LED bulb prices over the past quarter, with price declines most markedly in the German market for both 40W and 60W equiv. LED bulbs last month.Prices for 60W equiv. LED bulb have dropped more than 40W equiv. LED bulbs in September. Bulb price upticks have only been reported in the U.S. market last month, according to a recent global bulb price survey by LEDinside, a research subsidiary of Taipei-based market intelligence firm TrendForce.

The 40W equiv. LED bulb prices have dropped 1.8% Quarter-on-Quarter (QoQ) during 3Q14, while 60W equiv. LED bulb prices were down 6.3% during the same period, said LEDinside.

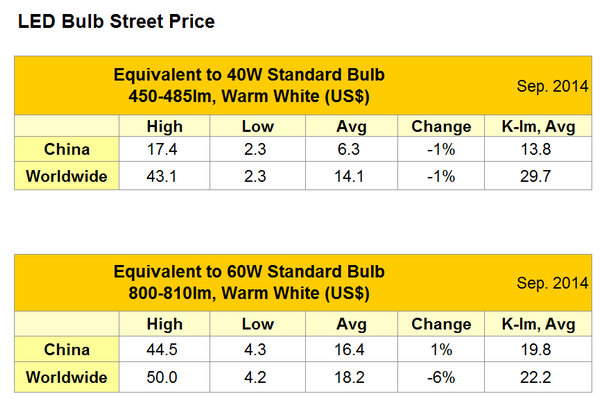

Global 40W equivalent LED bulbs ASP dropped 0.6 percent in September to US $ 14.1. Bulb prices fell the most in Germany, having dropped 13.1% in September as existing bulb product prices dwindled. Prices also slid 3.4 percent in the UK market last month, as prices for some products steadily declined. The Philips 8W LED bulb for instance was down 4% to US $27.2 in UK, and some low-priced have reentered the market.

|

|

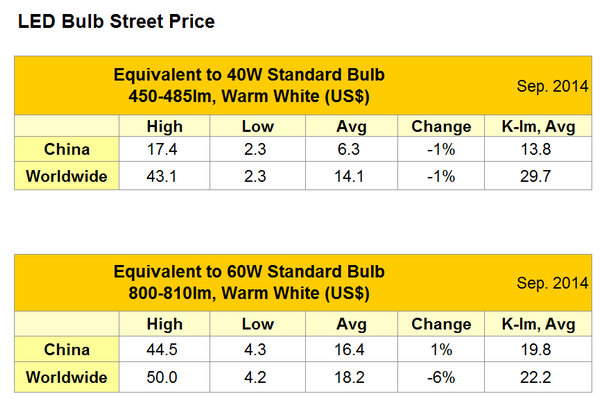

(Source: LEDinside) |

In contrast, 40W equiv. LED bulb prices were up 14.3% in the U.S. market. Manufacturers including Cree, Philips, GE and other renowned brands have raised prices for certain products in the U.S. market. Bulb prices in the Japanese market also increased incrementally by 1.5%. Iris Ohyama’s 8.8W LED bulb prices that were slashed to US $5.8 in August, but have not returned to previous retail price of US $15 in September. Bulb prices in other Asian markets including Korea, Taiwan and China have remained relatively stable. Retail prices of 40W equiv. LED bulbs in Taiwan and Korea were mostly affected by fluctuations in currency exchange rates. Bulb prices also remained the same in China, with the exception of a small portion of products, such as BYD Lighting 6.9W bulb prices were lowered from US $5.14 to US $4.44.

Prices declined even more for 60W equiv. LED bulbs last month, with the global ASP down 5.9% to US $18.2. Prices fell steeply in the German market last month, having dropped as much as 24.8%. This was mainly due to further price cuts among existing bulb products, and some products entered sales promotion. For instance, LG 12.8W LED bulbs was marked down 31% to US $14.35 on the German market. Prices also dropped sharply by 19.4% in the UK market in September, with Osram 10W LED bulb prices down by more than 30% to US $12.2. Low-priced products launched on the UK market last month also further drove down bulb prices in UK. The Japanese market also reported 60W equiv. LED bulb ASP falling 9.9% to US $16.6. Existing bulb prices all declined in Japan, for instance Toshiba’s 9.1W LED bulb prices was down 9% to US $8.91. New low-priced bulbs released on the market also further spurred price falls in the Japanese market.

In Korea, China, and Taiwan, 60W equiv. LED bulb prices have remained stable. Compared to the above listed markets, 60W equiv. LED bulb prices in U.S. have climbed up 11.1%, as Cree, Philips, and Sylvania raised retail prices.

Some interesting trends were observed in the Chinese LED market. While 40W equiv. LED bulb prices dropped the most in China on a quarterly basis having fallen 2.3% compared to the global average, the market reported 60W equiv. LED bulb price outperformed the global average last quarter having dipped a mere 0.6% QoQ. This was mostly contributed by the fact that most 40W equiv. LED bulbs are manufactured domestically in China, while 60W equiv. LED bulbs in the market are mostly made by international brands. Therefore, there are huge price differences between international brands and local Chinese vendors. Furthermore, global lighting brands have chosen a market strategy of raising product competitiveness instead of engaging in price wars in the Chinese market, said LEDinside.

CN

TW

EN

CN

TW

EN