Major Chinese LED chip suppliers including San’an Optoelectronics and HC SemiTek have lowered their product prices recently, indicating the end of LED chip price hike that had lasted for one and a half year. According to LEDinside, a division of TrendForce, the recent price drop signals the end of LED chip undersupply, and the next year will witness a balance in LED chip supply and demand.

“However, as the major LED chip makers continue to carry out capacity expansion plans, we do not exclude the possibility of temporary oversupply in the next two years”, says Figo Wang, senior analyst of LEDinside.z

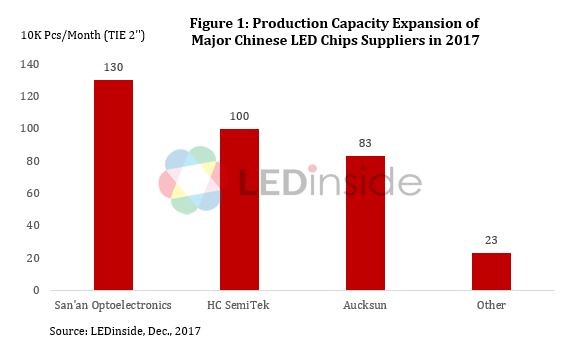

Wang also points out that prices of LED chips in China fell sharply during 2015, resulting in a surge of orders going to Chinese LED chip suppliers in 2016. In order to meet the demand, Chinese chip suppliers have decided to raise their CAPEX. In comparison, other chip makers worldwide have lowered their investment in production, and even withdrew from the LED market. In 2017, Chinese LED chip makers continue their active investment in the industry and this year’s new MOCVD expansion plans mainly come from San’an Optoelectronics, HC SemiTek and Aucksun.

Regarding 2-inch equivalent epitaxial wafer, San’an Optoelectronics, HC SemiTek and Aucksun increase their production capacity by 1.3 million pieces, 1 million pieces, and 0.83 million pieces respectively, making them the top 3 LED chip suppliers in China. With the chip makers’ capacity expansion at the end of 2017, the market is expected to enter a balance in supply and demand. Therefore, suppliers like San’an Optoelectronics and HC SemiTek strategically adjust their prices of chips for lighting applications and digital displays, which are always a focus of competition in the industry. The prices, which have been pushed up for one and a half year, have chances to enter a period of stability or slight fluctuation.

|

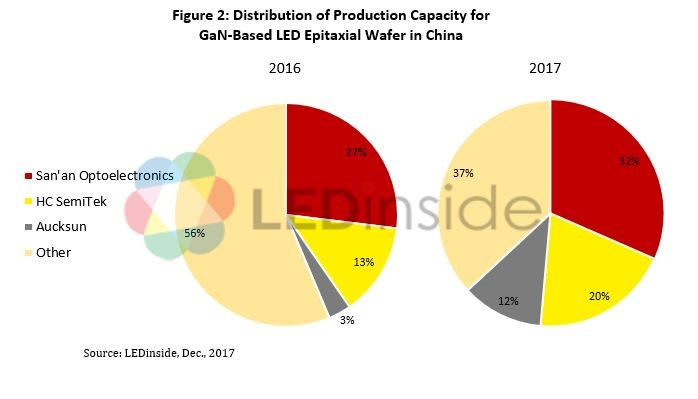

After this round of large-scale expansion, the production capacity of the three industry leaders will exceed 1 million pieces per month, increasing the industrial production concentration. It can also improve the supply structure and prevent excessive price competition. In addition, new MOCVD systems have higher production efficiency than previous generation of K465i, lowering the cost by 30%. As the result, major players like San’an Optoelectronics and HC SemiTek will enhance their cost competitiveness while other suppliers that cannot afford the production expansion will be marginalized in the market.

|

LEDinside Gold Market Report

|

|

Content

|

Format

|

Release

|

|

LED Industry Demand and Supply Data Base

|

Demand Market Forecast:

2017-2022 Demand Market Forecast

(Projection and Display / General Lighting / Architectural Lighting / Automotive- Passenger Car / Digital Display / SSL Like / UV LED / IR LED)

|

Excel

|

1Q (February) / 3Q (August)

|

|

Supply Market Analysis:

1. Chip Market Revenue (External Sales, Total Sales)

2. WW new MOCVD Chamber Installation volume / WW Accumulated MOCVD Chamber Installation / WW New and Accumulated MOCVD by K465i

3. Epi Wafer Market Demand (Total / By size)

|

|

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue

|

|

LED Package Market Analysis:

LED package vendors' revenue and LED revenue

Top 10 LED package revenues in Backlight, Lighting, COB, Automotive, Display, UV LED and IR LED (TBD)

|

|

LED Industry Price Survey

|

Price Survey- Sapphire / Chip / LED Package / Bulb

|

Excel

|

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November)

|

|

LED Market Demand and Supply Analysis

|

Demand Market

|

PDF

|

2Q (May) / 4Q (November)

|

|

Backlight

|

|

General Lighting

|

|

Automotive- Truck (2Q) / Truck (4Q)

|

|

Display

|

|

Infrared LED Market (2Q) / UV LED Market (4Q)

|

|

μLED (4Q)

|

|

Supply Market

|

|

|

|

|

Customized Report / Consulting Service: LEDinside Keeps the Right to Adjust the Contents, Depending on Industry Development Trend.

LEDinside provides customized reports and consulting service, please call or email us.

If you would like to know more details, please contact:

|

Joanne Wu

joannewu@trendforce.com

+886-2-8978-6488 ext. 912

|

|

|