Veeco Instrument released the financial results for its second quarter of 2018. Its revenue has grown by 40.64% YoY to US$ 157.8 million, with Non-GAAP operating income of US$ 11 million and EPS of US$ 0.15. With GAAP, the company had a net loss of US$ 237.6 million or US$ 5.02 loss per diluted share.

John R. Peeler, the Chairman and CEO of Veeco, said, “Veeco had solid Q2 performance with Non-GAAP gross margin, operating income, net income and EPS at the high end of our guided ranges. Based on Ultratech’s performance relative to our prior projections, we were required to record an intangible asset impairment charge of $252 million for GAAP results. This is a non-cash charge and does not affect our liquidity, day to day operations or Non-GAAP results.”

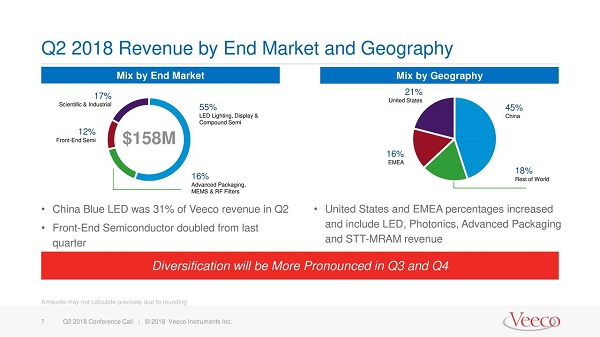

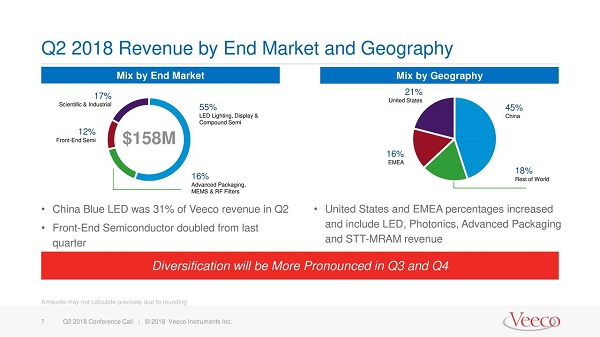

(Image: Veeco)

According to Veeco, more than half (55 percent) of the company’s revenue came from the end market of LED lighting, display and compound semiconductor and front-end semiconductor has doubled compared to last quarter, accounting for 12 percent. 17 percent of the revenue was from the scientific and industrial market while 16 percent was from advanced packaging, MEMS & RF filters. 45 percent of Veeco’s clients for Q2 were from China, 21 percent were from the U.S., 16 percent were from EMEA (Europe, Middle East and Africa) and the rest of the world accounted for 18 percent.

For the outlook of 3Q18, Veeco expects revenue to reach between US$130 – 140 million and Non-GAAP income to fall between US$ 4-9 million. The company plans to continue the integration with Ultratech to generate synergies for further progress and has initiated steps to rationalize manufacturing capacity by closing one of the Singapore manufacturing sites. With the completion of the initiative by the end of 1Q19, Vecco anticipates to save approximately $2 million annually.