According to the latest report by the LEDinside research division of TrendForce, titled 2020 Global LED Video Wall Market Outlook – Meeting Room, Sales Channel and Price Trend, the demand for displays with high resolution and HDR capabilities has skyrocketed; thus, the LED fine pitch display (pixel pitch ≤ P2.5) market is expected to reach 27% CAGR in the 2019-2023 period. On the other hand, ultra-fine pitch displays have more momentum for growth because of their lower shipment numbers at the present. The ultra-fine pitch display (pixel pitch ≤ P1.1) market is therefore projected to reach 58% CAGR.

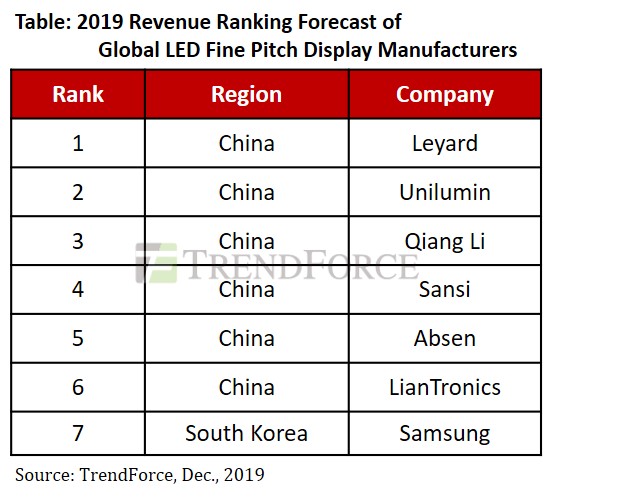

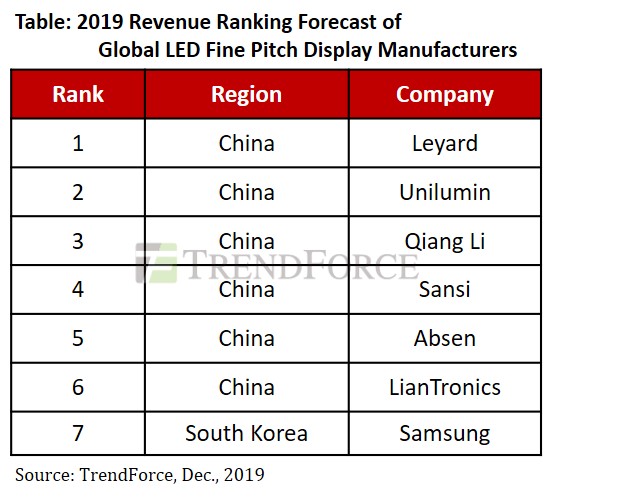

TrendForce indicates that the $2.6 billion LED fine pitch display market in 2019 registered a 31% growth YoY compared to 2018 figures. This rapid expansion of the market meant the corresponding growth of fine pitch display manufacturers’ revenues as well. In terms of revenue ranking, the top seven manufacturers have cornered 66% share of the total market, with Chinese manufacturers occupying the top six spots. With the increasing demand for 8K resolution, technical improvements, and lowered costs, LED video wall applications are expected to expand from single-use cases to commercial uses, such as cinemas, meeting rooms, home theaters, and even premium consumer markets. Consequently, the market for LED fine pitch displays is projected to grow exponentially as well.

LED ultra-fine pitch displays are changing the industry’s competitive landscape

P1.2~P1.6 display products are the largest revenue drivers in the global LED fine pitch display market. The 2020 Summer Olympics in Tokyo and the impending popularity of 8K resolution serve as two major market drivers that pave the way for LED displays with even finer pixel pitches. In addition to existing leaders in the fine pitch display market, namely, Leyard and Unilumin Group, global players in the consumer electronics display market, such as Sony, Samsung, and LG, have now begun manufacturing fine pitch displays, with even finer (≤P1.0) pixel pitch display products. Some of these products include Mini LED and Micro LED displays.

TrendForce forecasts P1.2~P1.6 fine pitch and ≦P1.1 ultra-fine pitch displays to have the highest momentum for growth among all product segments. Aside from predominant manufacturers of LED fine pitch displays, the market is seeing new entrants in the form of LCD panel manufacturers, TV brands, projector makers, and even upstream component suppliers. For example, Taiwan-based LED chip manufacturer Epistar have partnered with LED video wall market leader Leyard in an attempt to reduce manufacturing costs of Mini LED and Micro LED displays through advancements in semi-mass transfer technology and mass transfer technology respectively. On the other hand, driver IC manufacturer Macroblock Inc. has successfully developed ultra-fine pitch Micro LED display modules through a joint technological effort with the Industrial Technology Research Institute. Since manufacturing ultra-fine pitch displays and LED video walls with high resolution, HDR, and even lower costs is currently a common goal of LED display manufacturers, we forecast an increasingly competitive landscape for the industry.

Notes:

1. The terms “fine pitch display” and “ultra-fine pitch display” are defined by the distance from the center of one pixel to the center of its adjacent pixel.

-

Fine pitch: pixel pitch ≤ 2.5mm

-

Ultra-fine pitch: pixel pitch ≤ 1.1mm

2. The terms “Mini LED display” and “Micro LED display” are define by the size of LED chips, which are mostly used in ultra-fine pitch displays because of the chips’ diminutive size.

-

Mini LED: chip size between 100-300µm

-

Micro LED: chip size ≤ 100µm

LEDinside focuses on the analysis of LED fine pitch display application market, China and the US display trends and sales channels, and Micro LED / Mini LED ultra-fine pitch display technology. LEDinside aims to provide readers with a comprehensive understanding of LED digital display market marketing and sales.

LEDinside 2020 Global LED Video Wall Market Outlook- Meeting Room, Sales Channel and Price Trend

Release Date: 30 September 2019

Format: PDF

Language: Traditional Chinese / English

Page: 204

Chapter I. LED Video Wall Market Trend and Analysis

LED Video Wall Market Supply Chain and Requirement

2019-2023 Global LED Video Wall Market Scale Analysis

2018-2019 (F) LED Video Wall Player Market Share Analysis

2019-2023 Global LED Fine Pitch Display Market Scale by Pitch

2018-2019 (F) LED Fine Pitch Display Player Market Share Analysis

2018-2019 (F) LED Fine Pitch Display Market by Region

2017-2019 (F) Chinese LED Digital Display Player Shipment

2017-2018 Chinese LED Video Wall Player Revenue and Shipment Analysis

2018-2019 (F) Global LED Fine Pitch Display Market by Application

LED Display in Broadcast Market Growth Factors

LED Display in Security & Control Room Market Growth Factors

LED Display in Corporate & Education Market Growth Factors

LED Display in Public Area and Transportation Market Growth Factors

LED Display in Retail and Exhibition Market Growth Factors

LED Display in Entertainment & Cinema Market Growth Factors

Chapter II. Micro LED vs. Mini LED Video Wall Technology Trend

Micro LED vs. Mini LED Digital Display Product Advantages

Micro LED vs. Mini LED Digital Display Technology Overview

Micro LED vs. Mini LED Chip Size Analysis

Micro LED vs. Mini LED COB Process Analysis

Micro LED vs. Mini LED Transfer Technology Analysis-Micro LED Mass Transfer

Micro LED vs. Mini LED Transfer Technology Analysis-Mini LED Semi-Mass Transfer

Micro LED vs. Mini LED Drive Technology Analysis

Micro LED vs. Mini LED Backplane Technology Analysis

TFT with Active Matrix-Cost Advantages and Technical Difficulties

Micro LED Video Wall Product Specifications and Design

Micro LED, Mini LED and Fine Pitch Display- Cost Analysis

Micro LED vs. Mini LED Digital Display Developers

Chapter III. HDR Projection and Display Market Trend- Cinema vs. Home Theater, Meeting Room and 8K Markets

3.1 Cinema vs. Home Theater

2006-2026 Cinema Market Development Trend

2018 Global Cinema Projector Market Share Analysis

Premium Cinema Definition

2019-2023 Demand for Premium Cinema Screens

DCI-P3 Development Trend - Projector and Digital Display

Cinema DCI-P3 Regulation and HDR10+ Display Standard

Opportunities and Challenges of LED Video Wall in the Cinema Market

LED Display with 3D Cinema Opportunities

LED Display in Cinema Design Process and Future Market Trend

Projection and LED Display Products Price Analysis

2017-2018 Global Top 10 Cinema Chains Revenue Performance

Movie Chains' Views of Premium Cinemas

Home Theater Market Scale

LED Video Wall and Projector in Cinema vs. Home Theater

3.2 Meeting Room

Intelligent Conference Technology Trend

2019-2023 LED Video Wall vs. Projector Market Scale in Meeting Room

2019-2020 LED Video Wall and Projector in Meeting Room

LED Video Wall Vendors Launched LED Display System to Expand Applications

2019-2023 LED Video Wall vs. Projector Price Prediction in Meeting Room

3.3 5G Integrated with 4K and 8K Video & Audio Transmission

Huawei 2025 White Paper- 5G Transmission with Large HDR Display

8K LED Video Wall Analysis on Pixel Pitch and Dimension

MIIT and Local Governments to Promote of UHD Video Industry

Chapter IV. LED Video Wall Price Analysis

Four Key Factors Influencing the Price of Display Products

LED and LCD Display Price Analysis- By Pixel Pitch

P2.5 LED Display Price Analysis

P1.9 LED Display Price Analysis

P1.6 LED Display Price Analysis

P1.2 LED Display Price Analysis

P0.6, P0.8 and P0.9 LED Display Price Analysis

Chapter V. China and the US LED Video Wall Trends and Sales Channel Analysis

2019-2023 China LED Fine Pitch Display Market Scale

2018-2019 (F) China LED Fine Pitch Display Market by Application

China Channel Analysis- A/V System Integrators

China Channel Analysis- LED Video Wall Dealers

2019-2023 US LED Fine Pitch Display Market Scale

2018-2019 (F) US LED Fine Pitch Display Market by Application

US Channel Analysis- A/V System Integrators and Dealers

Chapter VI. LED Video Wall Player Strategies

Company Revenue, Production Base, LED and LED Fine Pitch Display Revenue, Regional Market Revenue, Product and Market Strategy

23 Major LED Video Wall Players: Leyard, Absen, Unilumin , Liantronics, Ledman, AOTO, Qiangli, SANSI, Hoozoe, Cedar, Infiled, Lighthouse, DAKTRONICS, Watchfire Signs, Samsung Electronics, LG Electronics, SONY, Mitsubishi Electric, BARCO, Christie, OPTOTECH, SiliconCore, and Delta

Chapter VII. LED Market and Player Strategies

7.1 2019-2023 Display LED Market Value and Volume Analysis

2019-2023 Display LED Market Value Analysis

2019-2023 Display LED Market Volume Analysis

2019-2023 Display LED Market Value- Mini LED and Micro LED

2019-2023 ≤P1.6 Display LED Market Value- By Package Type

7.2 Display LED Product Specifications and Price Trend

Display LED Package Application Market

LED Display Technology - PPI and Pixel Pitch Analysis

Dot Size v.s. Pixel Pitch

2019-2023 Fine Pitch Display- Pitch v.s. LED Usage Volume

2017-2019 Digital Display LED Price Trend

7.3 Display LED Capacity and Supply Chain Analysis

Digital Display Market Supply Chain and Requirement

Fine Pitch Display Supply Chain and Production Capacity

2017-2018 Digital Display LED Player Revenue Ranking

2017-2018 Digital Display LED Chip Player Revenue Ranking

7.4 Indoor Fine Pitch Display LED Technology

Indoor Fine Pitch Display LED Application Market Overview

2019-2021 Display LED Development Trend

Indoor Fine Pitch Display LED Packaging Technology Overview

Four-in-One Mini LED Pros and Cons Analysis

Mini LED COB Pros and Cons Analysis

Mini LED COB Current Supply Chain and Business Model

Chapter VIII. Display Driver IC Market and Player Strategies

2019-2023 Driver IC Market Value

2017-2018 Display Driver IC Player Revenue Ranking

2019-2023 Driver IC Market Shipment

1H19 Display Driver IC Player Market Shipment

Seven Technical Challenges for Fine Pitch Display Driver IC

Player Strategy: Revenue, Production Base, Monthly Shipment, Major Customers, Fine Pitch Display Revenue, Product Development

Macroblock, CHIPONE, Sunmoon, Fine Made, Sumacro, My-Semi Inc., LEDSIC Technology, SiliconCore

|

For further information about the report, please contact:

|

|

Global Contact:

|

|

|

|

|

|

Taipei:

|

ShenZhen:

|

|

|

|

|

|

|

For further information about the advertising, please contact:

|

|

Global Contact:

|

Taipei:

|

|

|

|