram’s LED chip expansion strategy. Hence, future partnerships will require both parties to compromise. However, if Osram forms a partnership with MLS, the company could lower its LED component prices through MLS large LED package production capacity. The lower priced LED components could then be reintroduced into Osram’s luminaires.

For these bidding Chinese manufacturers, collaborating with Osram’s large upstream LED business, and creating a brand new price competitive Osram Lighting will be the greatest challenge for these potential buyers.

|

|

|

(Source: LEDinside)

|

Conclusion

Who will acquire Osram’s lighting business? It is still too early to judge. However, Felio Acoustics recently announced it will be procuring Havells Sylvania lighting distribution channel for an estimated EUR 148.80 million (US $163.15 million). Felio Electric will be financing 40% of the acquisition with company assets and cash, which in turn signals the company’s early exit from the race to acquire Osram’s lighting business. MLS General Manager Lawrence Lin has spoken to media several times about the Chinese company’s interest in acquiring Osram’s lighting business, but the company faces strong competition. Especially from ETI, Tsinghua Tongfang, and Foshan Lighting that have shown their strength in the capital market. Manufacturers are using various financing methods, additionally the estimated depreciation of the Chinese Yuan in the next two years will make it increasingly difficult for Chinese companies finance the acquisition of U.S. dollar assets with Chinese Yuan loans.

International mergers and acquisitions are very exciting for companies to undertake, but can easily fail. From a strategic management perspective, financing operations are usually worth the risk, however, there is usually an accompanying “winner’s curse”. In any merger, differences in company culture, management concept and others can cause great disparities. Additionally, the two companies also need to spend time to solve communication and integration issues, which can involve immeasurable costs and come with a heavy price tag.

For example Benq, which was at one point the beacon of light among Taiwan’s smartphone brands during the telecommunications age, incurred massive losses after absorbing Siemens telecommunication department in 2005. The company has filed for bankruptcy, and was embroiled in labor disputes and multinational lawsuits. Do not forget Osram was a former member of Siemens group, and its decision to sell its general lighting business resulted in losses for several consecutive quarters. It’s EBITA has even sunken in the red, which signals

the acquisitor of Osram’s general lighting business would have to inject emergency financing immediately after the merger is concluded to keep the lighting company afloat.

(Author: Allen Yu, Research Analyst, LEDinsidehttp:// Translator and Editor: Judy Lin, Chief Editor, LEDinside)