According to TrendForce’s latest market research report the “TrendForce 2022 Mini LED New Backlight Display Trend Analysis”, the trend of Mini LED backlights led by leading players including Samsung and Apple in 2021 has encouraged other brands to introduce the up-to-date components into their new displays in 2022. For example, TV manufacturers such as Sony, Sharp, and Hisense have decided to use Mini LED backlights this year, while MSI, Lenovo, and GIGABYTE have applied the components to MNT and NB markets. As new comers have joined competition along with proactive approaches adopted by top businesses (i.e., Samsung and Apple) in the IT and TV markets, TrendForce predicts that in 2022, the number of Mini LED backlight display shipments will hit 17.6 million units, YoY 83%.

Analysis of New Display Market Strategies

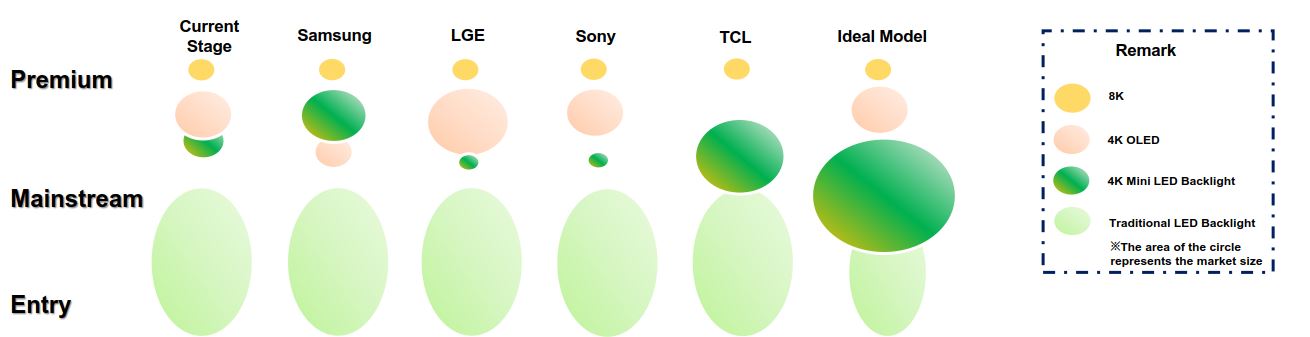

In the mid- and long term, shipments of Mini LED backlight displays from Apple and Samsung account for more than 50% of total counts, the two companies will decide the future development of relevant products. The dispute between Apple’s Mini LED displays and their OLED counterparts as well as Samsung’s positioning of its QD OLED and Mini LED backlight displays will become major factors affecting the mid- and long-term development of Mini LED products.

Categorization of Mini LED Backlight Technologies for Different Markets

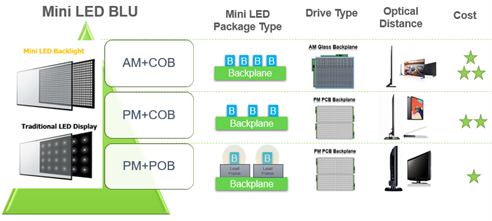

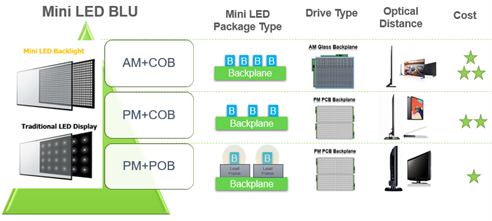

Currently, technologies of Mini LED backlight displays can be categorized by their target markets, namely the entry, mainstream, and premium markets. Regarding entry market, Mini LED backlight boards are produced using the more mature PM package-on-board (POB) solution, from which the products focus on creating a high cost–performance ratio. Compared to those targeting at the entry market, products targeting at mainstream-to-premium markets are made using the COB solution for SMT and packaging, which is capable of increased Mini LED array density. As for the premium market, Mini LED light boards are fabricated using glass backplanes available for even more dense diode arrangement plus the said COB approach; in this way, the resultant product can meet the strict resolution requirements of high-brightness thin displays for the premium market.

TrendForce 2022 Mini LED New Backlight Display Trend Analysis

Publication Dates: April 30 and October 31, 2022

Language: Traditional Chinese/English

Format: PDF

Number of Pages: The two publications will total 120–130 pages

Chapter 1. Current Development of Mini LED Backlight Displays

-

Shipment Forecasts of Mini LED Backlight Displays

-

Penetration Forecasts of Mini LED Backlight Displays

-

Application Distribution of Mini LED Backlight Displays

-

Leading Companies’ Strategies to Adopt Mini LED Backlight Displays

-

Market Segmentation Projection of Mini LED TV

-

Mini LED for TV Backlight – Samsung

-

Mini LED TV Backlight – LG

-

Mini LED TV Backlight – Sony

-

Mini LED TV Backlight – Sharp

-

Mini LED TV Backlight – Hisense

-

Mini LED TV Backlight – Huawei

-

Mini LED TV Backlight – LeTV

-

Mini LED TV Backlight – Skyworth

-

Market Segmentation Projection of Mini LED Notebook PC

-

Mini LED for NB Backlight – Gigabyte

-

Mini LED for NB Backlight – Msi

-

Mini LED for NB Backlight – Acer

-

Mini LED for NB Backlight – Apple

-

Market Segmentation Projection of Mini LED Monitor

-

Mini LED for MNT Backlight – Samsung

-

Mini LED for MNT Backlight – Dell

-

Supply Chain Roadmaps of Mini LED Backlight Modules by Major Vendors

-

Supply Chain of Apple’s Mini LED Backlight Modules

-

Supply Chain of Samsung’s Mini LED Backlight Modules

-

Supply Chain of LGE’s Mini LED Backlight Modules

Chapter 2. Development Trends of Mini LED Backlight Technologies

-

Categorization of Mini LED Backlight Technologies by Market

-

Mini LED Backlight Technology Roadmap

-

Trends of Mini LED Chip Miniaturization

-

Mini LED Packaging Technologies

-

Technologies of Mini LED Packaging Equipment

-

Differences between AM and PM Driving for Mini LED Backlights

-

Development of AM Driving for Mini LED Backlights

-

Combined with Optical Encapsulants to Save Chip Quantity

-

Reduced Usage of Optical Film Materials

-

65” 4K TV Module Cost

-

31.5“ 4K MNT Module Cost

-

15.6” 4K NB Module Cost

-

12.9" 3K Tablet Module Cost

Chapter 3. Analysis of New Display Market Strategies

-

Evaluation The Best Segment of Mini LED Application from The Capacity of Display Technology

-

Tablet & NB Key Brand Strategy Analysis

-

Projected Timelines of Apple Introducing Mini LED to New Products

-

Projected Timelines of Apple Introducing OLED to New iPads

-

Apple's Mini LED/OLED Strategy in IT Applications

-

Major TV Brand Strategy Analysis

Chapter 4. Mini LED Market Size Analysis

-

Definition of Mini LED Chip Size

-

Yield Forecast of Chips for Mini LED Backlight Applications

-

Output Forecast of Chips for Mini LED Backlight Applications

|

If you would like to know more details , please contact:

|