According to the latest report from LEDinside, a division of the market research firm TrendForce, 2018 Light LED and LED Lighting Market Outlook, LED lighting market scale will achieve USD 32.72 billion in 2018 and will reach USD 33.3 billion in 2019 when lighting that can be replaced enter the period of saturation, while industrial, architectural and landscape, outdoor and special commercial lighting will keep on developing.

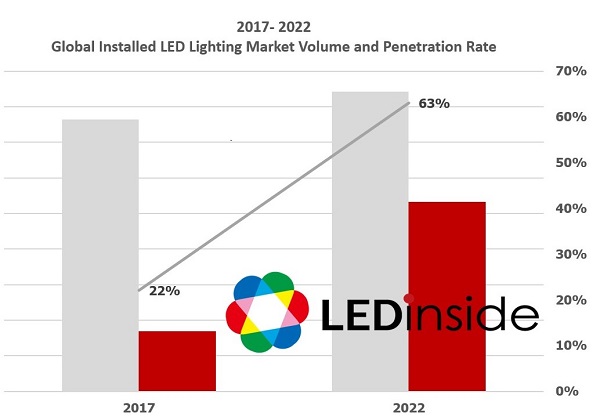

According to LEDinside survey on global installed LED lighting market, the quantity of installed LED lighting products replacing traditional lights increased rapidly. The LED lighting penetration in 2017 is 22% and it is expected to reach 63% in 2022. CAGR of installed LED lighting products will be 26% during 2017 to 2022.

Lighting LED Market Value is Expected to 7.16 Billion in 2018

The lighting LED market value increased more than 10% YoY in 2017, and is expected to grow about 7.8% in 2018, reaching USD 7.16 billion. But it will suffer decrease and enter recession period after 2020. The retrofit lamps like bulb and tube have been saturated, while the industrial lighting products including high/low bay and the commercial lighting products like troffer, panel light and filament lamp still achieve CAGR of 30%. The overall CAGR of lighting LED will reach 4% during 2016-2021.

Quality of light is still the one of the market attentions. High-CRI LED refers to the LED products with CRI higher than 90, mostly applied to high-end commercial lighting market like museum lighting, retail lighting and food lighting which has strict requirement on quality of light. High-CRI LED takes up small market share at present, and its global market scale in 2017 is around USD 330 million. As the market demand increases in next few years and the package technology improves, the revenue is expected to achieve rapid growth

LEDinside Smart Lighting, Niche Lighting and Lighting in Emerging Countries are Top Three Driving Forces for Global LED Lighting Market Trend

Driving Force One: Smart Lighting

The global smart lighting rapidly develops in 2017, and its market scale approximates to USD 4.6 billion, increased 95% YoY, as the technology & products mature and the product concepts become popular, the market scale is expected to reach USD 13.4 billion in 2020. Industrial and commercial lighting are the largest application fields of smart lighting, due to its digitalization, smart lighting will bring more new business model and value growth point for these two fields.

Driving Force Two: Niche Lighting

LEDinside surveyed four niche lighting market segment, including horticulture lighting, healthcare lighting, fishing lighting, and marine lighting and harbor lighting. Amongst those, Horticulture lighting grow rapidly in the US and China, which is mainly promoted by the demand for plant factory construction and greenhouse lighting.

Driving Force Three: Lighting in Emerging Countries

The economic development of emerging countries promotes infrastructure construction and enhances urbanization, the construction of large-scale commercial facilities and infrastructure and industrial economic zone stimulate LED lighting needs. Besides, the energy-saving policies including energy subsidies, tax incentives announced by national and local governments, the large-scale bidding projects like street lighting, residents and business district renovation and the improvement of lighting products standard certification contribute to the promotion of LED lighting. Amongst those, lighting market demand grows fast in Vietnam in Southeast Asia and India.

Lighting Player Strategies at Post Lighting Era

First: For the international lighting manufacturers, the traditional lighting capacity is high. Although they have transformed into LED lighting and have had a lot of plans for LED lighting products, the plan on increasing LED lighting penetration rate isn’t as expected. Thus, they will speed up the innovation and growth of LED lighting business to realize the goal of gaining profits. The representative manufacturers include Philips Lighting, OSRAM Licht AG, GE (Current) and LEDVANCE.

Second: The lighting manufacturers which focus on regional development are known as national team or local king. With the support of governments, they use specification, bidding and tariff to block the foreign manufacturers and encourage local lighting manufacturers to develop lighting products by political incentives and subsidies. The representative manufacturers include Acuity Brands, Panasonic, TOSHIBA, Feilo Acoustics and OPPLE, making the LED lighting penetration rate reach 60%-70% in 2016.

Third: The emerging manufacturers which have niche advantages, especially marketing channel, are able to enter the special market with technical assistance. No matter light bulb or lamp, they can adopt LED lighting products in the beginning and make profits. The representative manufacturers include Feit Electric and Iris Ohyama. However, due to the uncompetitive manufacturing costs, their revenue and profit decline year after year.

Fourth: The representative manufacturers, MLS (Forest Lighting), CREE, Yankon Lighting and LEEDARSON, are the companies which transformed from upstream and midstream manufacturing or OEM to own brands. Chinese lighting manufacturers have a foothold on the world’s biggest home of lighting production and manufacturing: the Chinese market. With the advantage of manufacturing cost, Chinese lighting manufacturers have accumulated the capability to enter the international market.

2018 Light LED and LED Lighting Market Outlook

Part One: Lighting LED Market Outlook

LED Lighting Market by LEDinside - Product Definition

2018-2021 Lighting LED Market Value

Mid and Standard Power LED Continued Expanding

2016-2018 Lighting LED Market Price Trend

2016 Global Top 10 COB LED Companies Revenue Ranking

High Power Lighting LED Market Trend- Stage Lighting

High Power Lighting LED Market Trend- Horticultural Lighting

2018-2021 Architectural Lighting LED Market Trend

High Power Lighting LED Market Trend- Architectural Lighting

Trend of Products with High CRI

Part Two: Global Lighting Market Trend

Global LED Lighting Market Trend

LED Lighting Market by LEDinside - Product Definition

European Lighting Market Trend

North American Lighting Market Trends

Japanese Lighting Market Trends

Chinese Lighting Market Trends

SEA and Australian Lighting Market Trends

Indian Lighting Market Trends

Middle East, and Africa Market Trends

Latin America Lighting Market Trends

Lighting Business in Emerging Market Holds Promising Outlook

2017-2022 Global LED Lighting Market Scale: By Product

2017-2022 Global LED Lighting Market Scale: By Region

2017-2022 Installed Global LED Lighting Market and Penetration

Halogen Lamps Will Be Phased Out After 2018

2016-2018 Global LED Lighting Market Forecast: By Product

2017 Global LED Lighting Market-Value Based: By Product v.s. By Region

2017 Global LED Lighting Market-Volume Based: By Product v.s. By Region

2018 Global LED Lighting Market-Value Based: By Product v.s. By Region

2018 Global LED Lighting Market-Volume Based: By Product v.s. By Region

Part Three: Lighting Player Strategies

2016- 2017(F) Top 20 Lighting Player Revenue Ranking

2016- 2017(F) Top 20 LED Lighting Player Revenue Ranking

Lighting Player Strategies at Post Lighting Era

European Lighting Manufacturer Strategies (Philips Lighting, LEDVANCE, Zumtobel)

US Lighting Manufacturer Strategies (Acuity Brands, Eaton Lighting, Hubbell)

Japanese Lighting Manufacturer Strategies (Panasonic, Toshiba, Endo Lighting)

Chinese Lighting Manufacturer Strategies (OPPLE Lighting, MLS, Feilo)

Part Four: Regulations

Zhaga Definition and Classification

Zhaga Development Direction and Future Trend

2018-2021 Global LED Light Engine Market Scale

U.S. Standard: DLC 4.2 Launched New Technical Requirements

U.S. Standard: Rf Index in IES TM-30-15 has been Selected into TC 1-90 Plan

Chinese LED Lighting Standard-GB

Chinese LED Lighting Standard - GB/T30413-2013

Customized Report / Consulting Service: LEDinside Keeps the Right to Adjust the Contents, Depending on Industry Development Trend.

LEDinside provides customized reports and consulting service, please call or email us.

If you would like to know more details, please contact:

Joanne Wu

joannewu@trendforce.com

+886-2-8978-6488 ext. 912