According to LEDinside, the LED research division of TrendForce, despite the rush orders during 2Q12 which kept LED chip and package makers’ utilization rates high, the 3Q12 outlook for LED backlight market turns murky due to the European debt crisis and the weak demand in China. No demand surge is in sight due to the weakened market confidence and the conservative attitude of LED companies. Whether or not brand vendors will cut orders in 3Q12 depends on the sales of end-market products.

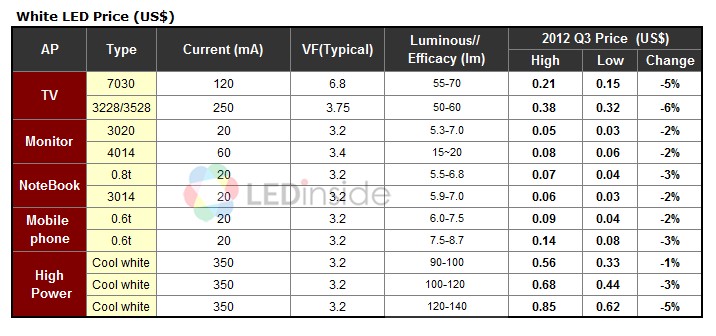

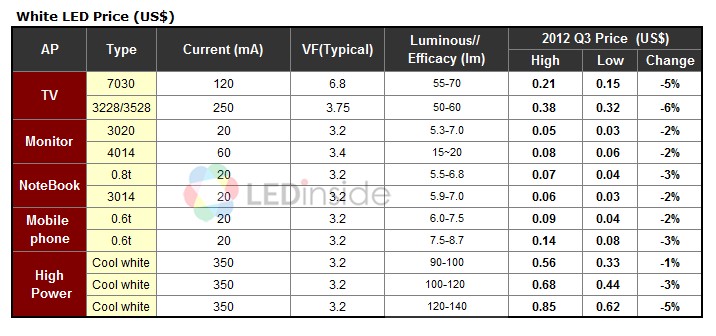

As for the TV backlight market in 3Q12, prices of LED packages such as 7030 and 3528 saw a decline of 5%-6% after they entered mass production and reach economies of scale. The price of LED for other backlight application saw limited price drops, averaging 2%-3%.

Source: LEDinside

Demand for Smartphone and Tablet PC Dipped, Notebook Shipment Saw No Growth

Affected by the lukewarm economic outlook, smartphone and tablet PC makers revised their shipment forecast. As for smartphone, the global shipment for 2012 is estimated at 660 million units, 55 million units less than the forecast made in early 2012. The forecast of orders for HB side view LEDs also lowered to 425 million units. Although the 2H12 LED backlight market remains uncertain, the price of LED for mobile phones application still dropped by 2%-3% QoQ due to the requirement for higher backlight brightness from the mobile phone makers.

In addition, TrendForce estimates that the global shipments of notebooks in 2012 will see no growth, which will affect LED backlight market growth in the notebook sector. On the other hand, the demand for tablet PC remains strong in 2012, with the global shipments seeing a YoY growth of 52%. However, as Apple takes up 60% of the tablet PC market, Apple’s LED backlight demand is supplied by two Japanese package makers. 0.8t side view LED price dropped by 3% in 3Q12, while 3014 packages for notebooks are sold at cost, whose price dropped by 2% in 3Q12.

LED Backlight Penetration Rate in TV Market to Reach 73% in 2012, New LED Package to Hit the Market in 2013

The end of the second quarter and the beginning of the third quarter is usually the time for TV makers to start develop new TV models. Aside from Japanese TV brand vendors, Korean TV makers are still going through the LED patent cases. For this reason, Korean companies adopt Taiwanese package makers’ LED product. Therefore, certain Taiwanese package makers may see booming growth in their orders by the end of 2012.

Although direct-type LED TV’s sales in 1H12 fell short of expectations, 3528 price dropped by 6% in 3Q12 as the sales went up, while 7030’s price dipped by 5%. Moreover, direct-type LED TV’s LED usage will be reduced by 30% come 2013. For example, 3528’s current will be increased to 400mA and only require 21 LEDs instead of 32 LEDs. Seeing that Korean companies have stopped production of CCFL TVs, TrendForce estimates that the LED backlight penetration in the TV market will further increase to 73% in 2012.

Perspective from LEDinside

According to TrendForce, given the uncertain outlook for 2H12, if the market outlook for 3Q12 remains stagnant and the LED inventory for the backlight market level remains high, clients may start to cut orders.

Hence, if LED companies can seek strategic alliances with other firms and continue to improve their products (reduce the use of LED or increase brightness under even lower voltage), it will be harder for them to be replaced in the LED industry. Additionally, new LED packages for TV backlight will start to affect the market in 2013.

CN

TW

EN

CN

TW

EN