Total global LED chip production capacity has entered a new peak expansionary phase in 2017, according to the latest LED market supply and demand analysis by LEDinside, a division of TrendForce. This recent surge of capacity expansion for LED chips has been a response to the rising demand from Chinese LED package suppliers that had started raising their production capacities earlier in 2016.

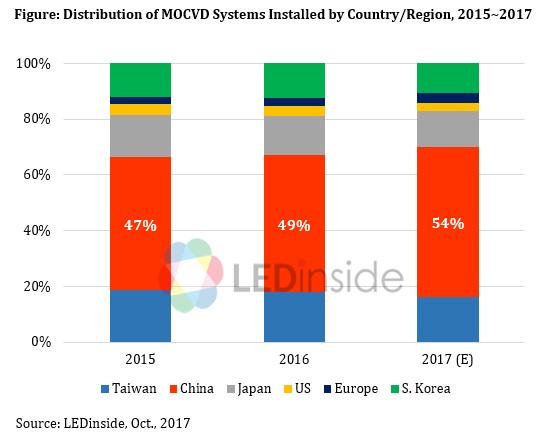

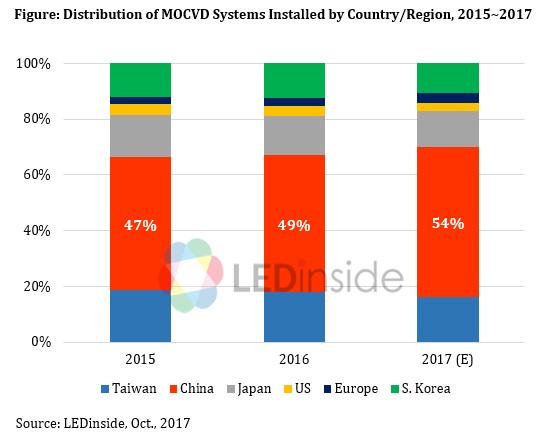

With Chinese LED chip suppliers recommencing their capacity building activities, LEDinside estimates that the number of MOCVD chambers (based on the standard K465i design) installed worldwide this year will be 401. This would represent the largest chip capacity increase since 2011.

“At the start of 2017, major Chinese LED chip makers including San’an Optoelectronics, HC SemiTek and Aucksun revealed that during the year they will be carrying out major capacity expansion plans,” said Roger Chu, research director of LEDinside. “We estimate that the new processing operations set up by the domestic chip makers will push China’s representation in the global MOCVD capacity to 54%.”

|

Chu added that this wave of capacity building for LED chips in China has been to meet the growing demand from the LED package suppliers in the downstream. Furthermore, domestic package suppliers in recent years have been relocating their operations to the second-tier cities due to the rising costs of labor and land in the traditional industry clusters of Guangdong Province and the Pearl River Delta. Local governments in the smaller cities have offered various incentives to get LED companies to build factories in their domains. Consequently, China’s LED industry in 2017 saw another in capacity growth spurt that was comparable to the one during 2010~2011 period.

There have been changes in China’s subsidy policy as well. In the past, small or mid-size domestic LED companies were in a rush to build chip fabrication plants because local governments’ subsidies mainly targeted the upstream of the supply chain. The latest round of subsidies by contrast target the LED package industry and its related businesses. China this time wants to generate demand for the upstream by helping the downstream in opening up market channels. Hence, major domestic package suppliers this year have also been expanding their capacities together with the first-tier domestic chip makers.

LEDinside believes the rapid and subsidized capacity expansions that is taking place in China is now squeezing heavily on the profit margins of long-established LED companies working on the global market. These international majors in turn have scaled down their own manufacturing or increase the share of outsourcing. Either way, Chinese LED companies will benefit and become even larger.

LEDinside Gold Member Report

LED Supply Chain - Backlight / Lighting / Automotive / Display / UV LED / IR LED / μLED

Major LED Package Ranking in Applications

|

Report Name

|

Content

|

Format

|

Release

|

|

LED Industry Demand and Supply Data Base

|

Demand Market Forecast:

2016-2021 Demand Market Forecast

(Backlight / Lighting / Automotive / Display / UV LED / IR LED / μLED)

|

Excel

|

1Q (February) / 3Q (August)

|

|

Supply Market Analysis:

1. Chip market revenue (external sales, total sales)

2. WW new MOCVD chamber installation volume / WW accumulated MOCVD chamber installation / WW new and accumulated MOCVD by K465i

3. Epi wafer market demand (total / by size)

|

|

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue

|

|

LED Package Market Analysis:

LED package vendors' revenue and LED revenue

Top 10 LED package revenues in backlight, lighting, COB, automotive, and display

|

|

LED Industry Price Survey

|

Price Survey - Sapphire / Chip / LED Package / Bulb

|

Excel

|

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November)

|

|

LED Market Demand and Supply Analysis

|

Demand Market

|

PDF

|

2Q (May) / 4Q (November)

|

|

Backlight

|

|

General Lighting

|

|

Automotive

|

|

Display

|

|

Infrared LED Market (2Q) / UV LED Market (4Q)

|

|

μLED (4Q)

|

|

Supply Market

|

|

MOCVD Market

|

|

Wafer and Chip Market, URT

|

|

Supply and Demand Sufficiency Analysis

|

If you would like to know more details, please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-8978-6488 ext. 912