About two years ago, LED manufacturers that turned up at LED Forum 2013 were skeptical about smart lighting taking off anytime soon. Many industry insiders projected it would be a niche market that would take another two years before fully blossoming, while others believed at the time only gadget lovers would warm up to the products. Their predictions have been fairly accurate so far.

Smart LED lighting started to pick up from 2014 to 2015, with major lighting manufacturers including Philips, GE, Osram, and others launching related products in the last two years. This trend has been especially eminent at LightFair International 2015 this year, where manufacturers were eager to display smart connected lighting technology.

|

|

A woman uses a Philips Hue Go product as a bedside lamp. (Photo Courtesy of Philips) |

Before delving into the different drivers, smart lighting has been defined by Tom Griffiths, Marketing Manager, Sensor Driven Lighting for Ams’ Emerging Sensing Strategies Group as “connected, integrated controls; Autonomy; and Sensing”.

So what has changed in the past two years to bring forth the deluge of smart lighting products and other connected lighting products onto the market?

Manufacturers are focusing on more profitable value adding products such as smart lighting or wearable devices as traditional lighting businesses become increasingly unprofitable. A Bloomberg report recently beautifully summed up the three major challenges the lighting industry is facing: high market competition, low profit margins, and slow growth caused by LEDs long life cycles.

Competition is especially rough in the LED bulb market, where we are seeing top lighting manufacturers, such as Philips launching two 60W LED bulbs for less than US $5. There are even market rumors that Philips intends to slash LED tube prices to the same level as Chinese rivals MLS and Foshan Lighting in the Chinese market. Even Chinese LED luminaire manufacturers are seeing profits drop, Kingsun Opto in particular had been particularly hard hit in 2014 with net profits plunging as much as 88%.

Lighting giants restructure policies have reflected the lighting industry’s increasingly profit-driven strategies, which has been highlighted in Philips and Osram’s restructure plan in 2014-2015, where less-profitable businesses have been let go.

Philips spun-off its lighting component and automotive business Lumileds in late March, 2015, and nearly one month later sold part of its OLED component business of Lumiblades to OLEDworks. On top of this, Philips announced focusing resources in developing smart lighting products in its 1Q15 financial report released in late April 2015. The release also highlights the company’s decision to prioritize smart lighting product developments in both residential and large city streetlight projects, which reflects its positive outlook on smart lighting products profitability.

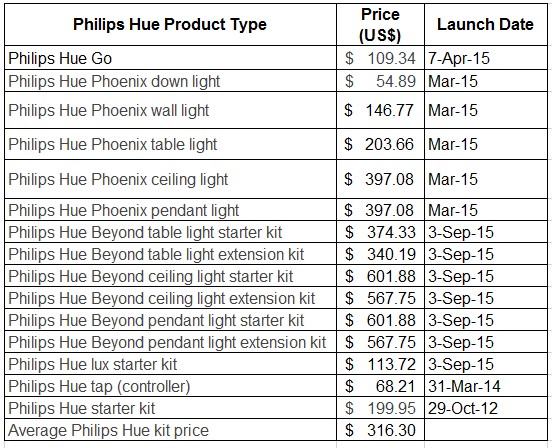

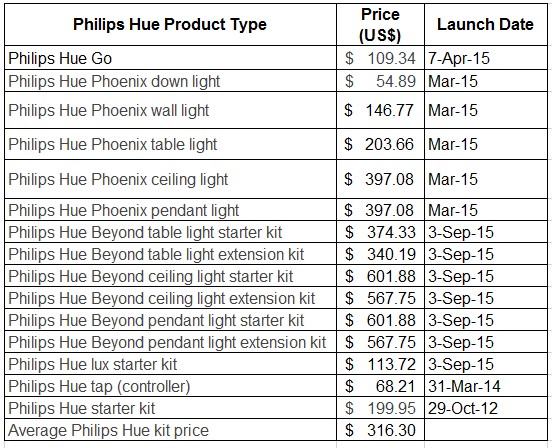

For example, Philips might be selling its regular 60W LED bulbs for less than US$ 5, but its smart Hue LED bulb kits on average sell for at least US$ 316.30. The first Philips Hue kit launched in 2012 on average cost US $60 per bulb, nearly 12 times the price of the average 60W LED bulb. Smart lights for now are still targeted pretty much at tech savy mid to high income families in Europe and U.S.

|

|

Philips Hue kit prices during initial launch. LEDinside is using Philips as the major example because the company was one of the first to develop smart lighitng products and has continued to invest in related products. (Source: LEDinside). |

German rival Osram has also taken a similar approach by parting with the less profitable traditional luminaires and overtly competitive LED lamp, driver, and light source businesses this year. The two European companies strategies reflect how large lighting manufacturers are now increasingly under pressure to focus on a small number of profitable products in the lighting industry. Before kissing its luminaire business goodbye, Osram was highlighting its smart lighting product Lightify at Light+Building in 2014, and the company has continued to promote its smart lighting control products up to May 4, 2015. Possibly implying while it will be abandoning most of its luminaire business, its smart lighting products and control system will be here to stay.

|

|

Osram's Lightify products. (Photo courtesy of Osram) |

Even U.S. LED manufacturers Cree and TCP Lighting have teamed up with Internet of Things (IoT) provider WeMo to develop their smart lighting products. The two companies’ strategies are similar in supply LED bulbs for the smart lighting system, while WeMo provides the connectivity technology. Similar alliance strategies implemented by other lighting manufacturers will be discussed in another article to be released at a later date.

More manufacturers are turning to smart LED lights that are believed to be more profitable and hold huge market potential. The smart lighting market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.9% from 2014 to 2020 to reach US $56.62 billion in 2020, estimated Transparency Market Research recently. Another market intelligence research firm Memoori estimated lighting control market would grow at CAGR of 12% from 2013 to 2020, but projected wireless lighting controls would grow at CAGR of 23%.

To sum up, LED bulb markets low technology entry level makes it relatively easy for manufacturers to enter leading to overt competition that has driven down profits in the sector. To cope in the increasingly profitless market situation manufacturers have been adopting market strategies that direct resources to more lucrative businesses and applications, such as smart lighting products.

(Author: Judy Lin, Chief Editor, LEDinside)