During the first half of 2014, China’s LED industry kept up high growth rates, a trend extended from 2013. Industry insiders have reached a consensus that LED lighting demands will propel this trend well into 2016. Related industries have started production expansion, talent headhunt, and distribution channels establishment. These companies have stuck it out during the LED industry’s initial restructure phase, and do not want to miss out on the exponentially growing LED lighting market.

However, if people do not think ahead there will definitely be problems in the near future. If manufacturers immerse themselves in the beautiful scenery of explosive market growth, they will be unaware to potential market threats. It will only be matter of time before these companies are consumed by market threats. The aim of this article is to reveal these potential dangers, and ignite a new round of discussions in the industry on these issues.

Over competition in the entire industrial chain

The Chinese LED industry witnessed several bankruptcies and restructuring cycles during long years of development. Yet, over competition still exists in the market.

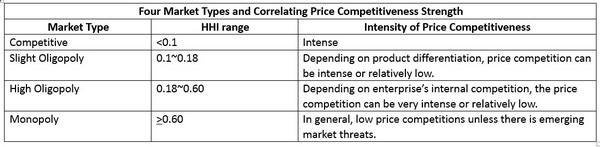

Based on LEDinside’s Herfindahl-Hirschman Index (HHI) calculations, different sectors of the LED industrial chain show varying degrees of market competitiveness. The LED chip market has a 0.146 HHI indicating the market is an oligopoly. In other LED markets including package, LED lighting and display, the HHI was smaller than 0.1, and imply an over competitive market situation. Overly aggressive market conditions undermine manufacturers’ capabilities in raising revenues.

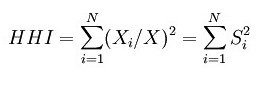

HHI is an index used to measure an industry’s market concentration. The index is calculated by squaring the market share of each competing firm, and then summing the resulting number. The HHI number indicates whether a market is a monopoly and less competitive. In contrast, the closer the number is to zero shows perfect market competition, according to an Investopedia entry.

|

|

HHI equation. |

The index gives manufacturers with larger market share higher rating, thus better reflects market competitiveness structure. According to Structure-Conduct-Performance (SCP) theory, industry concentration and market monopoly has a non-linear relation.

In other words, the higher the HHI the more likely the market is monopolized by top manufacturers, and shows less market competitiveness. U.S. Department of Justice often uses HHI as an evaluation standard for antitrust rulings, and has released the following regulations:

|

|

Source: LEDinside |

A popular market rumor in the LED industry has been LED chip manufacturers will be facing a life or death situation in the next two years, with only five companies remaining. This has misled many to think the LED chip industry has a grim outlook.

In reality, the LED chip industry HHI in general has increased, and is less competitive compared to downstream market. The upstream industry also has the most potential in forming cartels, surviving manufacturers will have better profit performance than right now. Still, hope remains slim for small manufacturers that are not operating smoothly at the moment.

Lack of innovative killer applications to delay market maturation

Any industry might encounter decline, some are evanescent, while others can endure for centuries.

The LED industry has continued to expand new application fields to drive industry growth. Upstream technology advancements has created opportunities that enable downstream manufacturers to enter new application fields. On the other hand, downstream manufacturers’ innovative applications have spurred related upstream manufacturers’ emerging developments. In the past decade, landscape lighting, mobile backlight, display, and TV backlight markets have all acted as the LED industry’s growth momentum at one time or another.

However, many applications have passed the period of rapid growth, with a couple even entering decline in 2014. The LED lighting market is the only major market driver left. Still, LEDinside remains uncertain as to whether the industry will slowly fade away, or completely collapse after the LED lighting cycle comes to an end.

After the LED lighting replacement cycle comes to a halt, what applications will become the industry’s major driving force to prevent the industry’s demise? What applications can fill in the huge demand shortages? Smart lighting, small pitch display, grow lights, and Ultraviolet (UV) applications are all potential segments that might generate new growth. However, these specific niche market applications are not enough to raise the entire industry’s growth momentum.

Will there be other new killer applications that can inject new growth momentum into this industry? This will rely on further discoveries and implementations from manufacturers, entrepreneurs and engineers. For instance, have LED manufacturers thought about responding measures during an industry decline scenario? And how will they manage their businesses?

Blurring industry boundaries, hidden opponents threaten current industry ecosystem

Usually, market competitiveness analyses are overtly focused on the entire supply chain. LEDinside analysts have a clear understanding of clients, suppliers and competitors.

The company’s analysts are also familiar with related replacement products, for example LED lamps are incandescent bulb replacements, Compound Fluorescent Lamps (CFL) are subs for halogen lamps. Digital Lighting Displays (DLDs) are replacements for displays, while OLED products are substitutes of LED backlight. Companies in landscape lighting and large LED signs are also aware that they are competing with the neon light industry.

However, there is almost no way to detect potential entrants. It is only when these new manufacturers barge into the market that LEDinside analysts are capable of understanding who they are. Unlike existing competitors whose strategies, distribution channels, and background are already well known, it is impossible to find out about these newcomers. Sometimes these industry newbies might possess resources that cannot be duplicated by other companies.

Shenzhen city situated in Guangdong, China is well known for large numbers of copycat smartphone manufacturers. The city has even been coined as “copycat city.” Yet, these companies started to disappear when Chinese consumer electronics company Xiaomi started to make smartphones. These potential new entrants can completely overhaul industry rules.

Moreover, in recent years, many companies have crossed into new industries. To list a few examples in the Chinese market, WeChat, a subsidiary of Tencent, has overtaken the major three telecom operators\ messaging businesses. S.F. Express in China, traditionally a logistics and delivery company, has edged into e-commerce and set up online shopping service Heike. Even top Chinese E-commerce group Alibaba Executive Chairman James Ma has shown a sudden interest in soccer, and has invested heavily in soccer teams. It is difficult to judge whether e-commerce company JD Online’s Founder Richard Liu’s interest will change from milk tea to LED someday.

Although, LEDinside includes revenue ranking in its statistics, the rankings are not very important. Companies with lower ranks should not be bothered because it is possible for later market entrants to catch up, and sometimes even excel in the industry within a few short years.

In the LED industry, Suzhou Dongshan Precision Manufacturing (SDPM) for instance has entered the LED backlight market, and Shenzhen MTC is now in the LED packaging and application business. IKEA has even started to manufacture its own LED bulbs. Who would have thought these conventionally non-LED companies could make it big in the LED industry within just a few short years?

Some manufacturers in the industry are passionate about investing money in rankings, just so they can make a mark on non-authoritative listings. In reality, this is an unnecessary investment, and many can recognize these are paid entries. The only people fooled are the manufacturers on the list, which is even duller than sales rankings.

So what is truly important? LEDinside believes manufacturers need to make the most use of their advantages to create a competitive edge, which cannot be imitated or surpassed by new competitors. This should be the essential of a company. Even if newcomers enter the market, existing companies still have competitive leverage, and can even force them to cooperate. The recent partnership between Yankon Lighting and JD Online in smart lighting is a good illustration of this.

How to acquire market capital when there are long IPO waitlists

The LED industry has basically improved. Additionally, Telecommunications, Media and Technology (TMT) sector market value increased over the past year. Although, LED market competition has been intense, and still has the flaw of low entry level, companies still benefited from premiums. Most listed companies have an expected P/E of more than 30.

|

|

Estimation of 2014 listed Chinese LED manufacturers P/E. (Source: Shanghai Wind Information) |

Larger Price-to-Earnings ratio (P/E) differences have appeared in listed companies’ acquisition in primary market, company values can be reevaluated through wealth amplification effect. For instance, a company with RMB 300 million revenue and a net profit of RMB 30 million requires RMB 240 million to be acquired at a P/E of 8. However, if financial statements are consolidated after acquisition, the non-listed subsidy could contribute RMB 30 million net profit each year, and the listed company would be able to increase market value by RMB 900 million when P/E is remained at 30, which is the so called wealth amplification effect (P/E game). If spin-offs is carried out, there will be less dilution and the parent company can acquire more assets from the non-listed company.

Non-listed companies do not necessarily incur heavy losses after selling their companies. Obstacles Chinese manufacturers face in launching Initial Public Offerings (IPOs) and costs involved can actually drag down a company. Evaluations based on Chinese companies on the IPO waiting list indicate enterprises will need to wait at least three years. If companies miss out the recent market peak or if the industry faces downturn, company profitability will also drop. Company’s estimated market value will also shrink considerably, and it will be difficult to sell the company at a high premium then.

In terms of timing, it is never a good time to enter secondary market when P/E is overtly high or too low. Listed companies are reluctant to procure companies with overtly low P/E because of limited wealth amplification effect. However, high P/E signals too much market speculation, and usually signals the end of growth. Under this condition, the company has also lost its acquisition value.

The best timing for acquisitions is when an industry has just emerged and there is potential industry growth. Industry concentration will also rise rapidly during this time period. The acquired companies during this time period also have better market exit conditions, especially those that offer private placements or convertible stock acquisition projects typically have a three year lock-up period. These shareholders naturally hope when the period passes, it is not the finale of the LED capital market.

Using Taiwanese LED chip manufacturer Epistar as a reference, the company’s history is marked with many successful acquisitions. The company has integrated resources in the Taiwanese LED chip industry to build a globally competitive LED chip company. Epistar’s development can be said to be a history of mergers.

Epistar’s acquisitions and integration roadmap

The Chinese LED industry currently possesses all the opportunities and right conditions. Manufacturers can do so much more during this time period. They can use the financial market to integrate industry resources, and realize the emergence of excellent companies.

(Author: Figo Wang, Senior Analyst, LEDinsidehttp://Translator: Judy Lin, Chief Editor, LEDinside)