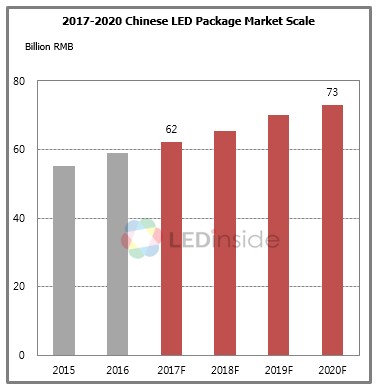

According to the latest report from LEDinside, a division of the market research firm TrendForce, 2017 Chinese

LED Chip and Package Industry Market Report, Chinese LED package market scale in 2016 reached RMB 58.9 billion, went up by 6% YoY, higher than expected.

LED price held steady in 2016, some products saw price growth, and the industry is still in an uptrend under the drive of fine-pitch, automotive and lighting markets. As for the market outlook in 2020, it is expected that the Chinese LED package market size will be up to RMB 73 billion.

LEDinside analyze top six market trend, according to Chinese LED chip and package industry trend.

Trend One: Chinese LED Camp Dramatically Accelerate in the Market, Domestic Usage Rate Consistently Increase

According to LEDinside analysis, domestic usage rate in Chinese LED package market in 2016 came to 67%, though the international manufacturers headed by Nichia are still the major suppliers in Chinese LED package market. Five of the top 10 manufacturers are international enterprises, and Nichia topped the ranking. But, in view of Chinese manufacturers, MLS achieved rapid development, surpassing Lumileds and taking the second place in 2016, as well as NationStar and Honglitronic improved their ranks.

Trend Two: Chinese Lighting LED Market Steadily Increase

Chinese lighting LED market scale reached RMB 25.9 billion, which is lower than expected market. The main reason is that the demand for

LED lighting in the global market did not witness a noticeable growth, causing China’s overall LED lighting export to slump. Yet, due to the demand and stable pricing in the domestic market, LED lighting in the China market still experienced a growth of 9% YoY in 2016, and LEDinside forecast that lighting LED market scale will increase to RMB 28 billion in 2017, and RMB 36.4 billion in 2020. with a CAGR of 9% from 2015 to 2020.

Trend Three: International Camp Release Lighting LED OEM Order to China

A number of international brand manufacturers (Lumileds, OSRAM, CREE, Samsung, LG Innotek) OEMs orders will gradually concentrated to China due to the low-power LED swept the lighting LED market, thus China's 1 tier manufacturers maintain high capacity utilization. The top five Chinese lighting LED manufacturers in 2016 is MLS, Honlitronic, Lightning Opto, Refond, and MTC.

Trend Four: Fine Pitch Display Market Demand Spur Each Manufacturer Expansion Plan

LEDinside analyze that display LED market is still growing due to the rise of fine-pitch display market demand. LEDinside estimates that display LED market scale in 2020 will be RMB 15.8 billion. Fine-pitch display LED was led by Everlight in the early stage. Many Chinese manufacturers have entered the area, including NationStar, MLS and Kinglight, which also spur each manufacturer expansion plan.

Meanwhile, AlInGaP LED capacity needs are also increasing in 2017. According to LEDinside analysis, San’an Opto, HC Semitek, Changelight, and Epistar all raise AlInGaP LED capacity in 2017.

Trend Five: Rising Domestic MOCVD Further Cost Reduction for Chinese Camp

According to LEDinside survey, the consolidated MOCVD shipment in 2016 amounted at 136 sets. Veeco mostly manufactured EPIK700 MOCVDs that feature larger chambers and it was therefore considered to produce the most chambers after recalculating the number of chambers produced using a K465i MOCVD as the reference. Meanwhile, Chinese MOCVD providers, such as AMEC and Topecsh, have been gradually rising lately, despite a total market share of merely 11% in 2016. Yet, after several tests were conducted by clients in 2016, domestic MOCVD equipment will be joining in the Chinese LED chip supply chain in 2017.

MOCVD equipment used to be in hands of western companies. Yet, ever since domestic MOCVD equipment emerged and local LED chip makers started testing it, it suggested a chance to see locally made MOCVD to be introduced to a part of chip makers’ plants in 2017. Also, as the equipment is pegged at lower rates, the total cost of ownership is likely to decrease.

Trend Six: Filament Bulb and Filament LED Market Demand Sufficiently Increase Year by Year

In the coming two years, due to the popularity of LED filament bulb in the Europe, North America, Australia, more and more manufacturers will enter this segment, and market scale will show a faster growth. LEDinside estimated that the global LED filament bulb market demand was 150 million pcs in 2016 and hit 600 million pcs in 2018.

On the packaging side, major filament LED suppliers will be Runlite, MLS, Refond, and Hangke Optoelectronics.

Authors Allen, Joanne / LEDinside

LEDinside 2017 Chinese LED Chip and Package Industry Market Report

Release: 30 June 2017

Language: Chinese / English

Format: PDF

Page: 269

Chapter I Chinese LED Package Industry Overview

-

2015-2020 Chinese LED Package Market Size

-

2015-2020 Chinese LED Package Market Size- Market Camps

-

2015-2020 Chinese LED Package Market Size- Power Types

-

Global Top 10 LED Manufacturers Revenue Rankings in China

-

Chinese Top 10 LED Manufacturers Revenue Ranking in China

Chapter II Chinese LED Segment Market Trend

Mobile Backlight LED and Flash LED Market

-

2015-2020 Chinese Package Market Scale

-

2016-2017 Mobile Shipment

-

Backlight LED Specification

-

Flash LED Specification

-

2016-2017 Flash LED Price Trend

-

Backlight LED Supply Chain

-

Flash LED Supply Chain

-

Chinese Small Sized Backlight LED Manufacturer Ranking

Large Sized Backlight LED Market

-

2015-2020 Chinese Package Market Scale

-

2016-2017 TV Shipment

-

Edge-Type TV Backlight LED Specification

-

Direct-Type TV Backlight LED Specification

-

TV Backlight LED Supply Chain

-

Chinese Large Sized Backlight LED Manufacturer Ranking

Lighting LED Market

-

2015-2020 Chinese Package Market Scale

-

Lighting LED Specification

-

Lighting LED Supply Chain

-

Chinese Lighting Manufacturer List

-

Chinese Lighting LED Manufacturer Ranking

-

2016 Chinese Top 10 COB LED Revenue Ranking

Display LED Market

-

2015-2020 Chinese Package Market Scale

-

Display LED Specification

-

2016-2017 LED Manufacturers Display LED Capacity Forecast

-

Fine Pitch Display LED Supply Chain

-

Major LED Display Manufacturers

-

Chinese Display LED Manufacturer Ranking

-

Analysis of Chinese LED Manufacturer R&D Competence

Chapter III 2016-2017 LED Industry Market Focus

Key Trend I- MOCVD Equipment Localization

-

Rising Domestic MOCVD Further Cost Reduction for Chinese Camp

-

New MOCVD Improved Capacity To Phase Out Old Equipment

Key Trend II- Increasing OEM Orders From the World to China

-

LEDinside Perspective- Increasing OEM Orders from the World to China

-

OEM Business Chain in China- LED Package House and Internal Brands

-

International Camp OEM Orders Flew to Chinese Camp

-

International Brands' Outsource Orders Increased

-

Major OEM Revenue Scales Sufficiently Increasing

-

2013- 2016 OEM Capacity Analysis

Key Trend III- AlInGaP LED Production Scale Up

-

AlInGaP LED Chip House in China and Taiwan

-

2017 AlInGaP LED Manufacturers Expansion Plan

Key Trend IV- Blooming LED Filament Market

-

LED Filament Bulb Market Trend- 2016-2018 Global LED Filament Bulb Market Scale & Forecast

-

Chinese LED Filament Lighting Manufacturer Strategy- MLS Bought Super Trend and Ledvance to Grab LED Filament Market

-

Chinese Major Filament LED Players and Capacity

Chapter IV Chinese LED Package Manufacturer Strategy Analysis

-

Major 20 Chinese LED package manufacturers strategy analysis, including revenue and profit, product mix, production capacity expansion plan, business summary for 2016, financial analysis, main customers, and LED perspective.

Chapter V International LED Manufacturers Business Activities in China

-

Nine international enterprises and eight Taiwanese manufacturers business activities are analyzed in the report, including company product and business strategy, revenue and profit, Chinese revenue and share, and main customers in China.

Chapter VI China’s LED Package Manufacturers Competitiveness

Chinese and International Manufacturers Competitiveness

-

Major LED Manufacturers Global Revenue

-

Major LED Manufacturers Revenue from China Market

-

Major Manufacturers Revenue from China

-

Major Package Manufacturers Revenues Growth Rate

-

Top 10 LED Manufacturers Revenue Rankings in China

-

International Manufacturers Activities in China’s LED Industry

Intense Market Competition Between Chinese Manufacturers

-

LED Industry Development Revolution From Mature Stage

-

Industry Concentration By Province

-

Industry Concentration By Region

-

Industry Concentration

-

Industry Integration Trend

Chinese Chip and Package Industry Trend

-

Package Manufacturers to Integrate into Lighting Field

-

Package Manufacturers to Integrate into Supporting Fields

-

Few Chip Manufacturers to Integrate into Packaging Business

Opportunities and Threats in Chinese LED Package Industry

Chapter VII Chinese Chip Market Analysis

-

2010-2016 Chinese LED Chip Industry Subsidies Analysis

-

2015-2016 Chinese LED Chip Market Scale

-

Chip Industry Development- 2015-2020 Chinese LED Chip Market Scale

-

Chip Industry Development- 2015-2017 Chinese LED Chip Production Value

-

2016 Chip Manufacturer Revenue Ranking in China

-

Major 13 Chip Manufacturer in China- Chip Revenue, MOCVD Plan, Product Strategy

Chapter VIII Conclusions and Suggestions

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912