The

LED video wall (Finished Product) market has weakened overall due to the ongoing Russia–Ukraine War and soaring inflation, while LED video wall manufacturers will pay more efforts to promote ≤P1.0 ultra-fine pitch displays to enter the high-end market and stabilize corporate revenue. Opportunities for the LED video wall market include corporation and education scenarios, home theaters, virtual production, retail, rental and events, sports, and government bids. In 2H22, the Chinese government will continue adopting the lockdown strategy against COVID-19 outbreak, but it is also expected to propose economy-related stimulus packages to drive up market demand. Overall, the LED video wall (Finished Product) market value is likely to slightly rise in 2022, reaching USD 7.229 billion (+6% YoY). Nevertheless, the North American and European markets, where borders have been reopened plus economic bounce backs, have still witnessed a growth rate higher than the average in 2022

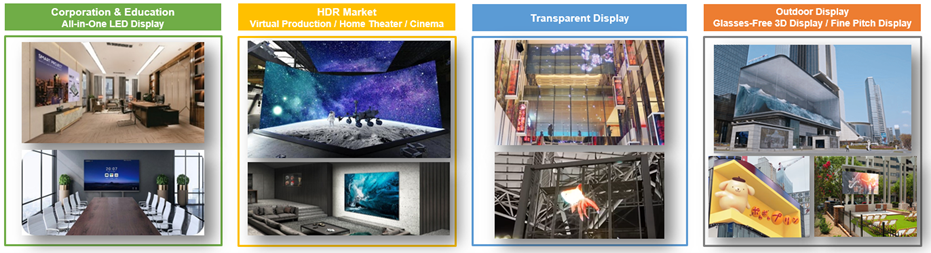

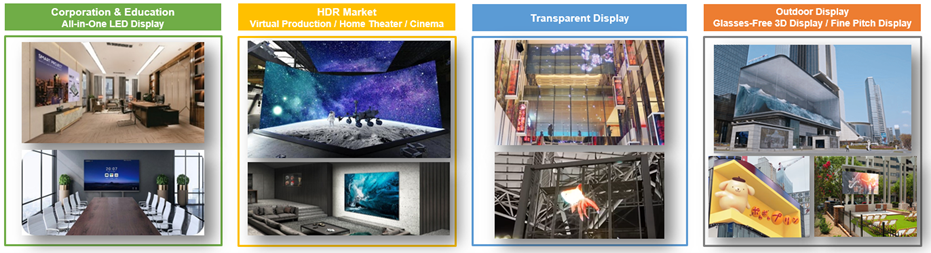

Indoor Display: Demand for high-resolution and HDR products has contributed to stable sales growth in video walls for corporation and education spaces, cinemas and home theaters, and virtual production. In addition, transparent displays in retail stores can bring a “beyond imagination” visual feast for all the shoppers.

Outdoor displays are mainly used for advertising, transportation, sports venue events, and live events. According to TrendForce, the Chinese government will continue implementing the “Thousands of Displays in Hundreds of Cities” campaign. Additionally, glasses-free 3D LED displays will mostly be applied to creative signage advertising. 3D advertising videos can create stunning visual experiences for audience and leave them a deep impression, which can be seen in the US, South Korea, and China, thereby stimulating the market demand for outdoor displays.

Global LED Fine Pitch Display Market Scale

As TrendForce reported, the market value of LED fine pitch displays will be USD 4.232 billion in 2022 (+12% YoY). As the demand for LED fine pitch displays in Europe and the US bounced back robustly, growth in the corporation & education, retail & exhibition, and entertainment & cinema sectors has been particularly strong with a boost of 14%, 13%, and 41%, respectively. The all-in-one LED display was successfully introduced to applications for corporation & education scenarios in 2020-2021, so this sector is likely growing steadily in 2022. Virtual production and home theater applications have contributed to growth in the entertainment & cinema segment, of which the market share will reach 7.2%.

Virtual Production Market Trend

According to TrendForce’s analysis, the LED video wall market scale for virtual productions came to USD 283 million in 2021 (+136% YoY). Virtual production has two major applications: (1) movie production; and (2) TV shows, theater performances, music videos, and commercials. Substituting a green screen with an LED video wall can significantly reduce both the time needed for post-production and the cost of video production. Moreover, an LED video wall can create an immersive background environment, which is beneficial for the performances of the actors and the director. Due to these advantages, the adoption of LED video walls for virtual productions is growing.

With an emphasis on HDR, HFR, and high grayscale images, virtual production, as an emerging niche market, demands for displays of high picture quality, detailed color reproduction, and great smoothness. LED video walls are mainly used as background, floor display, and ceiling displays. The specifications of the LED video walls used in virtual productions depend on the requirements of the scenes and the budgetary constraint. Background displays for high-end virtual production require high brightness (>1,500 nits), high resolution (P1.2-P1.6), high grayscale (16 bits), high refresh rates (3,840 / 7,680 Hz), and high frame rate (60 fps). A gamut range of DCI-P3 is preferable.

All-in-One LED Display Market Trend

All-in-One (AIO) LED displays are controller-integrated standardized products, which are slimmer (avg. 3–5cm in thickness), emphasize on-site modularization enabling quick installation, and can be installed and testing within 1-2 hours. All-in-One LED displays feature an aspect ratio of 16:9, a size ranging 110–220 inches, a pitch pixel of P1.2–P2.5, and FHD resolution, and can be portable, wall mounted, or floor-standing. AIO LED displays are mainly applied to corporate meeting rooms, event, retail and exhibition, lecture halls, control rooms, gaming events, and even home theaters. Major manufacturers include MaxHub, Leyard, Absen, CLT and Unilumin. Samsung unveiled The Wall All-in-One at ISE 2022 in three models, including 146-inch 4K P0.84, 146-inch 2K P1.68 and 110-inch 2K P1.26, being available globally now.

≤P1.0 Ultra-Fine Pitch Display Application Market Analysis

TrendForce reported the ≤P1.0 ultra-fine pitch display market, with an increasing number of new players, was valued at USD 251 million in 2021.Top five players were Leyard, Unilumin, Samsung Electronics, Ledman, and HCP, totaling a 74% share of market sales.

Regarding AM solutions applied to large splicing displays, LTPS (side wiring) have been adopted in ≤P0.625 LED displays. A challenge facing the side wiring technology is that width between interconnected metals becomes increasingly narrower, resulting in greater electrical impedance plus obvious IR drop. Therefore, circuit design must be improved. Moreover, tiling line processing, tiled surface flatness, color uniformity, and cost control have been the major challenges on product development.

TrendForce’s analysis focuses on 2023 LED video wall market outlook and application market trends; major LED video wall players’ revenue and product development; LED video wall price and cost analysis; suppliers’ technology and product specification cost development of the Micro LED / Mini LED / ≤P1.0 ultra-fine pitch display markets; LED video wall sales channel analysis, etc. TrendForce aims to provide readers with a comprehensive understanding of marketing and sales in the LED video wall market.

Author: Joanne, Allen / TrendForce

TrendForce 2023 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2022

Language: Traditional Chinese / English

Format: PDF

Page: 238

Chapter I. LED Video Wall Market Scale and Trend Analysis

-

LED Video Wall Market Supply Chain and Requirement

-

2022-2026 Global LED Video Wall Market Scale

-

2020-2021 Top 20 LED Video Wall Player Revenue Ranking

-

2021 Top 20 LED Video Wall Player Market Share Analysis

-

2022(E) Top 10 LED Video Wall Player Revenue vs. Market Share

-

2021-2022(E) Top 10 LED Video Wall Player Revenue vs. Shipment

-

2022-2026 Global LED Fine Pitch Display Market Scale

-

2022-2026 Global LED Fine Pitch Display Market Shipment

-

2020-2021 Top 20 LED Fine Pitch Display Player Revenue Ranking

-

2021 Top 20 LED Fine Pitch Display Player Market Share Analysis

-

2022(E) Top 10 LED Fine Pitch Display Player Revenue vs. Market Share

-

2021-2022(E) Top 10 LED Fine Pitch Display Player Revenue vs. Shipment

-

2021-2022(E) Mini LED Video Wall Market Scale / Specification / Player Revenue

-

2021-2022(E) Global LED Fine Pitch Display Application Market Analysis

-

2021-2022(E) P2.1-P2.5 LED Video Wall Application Market Analysis

-

2021-2022(E) P1.7-P2.0 LED Video Wall Application Market Analysis

-

2021-2022(E) P1.2-P1.6 LED Video Wall Application Market Analysis

-

2021-2022(E) ≤P1.0 Ultra-Fine Pitch Display Application Market Analysis

-

2021 ≤P1.0 Ultra-Fine Pitch Display Player Revenue vs. Market Share

-

2021-2022(E) Global LED Video Wall Regional Market Scale

-

2021-2022(E) Global LED Fine Pitch Display Regional Market Scale

-

2021 Global LED Fine Pitch Display Regional Market- By Application

-

2022(E) Global LED Fine Pitch Display Regional Market- By Application

Chapter II. Micro / Mini LED Video Wall Market Trend

-

Micro / Mini LED Video Wall

-

Micro / Mini LED Video Wall Product Advantages

-

Micro / Mini LED Video Wall Technology Overview

-

Mini LED Video Wall- Chip Yield Rate, Price Trend, and Brand Target

-

Mini LED Video Wall- Pick-and-Place Technology Trend

-

Micro LED Video Wall- Chip Yield and Brand Target

-

Micro LED Video Wall- Mass Transfer Technology Trend

-

Micro / Mini LED Video Wall- Backplane Analysis

-

Micro / Mini LED Video Wall- AM vs. PM LED Video Wall Product Design

-

Micro / Mini LED Video Wall- Active Matrix vs. Passive Matrix Challenges

-

2022-2023 COB vs. COG Technology Trend and Challenges

-

Micro / Mini LED Video Wall- Controller Market Trend

-

P0.625 LED Video Wall Cost Analysis- Active vs. Passive Matrix

-

P0.9375 LED Video Wall Cost Analysis- Active vs. Passive Matrix

-

89-inch 4K P0.51 LED Video Wall / TV Cost Analysis- Active Matrix

-

101-inch 4K P0.57 LED Video Wall / TV Cost Analysis- Active Matrix

-

114-inch 4K P0.625 LED Video Wall / TV Cost Analysis- Active Matrix

-

Micro / Mini LED Video Wall Manufacturer Supply Chain Analysis

-

2022-2023 Mini LED Video Wall Product Specification and Progress

-

2022-2023 Micro LED Video Wall Product Specification and Progress

-

LED Video Wall Size and Pixel Pitch Analysis

Chapter III. 2023 LED Video Wall Market Outlook and Highlight

-

2023 LED Video Wall Market Outlook

3.1 Corporation and Education Market Trend

-

2021-2022(E) Corporation & Education- LED Video Wall Specification Trend

-

LED / LCD Video Wall vs. Projector Specification and Price Analysis

-

All-in-One LED Display Product and Applications Analysis

-

2021-2022(E) All-in-One LED Display Market Scale vs. Target Customers

-

2021 All-in-One LED Display Player Shipment Ranking vs. Market Share

-

All-in-One LED Display Product Overview

-

2022 All-in-One LED / LCD Display Price Analysis

-

2022 All-in-One LED Display Specification and Brand Price Analysis

3.2 HDR Market Trend- Virtual Production, Home Theater and Cinema

-

2021-2022(E) Entertainment & Cinema- LED Video Wall Specification Trend

-

Virtual Production Market Strength Analysis

-

2022-2023 Virtual Production LED Video Wall- Specification and Price

-

2021-2022(E) Virtual Production LED Video Wall- Market Scale Analysis

-

2021 Virtual Production LED Video Wall- Player Revenue Ranking

-

Virtual Production LED Video Wall- Product Specification Analysis

-

Virtual Production Market Landscape Analysis

-

Home Theater Market Trend- LED Video Wall vs. Projector Market Scale, Specification and Price

-

Home Theater Market Opportunities and Potential

-

5G+8K LED Video Wall Product Requirements

-

Premium Cinema- Definition vs. Market Scale

-

Cinema LED Video Wall- Market Opportunities and Challenges

-

2018-2022 Cinema LED Video Wall- Player Progress Analysis

-

2018-2022 Cinema LED Video Wall- Global Map Analysis

-

LED Video Wall in 3D Cinema- Market Opportunities

-

DCI-P3 Standard- LED Video Wall and Projector

3.3 LED Transparent Display Market Trend

-

2022-2026 LED Transparent Display Market Scale

-

2021 LED Transparent Display Player Revenue Ranking

-

LED Transparent Display Specification and Price Analysis

-

LED Transparent Display- Photoelectric Glass Technology

-

Micro LED Transparent Display Application and Cost Analysis

3.4 LED Outdoor Display Market Trend

-

LED Outdoor Display Application Market Overview

-

2021-2022(E) Global LED Outdoor Display Application Market Analysis

-

2022 P1.5-P10 LED Outdoor Display Specification Analysis

-

2022 P1.5-P10 LED Outdoor Display Price Analysis

-

Glasses-Free 3D Display vs. LED Outdoor Fine Pitch Display Markets

-

Glasses-Free 3D Display Specification Requirements

-

Glasses-Free 3D Display Market Landscape Analysis

-

LED Outdoor Fine Pitch Display Application Market Analysis

-

LED Outdoor Fine Pitch Display Player and Product Specification

-

LED Outdoor Fine Pitch Display Specification Analysis

Chapter IV. Video Wall Market Price and Cost Analysis

-

LED Video Wall Market Price Survey- Methodology and Definition

-

LED Video Wall Sales Models and Price Strategies

-

2022-2023(E) LED Video Wall Price Analysis

-

2022-2023(E) P2.5 LED Video Wall Price Analysis

-

2022-2023(E) P1.9 LED Video Wall Price Analysis

-

2022-2023(E) P1.5-P1.6 LED Video Wall Price Analysis

-

2022-2023(E) P1.2 LED Video Wall Price Analysis

-

2022-2023(E) P0.9 LED Video Wall Price Analysis

-

2022-2023(E) P0.7-P0.8 LED Video Wall Price Analysis

-

2022-2023(E) P0.625 LED Video Wall Price Analysis

-

2022 4K LED Video Wall / TV Brand Price

-

2022 P1.68 LED Video Wall Cost Analysis

-

2022 P1.26 LED Video Wall Cost Analysis

-

2022 P0.9375 LED Video Wall Cost Analysis

-

2022 P0.84 LED Video Wall Cost Analysis

-

2022 P0.78 LED Video Wall Cost Analysis

-

2022 P0.625 LED Video Wall Cost Analysis

Chapter V. LED Video Wall Player Strategies

-

Global Major LED Video Wall Player List

-

P≤1.0 Ultra-Fine Pitch Display Product Progress

-

LED Video Wall Player OEM Supply Chain Analysis

-

LED Video Wall Player Product Strategy and Sales Performance

Samsung Electronics

LG Electronics

SONY

BOE

TCL CSOT

Leyard

Unilumin

Absen

Liantronics

Ledman

Qiangli Jucai

GKGD

SANSI

Hikvision

Dahua

Cedar

CVTE / MaxHub

HCP

CREATELED

Konka

Daktronics

PanelSemi

SiliconCore

Lighthouse Technologies

Chapter VI. Display LED Market Trend and Product Strategies

6.1 Indoor Fine Pitch Display LED Product Analysis

-

Display LED Product Application Market

-

Fine Pitch Display LED Product Overview

-

Fine Pitch Display LED Technology Overview

-

2022-2023 Display LED Product Trend

-

0202 / 0404 RGB LED Product Pros and Cons Analysis

-

Mini LED Chip Yield Rate, Price Trend, and Brand Target

-

2022-2023 Micro / Mini LED COB Supply Chain and Business Model

-

4-in-1 Mini LED Product Pros and Cons Analysis

6.2 Display LED Market Scale and Player Strategies

-

2022-2026 Display LED Market Value Analysis

-

2022-2026 Display LED Market Volume Analysis

-

2022-2026 Display LED Market Value Analysis- Incl. Micro / Mini LED

-

2022-2026 ≤P2.5 Display LED Market Value Analysis- By LED Product

-

2022-2026 ≤P1.0 Display LED Market Value Analysis- By LED Product

-

2021-2022 Display LED Price Trend- SMD LED

-

2021-2022 Display LED Price Trend- 4-in-1 Mini LED

-

2021-2022 Display LED Price Trend- RGB Mini LED Chips

-

2020-2021 Display LED Chip Player Revenue Ranking

-

2020-2021 Display LED Package Player Revenue Ranking

-

2022 Display LED Player Capacity and Supply Chain Analysis

Chapter VII. Driver IC Market and Player Strategies

-

2022-2026 LED Display Driver IC Market Value Analysis

-

2020-2021 Driver IC Player Revenue Ranking

-

2022-2026 LED Display Driver IC Market Shipment Analysis

-

2021-1H22 Driver IC Player Shipment Ranking

-

2021-2022 Common-Cathode Driver IC Market Opportunity and Penetration Rate Analysis

-

Driver IC Product Trend and Specification Summaries

-

2021-2022 Driver IC Market Price Survey

-

Driver IC Player Revenue Performance and Product Analysis

Macroblock

Chipone

Xm-Plus

Novatek

Developer

SHIXIN

Sunmoon

Fine Made

Appendix. Pro A/V System Integrator / Distributor List Analysis

-

North America- Pro A/V System Integrator List

-

North America- Pro A/V System Integrator and Distributor (Dealer) List

-

China- LED Video Wall Distributor (Dealer) List

-

Europe- Pro A/V System Integrator List

|

If you would like to know more details , please contact:

|