Market research firm

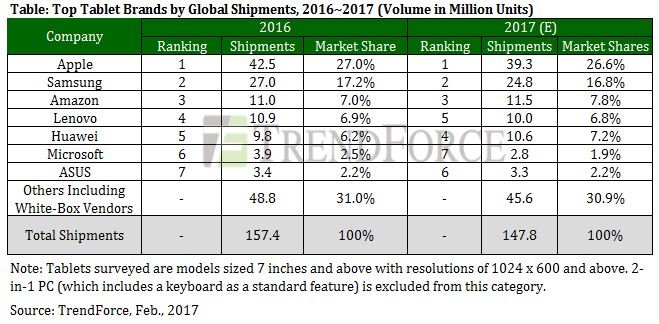

TrendForce reports annual tablet shipments worldwide posted a decline for 2016, dropping 6.6% to 157.4 million units. However, total shipments from branded tablet vendors surpassed expectations because of the robust year-end holiday sales.

"Together, major tablet brands posted a marginal decline in their total shipments for 2016," said Anita Wang, TrendForce notebook analyst. "Chief shipment contributors included Apple and Amazon. The former enjoyed strong iPad sales in the fourth-quarter busy season, and the latter nearly doubled its annual shipments. Other brands such as Huawei, Lenovo and Acer also expanded their shipments despite market headwinds."

As for white-box (white brand) vendors, Wang pointed out that their shipments were impacted by limited panel supply. "Due to profit considerations, panel makers scaled back the supply of tablet panels," noted Wang. "As a result, global white-box tablet shipments for 2016 fell by more than 20% compared with the previous year."

Going into 2017, demand for tablets will continue to be curtailed by the increasing consumer preference for large-size smartphones. Furthermore, major brands and white-box vendors will be constrained by insufficient panel inventory as South Korean panel makers cut back on the production of LCD tablet panels. According to TrendForce's projection, this year's global tablet shipments will come to 147.8 million units, a drop of 6.1% from 2016.

Apple posted better than expected iPad shipments last year; at least three new iPad models are lined up for 2017

Global iPad shipments for 2016 totaled 42.55 million units, representing an annual decline of 14.1%. Nonetheless, iPad shipments on the whole were above market expectations. Strong demand in North America and exceptional results from year-end holiday sales sustained iPad shipments last year.

Wang pointed out that Apple has as many as three to four new iPad products lined up for 2017. "In addition to an economically priced 9.7-inch model that is ready for market release, Apple will also launch a new 12.9-inch model," said Wang.

"Furthermore, Apple will also introduce a new 10.5-inch iPad. This will be a new size category for the device series."

TrendForce estimates that this year's iPad shipments will fall by 6~8% annually to around 40 million units. There are reports of a "Pro" version of iPad mini being planned. If Apple decides to release such a product this year, the annual iPad shipments may stabilize and even register growth.

Samsung remains focused on promoting OLED tablets

Samsung's tablet shipments for 2016 fell 19.4% annually to 27 million units. "The general decline in tablet demand and the fierce market competition compel Samsung to offer products with higher specifications and unique features to in order to maintain profitability for its tablet business," said Wang. "OLED displays therefore will continue to be an important part of Samsung's marketing strategy for this year." Samsung has scheduled two models, respectively sized 9.7 and 12 inches, to be released in the first quarter of 2017. Both models will feature an OLED screen.

Samsung's tablet shipments for this year are estimated to fall by 8~10% annually to around 25 million units. The brand will be concentrating on developing the high-end segment of the tablet market with OLED products rather than growing its shipment volume.

Microsoft saw flat shipment growth last year and will face the challenge of supply bottleneck for panels this year

Looking at other brands, Amazon posted a phenomenal 99.4% annual growth in its tablet shipments for 2016, totaling 11 million units. Amazon benefited from its vast base of service subscribers and was very successful in its fourth-quarter promotional activities. By nearly doubling its annual volume, Amazon climbed to the third place in the 2016 ranking of tablet brands.

In addition to the home market, Lenovo also targeted Europe, North America and Japan for shipment expansion last year. Lenovo grew its global tablet shipments by 12.3% annually to 10.9 million units and took fourth place in the 2016 ranking. Lenovo did particularly well in the fourth quarter as favorable currency exchange rates increased channel distributors' stock-up demand for its products.

Huawei last year committed substantial resources on its tablet products with a special focus on tablets with phone function and low-priced models. The brand also expanded shipments in overseas markets by leveraging its smartphone channels and close relationships with telecom companies. Huawei retained its fifth-place position in the annual tablet shipment ranking with a volume of 9.77 million units for 2016.

Microsoft in the second half of 2016 oriented its marketing efforts for the Surface Pro series towards business customers and made a strong sales push in the year-end holiday season. On the whole, Microsoft's shipments of the Surface Pro series totaled about 3.89 million last year, a decline of just 1.4% compared with the 2015 shipment figure for the device series. The brand held on to its sixth-place position in the annual ranking.

Looking ahead, Microsoft has scheduled to launch Surface Pro 5 in the first half of 2017. However, Wang noted that shipments of the Surface Pro series are going to be affected by low panel supply through 2017. "The decision by the major panel supplier Samsung Display (SDC) to reduce its LCD tablet panel production, along with the limited Oxide TFT capacity, will work against Microsoft as it tries to secure panel supply for the Surface Pro series," said Wang.

TrendForce's current shipment estimate for the Surface Pro series in 2017 is less than 3 million units. On the other hand, Microsoft also has a 10-inch device in the works. If this product is released this year and does well in sales, then there is possibility for upward revisions in Microsoft's shipments of the Surface Pro series.

ASUS shipped 3.4 million tablets in 2016, representing a significant drop of 35.3% from 2015. ASUS currently wants to maintain profitability for its tablet business and is not interested in lowering prices to boost sales. If the brand stays with this strategy during 2017, its annual shipments are expected to fall by 5~10%.