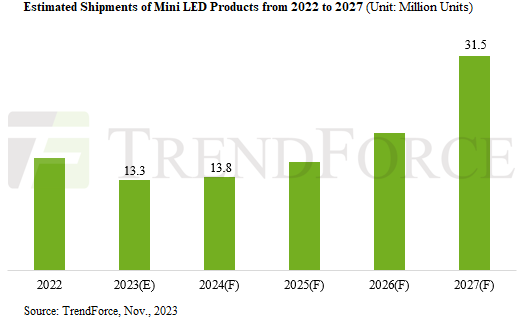

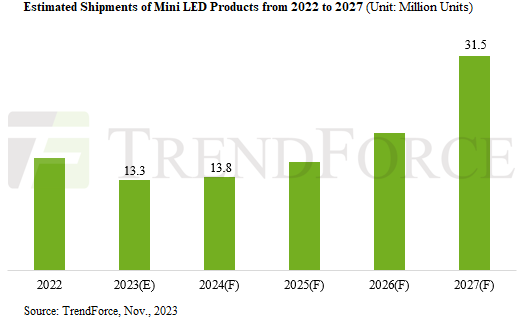

TrendForce's "2024 New Mini LED BLU Display Trend Analysis" report reveals that due to declining demand in consumer electronics, shipments of Mini LED products are expected to decrease to 13.337 million units in 2023. However, the market is projected to rebound in 2024, with shipments estimated at 13.792 million units, and the growth trend is expected to continue through 2027. This decline is part of a larger trend of decreasing prices for Mini LED products, setting the stage for sustained growth in shipments. The report predicts that by 2027, shipments could reach as high as 31.453 million units, with a CAGR of approximately 23.9% from 2023 to 2027.

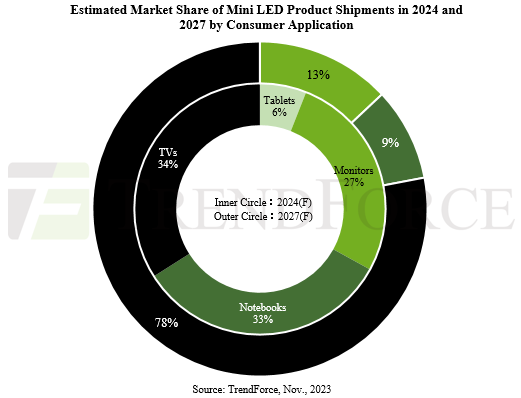

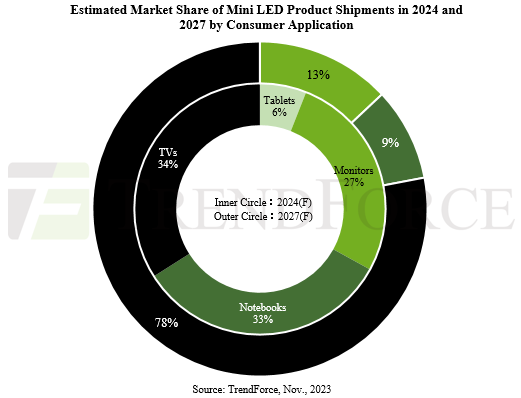

In the television sector, despite the robust increase in LCD panel prices and the continued high depreciation costs of OLED products, Mini LED component prices are on a downward trend. Now, apart from the relatively small-scale and still early-stage glass-based Mini LEDs, the costs of various other Mini LED TV panels are lower than those of White OLED and QD OLED. Thus, TrendForce maintains that Mini LEDs remain the most effective and optimal solution for enhancing contrast. Against this backdrop, the forecast for Mini LED TVs is positive, with an expected continuous growth in shipment volumes. Shipments are projected to reach 6.21 million units by 2024, marking a 53.5% YoY increase. Moving forward to 2027, shipment volumes are projected to hit 24.4 million units, capturing roughly 12.1% of the overall TV market. The CAGR for this segment from 2023 to 2027 is projected to be around 56.7%.

In IT applications, Mini LED monitor shipments are estimated at 296,000 units in 2023. Due to the diverse range of form factors available for monitors, including COB and POB, the cost structure is more flexible. After the market for OLED monitors gradually saturates and the costs of Mini LEDs continue to decrease, Mini LED monitors are expected to enter a growth phase between 2026 and 2027, with a significant increase in market penetration expected by 2027, estimated at around 3.1%.

Notably, as RGB OLED continues to expand, both Mini LED tablets and notebooks are facing potential threats and both applications are expected to reach an inflection point this year. The shipment volume for Mini LED notebooks is estimated to decrease by approximately 39% YoY. Meanwhile, with the 12.9-inch iPad Pro expected to be discontinued in 2024, the shipment volume of Mini LED tablets is expected to decrease by about 15.6% YoY, making these two the only applications expected to decline.

For the automotive market, even though inflation in Europe and the US is slowing down in 2023, the global economy remains weak. Automakers are stimulating demand through price reductions, inadvertently leading to a price war across the entire automotive market. However, the adoption of Mini LEDs in automotive displays is gradually expanding. With the development of smart cockpits, there is a trend towards a higher-end upgrade of in-car screens.

TrendForce investigations reveal that automakers, including BMW, Mercedes-Benz, Volvo, NIO, Roewe, and Li Auto are actively entering the Mini LED automotive display market. Mini LED COB technology, which uses blue LED combined with QD/phosphor, will compete with Mini LED POB/OLED display technology in the automotive display market.

TrendForce 2024 New Mini LED BLU Display Trend Analysis

Release Date: 31 October 2023

Language: Traditional Chinese / English

Format: PDF

Page: 153

Chapter 1. Global Lighting Market Trend

-

2023-2027 Shipment and Penetration Rate for Mini LED BLU TVs

-

2023-2027 Mini LED BLU Types and LED Demand for TVs

-

2023-2027 Shipment and Penetration Rate for Mini LED BLU Monitors

-

2023-2027 Mini LED BLU Types and LED Demand for Monitors

-

2023-2027 Shipment and Penetration Rate for Mini LED BLU NBs

-

2023-2027 Mini LED BLU Types and LED Demand for NBs

-

2023-2027 Shipment and Penetration Rate for Mini LED BLU Tablets

-

2023-2027 Mini LED BLU Types and LED Demand for Tablets

-

2023-2027 Shipment and Penetration Rate for Mini LED BLU VR Headsets

-

2023-2027 Mini LED BLU Types and LED Demand for VR Headsets

-

Penetration Rates of Mini LED BLUs in Consumer Electronics Applications

-

Shipments of Mini LED BLUs in Consumer Electronics Applications

-

Quantity Demanded of LED (COB) for Mini LED BLU Applications

Chapter 2. Mini LED BLU Technology Trends and Market Dynamics

-

Supply Chain Of Mini LED Backlight Market

-

Capital Distributions among Chip Manufacturers

-

LED Chip Manufacturers: HC SemiTek

-

LED Chip Manufacturers: San'an

-

Midstream Player' Capital Layout

-

Equipment Player: HOSON

-

LED Package Player: Everlight

-

LED Package Player: Lextar

-

LED Package Player: Hongli

-

LED Package Player: MTC

-

LED Package Player: Nationstar

-

LED Package Player: Refond

-

LED Package Player: APT Electronic

-

LED Package Player: Jufei

-

LED Glass Substrate Manufacturers: WG Tech

-

LED Module Player : SmileLighting

-

LED Module Player : MLED

-

LED Module Player : Longli

-

Application Player: BOE

-

Application Player: TCL

-

TCL X11G Max: Specs analysis

-

Application Player: Tianma

-

Application Player: Hisense

-

Analysis Of POB / COB / COG Technology

-

COB Process & Technology Maturity Analysis

-

Analysis Of PCB Substrate

Chapter 3. Development of the TV Application Market for Mini LED Backlight and OLED

-

Brand Landscape Dynamic: Mini LED TV

-

Mini LED TV Overview

-

Trend Analysis of Mini LED Backlight TV

-

Analysis of Next-gen Mini LED-backlit/OLED TVs in Each Market by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED TVs in Each Market by Price Difference

-

2022-2023 Shipments of Mini LED BLU TVs among Brands

-

Samsung VD’s Strategy Shift for Sources of LCD TV Panel Procurement

-

A Breakdown of Samsung VD’s TV Portfolio in 2023

-

2022-2023 OLED TV Market Share by Brands

-

65“ 4K TV Panels Cost Comparison with Different Display Technologies

-

2023-2028 Estimates of Global TV Shipments

-

2023-2027 Shipment Estimates for OLED and QLED TVs

-

Panel price comparison: 55" LCD Open Cell VS. OLED

-

Panel price comparison: 55" LCD Open Cell VS. OLED

-

White OLED: Technological Development and Structural Optimization

-

QD OLED: Technological Development and Structural Optimization

Chapter 4. Development of the IT Application Market for Mini LED Backlight and OLED

-

Brand Landscape Dynamic: Mini LED MNT/NB

-

Mini LED MNT Overview

-

Trend Analysis of Mini LED Backlight MNT

-

Analysis of Next-gen Mini LED-backlit/OLED MNTs in Each Market by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED MNTs in Each Market by Price Difference

-

Specs/Price Analysis of COG Mini LED-backlit MNTs in China

-

2022-2023 Shipments of Mini LED BLU Monitors among Brands

-

2023-2027 Global Monitor/AIO Set Shipment Forecast

-

2022-2025 OLED Monitor Shipment Forecast

-

OLED Monitor Type and Size Distribution

-

31.5“ 4K MNT Panels Cost Comparison with Different Display Technologies

-

Mini LED NB Overview

-

Trend Analysis of Mini LED Backlight NB

-

Analysis of Next-gen Mini LED-backlit/OLED NBs in Each Market by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED NBs in Each Market by Price Difference

-

2022-2023 Shipments of Mini LED BLU Notebooks among Brands

-

2023-2026 Global Notebook PC Shipment Forecast

-

Apple’s Display Technology Plan for MacBook, iPad, and iMac

-

15.6“ FHD NB Panels Cost Comparison with Different Display Technologies

-

2022-2024 OLED NB Penetration Rate Forecast

-

2023 OLED Notebook Penetration Rate by Brands

-

Analysis of Next-gen Mini LED-backlit/OLED Tablets in Each Market by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED Tablets in Each Market by Price Difference

-

12.9" Tablet Panels Cost Comparison with Different Display Technologies

-

Analysis of Next-gen Mini LED-backlit/OLED Displays in India by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED Displays in India by Price Difference

-

Analysis of Next-gen Mini LED-backlit/OLED Displays in Brazil by Quantity

-

Analysis of Next-gen Mini LED-backlit/OLED Displays in Brazil by Price Difference

-

New AMOLED Fab Investment Plan

-

AMOLED Capacity and Product Planning

-

New OLED Technology in IT applications - eLEAP

-

New OLED Technology in IT applications – Tandem

-

Panel Marker Ability Analysis for OLED NB

Chapter 5. Development of the Automotive Display Market for Mini LED Backlight

-

Smart Cockpit Trend

-

Automotive Display Technology Overview

-

2023-2027 Automotive Display Backlight Analysis

-

2022 Mini LED / HDR Automotive Display- Specification and Supply Chain

-

2022-2025 Mini LED / HDR Automotive Display Schedule and Specification

-

NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

-

Roewe RX5 Automotive Display- Specification and Cost Analysis

-

Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

-

2023 Automotive Display Cost Analysis- Edge / Direct Type

-

2023 Automotive Backlight LED Specification Analysis

-

2023 Automotive Backlight LED Product Specification and Price Analysis

-

Mini LED / HDR Automotive Display- Driver IC Specification Analysis

-

Automotive Display Supply Chain Flow Analysis

-

2023-2027 HUD Market Shipment- Product vs. Regional Market Analysis

-

2023-2027 HUD Market Shipment- Product Technology Analysis

-

2021-2022 HUD Player Market Share Analysis

-

2023 HUD Product Specification and Price Analysis

-

2023 HUD Product Price Analysis

-

AR-HUD Technology Analysis

-

3D AR-HUD Product Trend

-

AR-HUD OEM Supply Chain and Product Specification Analysis

-

HUD Market Value Chain Analysis

Chapter 6. Development of the Head-mounted VR Display Market for Mini LED Backlight

-

Virtual Reality Product Analysis- Oculus Quest Pro

-

Virtual Reality Product Analysis- Sony PlayStation VR 2

-

Virtual Reality Product Analysis- HTC VIVE Focus 3 / Pico 4 Pro

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN