According to TrendForce’s latest report “Gold+ Member: Global LED Market Demand and Supply Database and LED Industry Quarterly Update”, in 2025, due to the impact of increased tariffs imposed by the United States, rising business costs have led to higher product prices, suppressing global consumer demand. However, sectors such as the Micro/Mini LED, automotive LED, horticultural lighting, and UV / IR LED markets continue to grow. Overall, the LED market value is estimated to reach USD 13.003 billion in 2025.

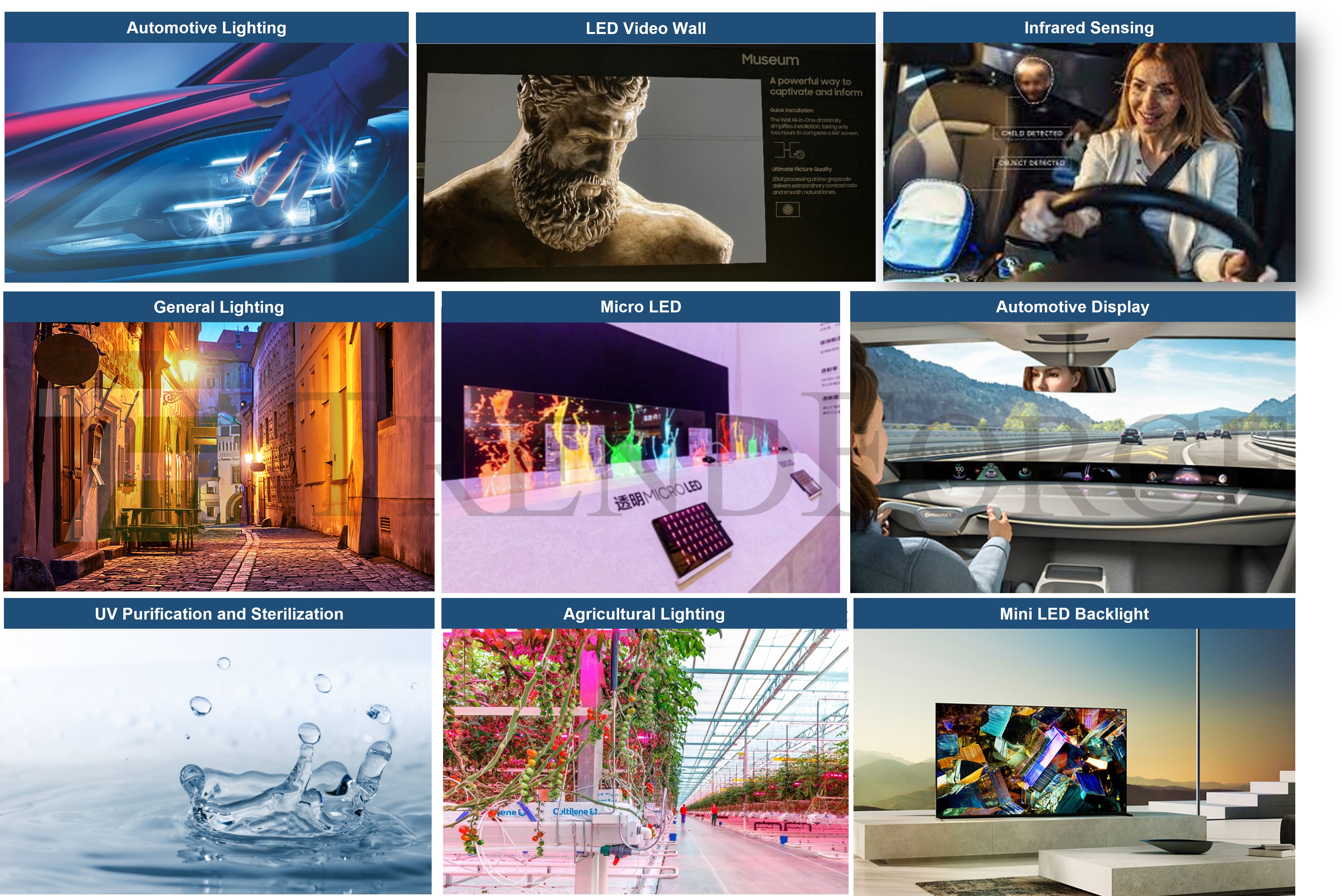

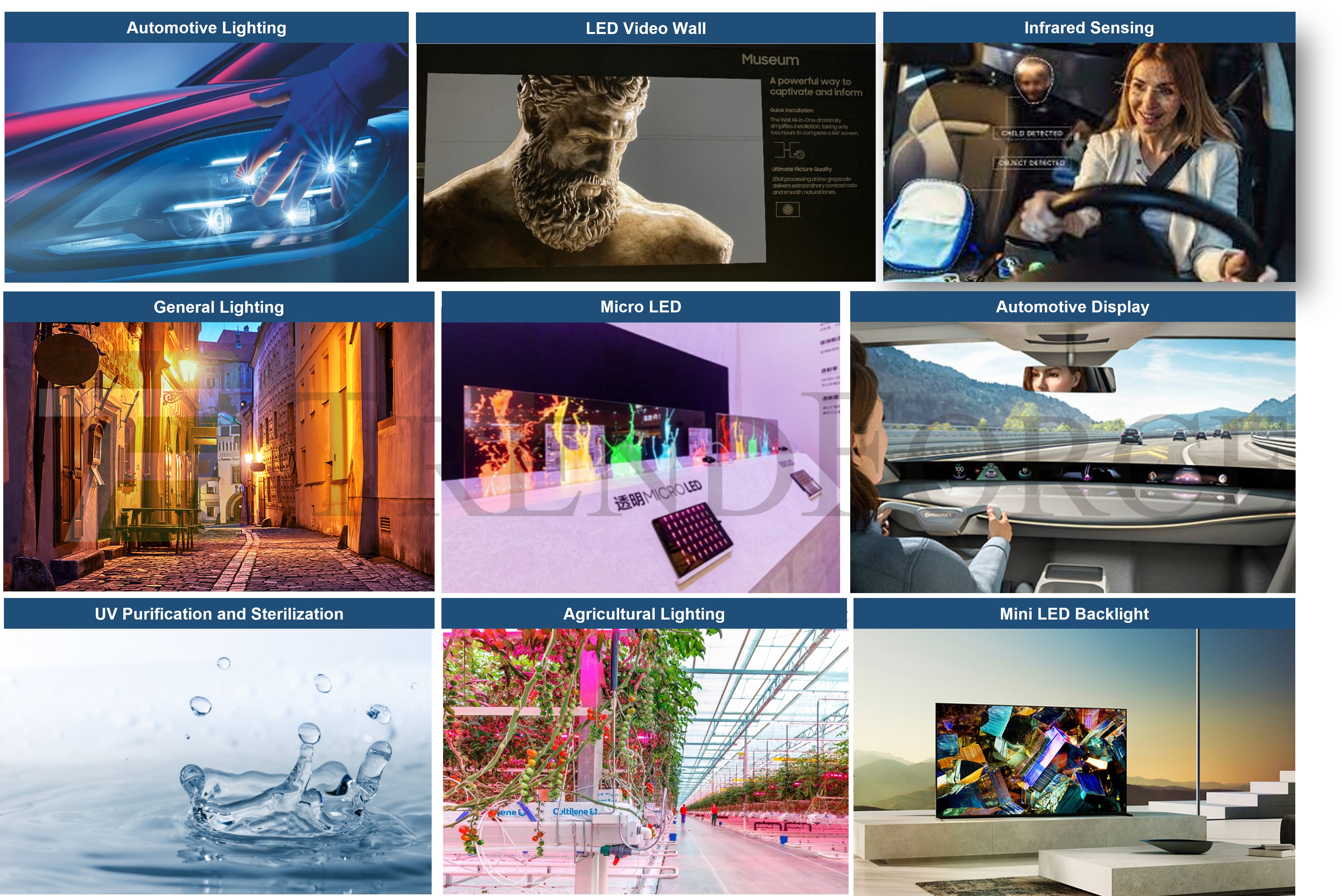

TrendForce has summarized some highlights for markets and applications with great potential as follows.

Micro LED Applications

The rapid advancement of AI has shifted resources toward AR devices among manufacturers. High-brightness, miniaturized Micro LED-equipped monochrome light engines, empowered by the AI boom, have seen deeper development in simple functions like information prompts, contributing some market value to Micro LEDs in head-mounted devices in the short run. However, the emerging trend of AI glasses has significantly hindered further advancement, with monochrome engines lacking differentiation, causing a slowdown in growth. From a long-term perspective, the current AI glasses offer an advantage in expanding applications, laying a solid foundation for the future development of the full-color Micro LED display market. The monolithic full-color Micro LED solution is gradually maturing, and the efficiency enhancement requirements of waveguide technology cannot be ignored. Continuous innovation by solution providers and related material manufacturers will help reduce costs. Therefore, TrendForce projects that the market size of Micro LED devices—with the existing specification advantage—in the AR sector will truly take off after 2027.

Mini LED Video Walls

According to TrendForce research, the demand for Mini LED (COB) displays continued its rapid growth in 2024, and major manufacturers include Samsung, LG, Leyard, Unilumin, Absen, BOE, Cedar, and Ledman. In 2024, with technical improvements, chip sizes have gradually transitioned from 04x07mil to 03x07/03x06mil. Driven by the rising end-market demand, the growth of Mini LED wafers remains strong.

Automotive Lighting and Displays

Amid market competition, automotive manufacturers actively have advanced technologies such as adaptive driving beam (ADB) headlights, Mini LED taillights, full-width taillights, (intelligent) ambient lights, and Mini LED-backlit displays as high-value-added products for marketing concerns, driving stable growth in the automotive LED market in 2024. Towards 2025, automotive manufacturers will continue facing competition and cost reduction pressures, requiring automotive LED suppliers to lower their offers in 2025. Due to the ongoing uncertainty in the overall economy, greater downward pricing pressure is anticipated in 2025. However, according to TrendForce’s analysis on automotive LED manufacturers’ orders on hand, car production is expected to recover again in 2H25. Additionally, with advanced technologies continuing to be incorporated into car models in 2026, the automotive LED market value is forecasted to grow to USD 3.509 billion in 2025.

UV LED

Compared to UV lamps, UV LEDs have a longer lifespan and simpler optical design. Manufacturers such as Nichia, Seoul Viosys, Violumas, and UVT have launched a wide range of UV-A, UV-B, and UV-C LED product lines, aiming to provide comprehensive wavelength solutions to meet the needs of customers looking to replace UV lamps. With the increasing maturity of relevant technologies year by year, DUV LEDs can be used not only for disinfection and purification, phototherapy, and horticultural lighting but also to enhance the quality and stability of curing products. Between 4Q24 and 1Q25, ams OSRAM and Nichia announced 115mW and 135mW UV-C LEDs, respectively, with major manufacturers of ≥100mW UV-C LED single-chip packages in 1H25 expected to include ams OSRAM, Nichia, Violumas, NKFG, UVT, and LITEON. Overall, UV LED market growth is supported by stable demand in the UV curing market and the adoption of UV-C LED technology in new applications such as air conditioning, air purification, and flowing water sterilization due to favorable technological maturity.

Agricultural Lighting

Looking ahead to 2025, the continued recovery in the end-market demand for horticultural lighting and the application of new technical solutions are expected to be key factors driving stable growth in the demand for agricultural lighting LEDs. Firstly, there is an increase in localized supply for fruits, vegetables, and flowers, while the rising trends in healthy and nutritional consumption and government subsidies have stimulated the construction of new integrated and multifunctional greenhouse complexes. Second, energy-saving and cost-reduction efforts aimed at achieving higher efficiency are expected to drive the replacement cycle of old lighting products from 2020-2021 (with 3-5 year warranties) in 2024-2025, with market expectations for higher photosynthetic photon efficacy (PPE), luminous intensity, and dimmable multi-channel LED luminaires.

Gold+ Member Report

Gold+ Member Report

(Global LED Industry Database vs. LED Player Movement Quarterly Update)

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis:

|

PDF / Excel

|

1Q (Mid March)

3Q (Early September)

|

|

2025-2029 Demand Market Forecast

|

|

(Backlight and Flash LED / General Lighting / Agricultural Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / UV LED / IR LED / Micro LED / Mini LED)

|

|

Supply Market Analysis:

|

|

1. LED Chip Market Value (External Sales, Total Sales)

|

|

2. WW New / Accumulated GaN LED and AS/P LED MOCVD Chamber Installations

|

|

3. GaN LED and AS/P LED Wafer Market Demand (By Region / By Wafer Size)

|

|

4. GaN LED and AS/P LED Wafer Market Demand and Supply Analysis

|

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis:

|

PDF / Excel

|

2Q (Early June)

4Q (Early December)

|

|

Top 10 LED Chip Manufacturers by Revenue and Wafer Capacity

|

|

LED Package Market Analysis:

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

Top 10 LED Package Players by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

LED Industry Price Survey

|

Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED, IR LED, VCSEL)

|

Excel

|

1Q (Mid March)

2Q (Early June)

3Q (Early September)

4Q (Early December)

|

|

LED Industry Quarterly Update

|

Major Players Quarterly Update:

|

PDF

|

1Q (Mid March)

2Q (Early June)

3Q (Early September)

4Q (Early December)

|

|

EU / U.S- Lumileds, ams OSRAM, Cree LED

|

|

JP- Nichia, Stanley, ROHM

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

ML- Dominant

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Micro/Mini LED

Exhibit Report

|

CES 2025 / Touch Taiwan 2025

|

PDF

|

Aperiodically

|

If you would like to know more details , please contact:

CN

TW

EN

CN

TW

EN