According to the latest research report of LEDinside 「2019 Global LED Video Wall Market Outlook - Cinema, Rental Market and Price Trend」, as the demand for LED display in markets including rental market, HDR market application, retail and meeting room boosts, the annual growth rate of indoor fine pitch display in 2018 is expected to 39% and its CAGR during 2018 o 2022 will reach 28%, which is driven by the continuous development of ultra-fine pitch display in the future.

Regarding display LED market, LEDinside projected that the CAGR of LED market value in fine pitch display market is 26% from 2017 to 2022. Fine-pitch display is still the main driver of display LED demand.

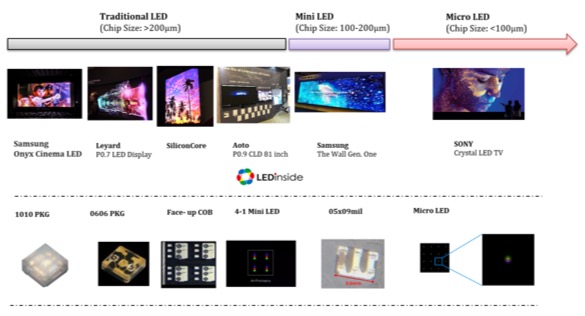

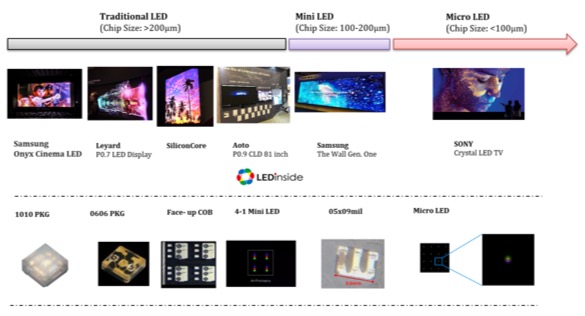

According to LEDinside, major display LED products in 2018 include traditional LED package (SMD LED), COB LED, four-in-one Mini LED package, Mini LED and Micro LED. With the development of ultra-fine-pitch display market, the market share of four-in-one Mini LED package, Mini LED and Micro LED is expected to increase obviously. Currently, main Mini LED related players include San’an, HC Semitek, Epistar, NationStar, Harvatek, and Macroblock. Other Chinese LED manufacturer are expecting to enter the supply chain.

According to LEDinside analysis, the profit of video wall (digital display) market is considerable, compared with other industries. As the pitch is narrowed, new application scenes continue to be developed. Chinese and Taiwanese manufacturers in related fields, from chips and packages to systems and brands, are eager to enter this market.

LEDinside 「2019 Global LED Video Wall Market Outlook - Cinema, Rental Market and Price Trend」have a comprehensive analysis on the video wall market scale, player status, product trend, application scenes like Cinema, rental, and video wall (digital display) price trend. For further information, please contact us!

2019 Global LED Video Wall Market Outlook-Cinema, Rental Market and Price Trend

Release Date: 01 September 2018

Format: PDF

Language: Traditional Chinese / English

Page: 205

Chapter I. Display Market Trend and Analysis

Chapter II. Micro LED Display Technology Trend

Chapter III. HDR and Cinema Market Trend

Chapter IV. Analysis of LED Display Price

Chapter V. LED Display Rental Market

Chapter VI. Display Manufacturer Strategy

Chapter VII. LED Manufacturer Business Strategies

Chapter VIII. Display Driver IC Market and Player Strategies

Chapter I. Display Market Trend and Analysis

Digital Display Market Supply Chain and Requirement

2018-2022 Global LED Display Market Scale Analysis

2017-2018 (F) LED Display Player Market Share Analysis

2018-2022 Global Fine Pitch Display Market by Pitch

2017-2018 (F) LED Fine Pitch Display Player Market Share Analysis

2017-2018 (F) Fine Pitch Display Market by Region

2017-2018 (F) Chinese LED Digital Player Shipment

2017 Chinese LED Digital Player Revenue and Shipment Analysis

2017-2018 (F) Global Fine Pitch Display Market by Application

LED Display in Broadcast Market Growth Factors

LED Display in Security & Control Room Market Growth Factors

LED Display in Corporate & Education Market Growth Factors

LED Display in Public Area and Transport Market Growth Factors

LED Display in Retail Market Growth Factors

LED Display in Hospitality & Entertainment Market Growth Factors

Chapter II. Micro LED Display Technology Trend

Micro LED Display Advantages

Micro LED Display and Fine Pitch LED Display- Cost Analysis

Micro LED Display Technology Overview Analysis

u Chip and Package Size Development Trend

u RGB LED Chip Technology Analysis

u Drive and Backplane Technological Requirements

u Drive and Backplane Design Trend Requirements

Samsung Electronics v.s. LG Electronics Step in Micro LED Display

SONY

u Crystal Micro LED Display First Generation Product

u Crystal Micro LED Display Second Generation Product

Display Players and LCD Players Step in Micro LED Display

Chapter III. HDR and Cinema Market Trend

HDR Display Application Environment

Projector and LED Display Long-Term Target Market

3.1 Cinema Market Trend

2006-2026 Cinema Market Development Trend

Cinema Three Major Development Trends

2018-2020 Projector Replacement Market Trend

Premium Cinema Definition

2018-2020 Premium Cinema Market Demand

3.2 Cinema Display and Sound Effect Market Requirements

Cinema Market Image Display and Sound Effect Requirements

Cinema DCI Regulation and HDR10+

HDR10+ Specifications Approach Dolby Vision

Impact of HDR10+ Specifications on LED and Driver IC Market

3.3 LED Display and Projection Market Opportunities

LED Display Opportunities and Challenges in Cinema Market

2020 Cinema Screen Size Market Trend

LED Display in Cinema Design Process and Future Market Trend

LED Display with 3D Cinema Opportunities

2018 Projection and LED Display Market Scale

Projection and LED Display Products Price Analysis

Chinese Cinema Chain Market Strategy

Chapter IV. Analysis of LED Display Price

Four Key Factors Influencing the Price of Display Products

LED and LCD Display Price Analysis- By Pixel Pitch

P2.5 LED Display Price Analysis

P1.9 LED Display Price Analysis

P1.6 LED Display Price Analysis

P1.2 LED Display Price Analysis

P0.8 and P0.9 LED Display Price Analysis

Chapter V. LED Display Rental Market

Equipment Rental Market

2018-2022 LED Display Rental Market Scale

Main Image Display Equipment Rental Players- Business Model

Image Display Equipment Rental Market for LED Display- Four Major Rental Requirements

Main Image Display Equipment Rental Players- North America Manufacturers

Main Image Display Equipment Rental Player- European Manufacturers

Main Image Display Equipment Rental Player- Taiwanese Manufacturers

Chapter VI. Display Manufacturer Strategy

22 Companies Revenue

Product and Market Strategy

Chapter VII. LED Manufacturer Business Strategies

u 7.1 2018-2021 Display LED Market Value and Volume Analysis

u 7.2 Display LED Product Specifications and Price Trend

u 7.3 Display LED Capacity and Supply Chain Analysis

u 7.4 Indoor Fine Pitch Display LED Technology

u 7.5 Outdoor Fine Pitch Display LED Technology

Chapter VIII. Display Driver IC Market and Player Strategies

|

Taipei:

|

|

|

Grace Li

graceli@trendforce.com

+886-2-8978-6488 ext. 916

|

Eric Chang

eric.chang@trendforce.com

+886-2-8978-6488 ext. 822

|