AIXTRON SE (FSE: AIXA; OTC: AIXNY), a major provider of deposition equipment to the semiconductor industry, announced its financial results for the first quarter 2017.

(Image: AIXTRON)

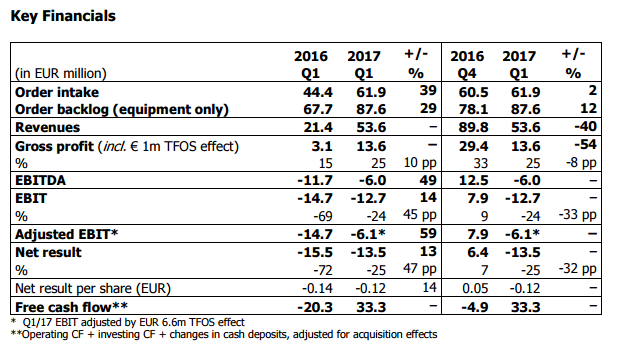

Total revenues for Q1/2017 increased to EUR 53.6m (Q1/2016: EUR 21.4m; Q4/2016: EUR 89.8m). This figure, which represents the highest Q1 revenues since 2011, was supported by a solid order backlog and mainly driven by demand for production systems for Opto and Power Electronics, LEDs, as well as for Memory applications.

The free cash flow of EUR 33.3m in Q1/2017 improved by EUR 53.6m on the previous year (Q1/2016: EUR -20.3m; Q4/2016: EUR -4.9m). This was mainly due to the collection of receivables as well as advanced payments received from customers.

Order intake in Q1/2017 came to EUR 61.9m, 39% higher than in the previous year (Q1/2016: EUR 44.4m; Q4/2016: EUR 60.5m). This was due to consistently high demand of Equipment for LED, telecom and optoelectronic applications.

As of March 31, 2017, the equipment order backlog totaled EUR 87.6m, a 12% increase on the figure of EUR 78.1m at the beginning of the year (March 31, 2016: EUR 67.7m).

Cash and cash equivalents (including cash deposits with a maturity of more than 90 days) increased to EUR 193.6m as of March 31, 2017, as against EUR 160.1m as of December 31, 2016. The difference is mainly due to the collection of receivables.

Business Development

Revenues in Q1/2017 developed in line with expectations. As in previous quarters, the key driver for the development in revenues and order intake was demand for production systems for specialty LED, telecom and optoelectronics, as well as for memory applications. This in turn was mainly attributable to emerging technology trends, such as big data, cloud computing, electro mobility, and the upcoming 5G mobile communication standard.

First measures in order to focus R&D spending for the development of future technologies, were freezing the product development for III-V-Materials for future generation logic chips (TFOS). This resulted in a one-time write down of TFOS assets totaling EUR 6.6m.

Cost of sales for Q1/2017 increased to EUR 40.0m year-on-year, equivalent to 75% of revenues (Q1/2016: EUR 18.3m, or 85% of revenues; Q4/2016: EUR 60.5m or 67% of revenues). This was a reflection of the corresponding revenue levels as well as low margin AIX R6 sales from inventory and a write down of EUR 1.0m related to the TFOS activities during Q1/2017.

Gross profit and gross margin in Q1/2017 improved to EUR 13.6m and 25% respectively against the previous year but fell on a quarterly comparison (Q1/2016: EUR 3.1m, 15% gross margin; Q4/2016: EUR 29.4m, 33% gross margin) mainly due to above mentioned reasons.

Operating expenses in Q1/2017 increased to EUR 26.4m (Q1/2016: EUR 17.8m; Q4/2016: EUR 21.4m). This was mainly due to higher R&D expenses which included a EUR 5.6m write down of assets related to AIXTRONs TFOS activities.

EBITDA in Q1/2017 was EUR -6.0m, an improvement 49% year-on-year (Q1/2016: EUR ‑11.7m; Q4/2016: EUR 12.5m).

The EBIT improved year-on-year by 14% to EUR -12.7m in Q1/2017 (Q1/2016: EUR -14.7m; Q4/2016: EUR 7.9m).

The adjusted EBIT which excludes the previously mentioned TFOS write downs was EUR ‑6.1m in Q1/2017.

The net result for Q1/2017 amounted to EUR -13.5m and thus improved by 13% on the previous year (Q1/2016: EUR -15.5m; Q4/2016: EUR 6.4m). Q1/2017 adjusted net result before one-time TFOS write downs was EUR -6.9m.

Management Review

“AIXTRON has a wide portfolio of enabling technologies for highly diversified applications and industries. To better focus R&D costs for the development of future technologies, we will group our portfolio for future technologies and transfer it into clearly defined independent units to be financed with respective technology partners”, comments Kim Schindelhauer, CEO of AIXTRON SE.

“In a first step to focus our Research and Development expenses in the future, we wrote down assets totaling 6.6m Euros resulting from freezing our product development for III-V-Materials for future generation logic chips (TFOS). We will not spend further R&D until a firm timeline for the introduction of this material application has been set and a partner covers the required developments costs. Then, we are fully committed to support our customers to introduce TFOS materials to the market.”

Guidance

The revenue development in the first three months of 2017 was supported by the solid order backlog at the end of 2016. The comparatively high order intake in Q1/2017 supports Managements’ expectation on the development of revenues and order intake during 2017.

Consequently, Management reiterates the full year 2017 guidance given in February 2017 with an order intake and revenues between EUR 180 and 210 million.

Management continues to expect an improvement of the free cash flow in 2017 compared to 2016 and to achieve a positive EBIT for full year 2018.