According to TrendForce’s latest report, 2025 Global LED Lighting Market Trend- Database and Player Strategies (2H25), the reciprocal tariffs policies launched by the United States in April have further exacerbated uncertainties over the global economy, leading to significant contractions in business investments and commercial activities. In 1H25, the general LED lighting market failed to rebound as expected. The pace of new installations remained sluggish, while replacement demand in the existing installed market slowed down, resulting in continued market contraction and weak player revenue performance.

Looking ahead to 2H25, the impact of reciprocal tariffs is expected to heighten market caution, with clients adopting a strong wait-and-see stance and exercising strict inventory control. Consequently, the global demand for LED lighting products is still under downward pressure.

Despite overall softness, clear market segmentation trends have emerged. High-efficacy, human-centric, smart, and circular lighting products posted strong order growth in 1H25, becoming key drivers for revenue contribution and market share stability among certain vendors. In the professional segment, horticultural lighting benefitted from sustained energy-saving demand in Europe, partially offsetting weakness in other regions.

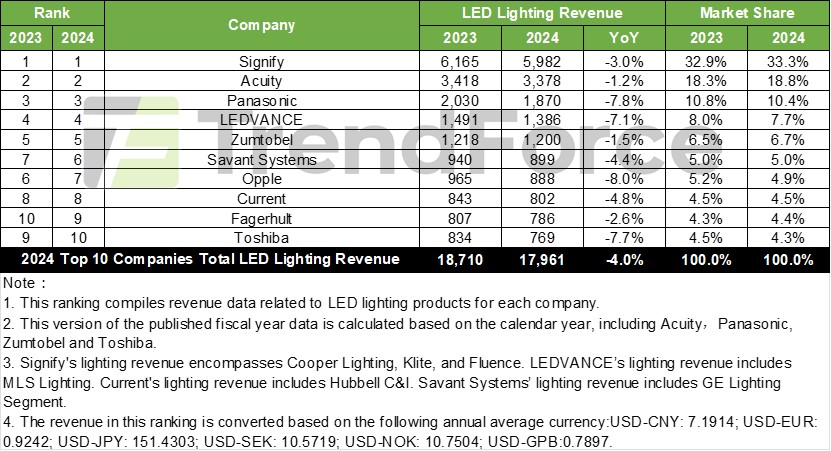

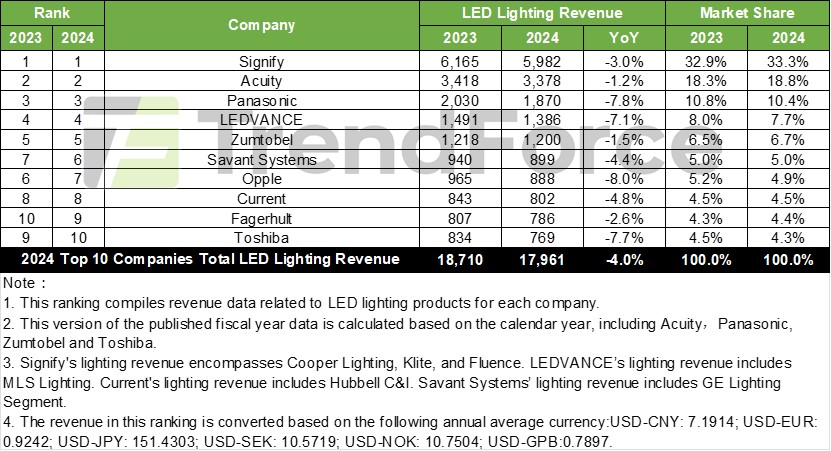

2024 Revenue Rankings of Global Top 10 LED Lighting Manufacturers(Unit: Million USD)

1. LED General Lighting Market Continues to Decline, Certain Application Sectors Unleash Growth Potential

In 1H25, The construction sector, which is closely linked to the LED lighting industry, remains sluggish. The pace of new installations and renovation projects has slowed down. There is an increasing demand for LED retrofitting in the existing market. Furthermore, proportions of demand have also grown for high-efficacy LEDs, healthful (integrative) lighting, smart lighting, and lighting products based on designs that align with the circular economy or sustainable development. However, the lighting market as a whole is still weak, characterized by declining volumes and prices. This ongoing trend makes it challenging to reverse the decline in the overall value of the global lighting market. As a result, TrendForce estimates that the overall value of the global LED lighting market will drop by 4.4% YoY to USD 53.573 billion in 2025.

On the product and application side, high energy costs and new regulatory measures are expected to unlock incremental demand in low-penetration segments such as outdoor, industrial, and emergency lighting. These areas are forecast to sustain steady shipment growth for LED streetlights, high-bay lights, and floodlights. In new installations, AI-driven digital infrastructure projects are supporting stable demand, with LED Light Strip expected to maintain growth.

Looking at LED lighting products and applications, TrendForce believes that certain niche application market segments could release installation or replacement demand for LED lighting products in 2025 despite poor economic conditions. These segments with potential opportunities include outdoor lighting, industrial lighting, and emergency lighting. The reasons for this projection are high energy costs, the implementation of new regulations, and the initially low LED penetration rate in existing markets. Therefore, it is expected that the shipment volumes of related products, including LED street lights, LED high bay lights, LED floodlights, and LED parking lot lights, will increase. In new installations, AI-driven digital infrastructure projects are supporting stable demand, with LED linear lights expected to maintain growth.

2. Smart Lighting Penetration Accelerates, with Smart Residential and Smart City Application Driving Growth

Driven by energy-saving policies and rising user demand for dynamic dimming, color tuning, and human-centric wellness lighting, the penetration of LED smart lighting continues to accelerate. From a technology perspective, declining R&D costs, the introduction of next-generation interoperable protocols such as Matter, and integration of AI algorithms are speeding up product launches and boosting shipments.

In 1H25, as predicted by TrendForce at the beginning of the year, market demand for consumers has improved, leading to a strong rebound in the smart residential lighting sector, driving growth in demand for LED smart bulbs, LED smart ceiling lights, LED smart floor lamps, and LED smart light strips. Looking ahead to 2H25, increased government infrastructure investment is expected to fuel smart cities development, further boosting demand for IoT outdoor lighting. Consequently, TrendForce estimates that the global smart lighting market is projected to reach USD 11.573 billion in 2025 (+19.2% YoY) and grow to USD 21.941 billion by 2029, with a CAGR of 17.7% from 2024 to 2029.

3. Horticultural Lighting Market Supported by Europe, Expected to Maintain Moderate Growth

In the U.S., reciprocal tariffs have dampened new and replacement demand in horticultural lighting, particularly for specialty crop retrofit cycles. With over 80% of North America’s supply sourced from Mainland China, tariff pressures have raised costs and prompted growers to delay procurement. Globally, new greenhouse and vertical farm projects have also faced delays.

On the product side, smart LED grow lights with dynamic control are increasingly deployed in greenhouses and vertical farms. Adoption of 3–4 channel tunable spectrum products is rising, integrated with advanced control systems to enable energy-efficient and precision farming.

4. Revenue Decline Narrows for Market Leaders,Industry Consolidation Accelerates

TrendForce's latest data shows that the top 20 global lighting companies achieved combined revenue of USD 23.883 billion, a 5.3% year-on-year drop,, with market concentration continuing to rise. The top five—Signify, Acuity, Panasonic, LEDVANCE, and Zumtobel—held their rankings, while Fagerhult moved up to 9th through strategic acquisitions.

According to TrendForce, the global lighting market demand has remained weak in 1H25. Nevertheless, the demand for high-efficacy and smart lighting products is growing strongly, with their revenue contribution increasing annually. What’s more,

The impact of the US dollar's depreciation has also narrowed revenue declines for Japanese manufacturers when calculated in US dollar. TrendForce projects the top 20 lighting manufacturers’ combined revenue to fall to USD 22.947 billion, representing a 3.9% year-on-year decline.

Meanwhile, industry consolidation is accelerating, with major players enhancing one-stop solution capabilities and reinforcing regional market share through M&A (e.g., LEDVANCE’s acquisition of Loblicht) and brand integration. TrendForce expects the “strong-get-stronger” trend to continue, with future strategies focused on eco-friendly products, digital lighting solutions, and faster integration of AI and sensors into intelligent control systems.

5. Lighting LED Packaging Prices Decline Rapidly, International Brands Adjust Strategies to Capture Market Share

In 1H25, average prices in the LED package market fell at a faster pace as leading Western brands adjusted product portfolios and pricing to accelerate the introduction of cost-competitive solutions. Companies such as Cree LED and ams OSRAM shifted strategies to meet downstream cost-optimization needs and address price competition in the packaging segment, leveraging technical advantages to launch lower-cost products or broaden specifications to win share.

TrendForce provides in-depth insights into global LED lighting industry trends, covering market size, pricing, and regional distribution across general, smart, and horticultural lighting segments, along with analysis of developments in the LED packaging sector. The report tracks revenue and strategies of the top 20 manufacturers, examines the competitive positioning of leading players such as Signify, Acuity, Panasonic, LEDVANCE, and Opple, and outlines trends and price movements in seven major luminaire categories, supported by monthly updates and policy and regulation analysis.

Author: Christine / TrendForce

TrendForce 2025 Global LED Lighting Market Trend- Database and Player Strategies-2H25

1. Database and Player Strategies

Release Date: 15 February 2025 / 15 August 2025

Format: PDF and Excel

Language: Traditional Chinese / English

2. LED Lighting Market Dynamics Monthly Report

Release Date: 20th of Every Month

Format: PDF

Language: Traditional Chinese / English

【EXCEL】2025 Global LED Lighting Market Trend- Database

PART 1 Introduction

1.1 Market Research Methodology

1.2 Global Economics (GDP)

1.3 Exchange Rates

PART 2 General Lighting Market Forecast (2025-2029)

2.1 General LED Lighting Market Scale-Demand Market Value & Volume & ASP-by Product

2.2 General LED Lighting Market Scale-Demand Market Value-by Category-Lamps & Luminaries

2.3 General LED Lighting Market Scale-Demand Market Value-by Region

2.4 General LED Lighting Market Scale-Demand Market Value & Volume-by Product & by Region

2.5 General LED Lighting Market Scale-Demand Market Value-by Application

2.6 General LED Lighting Penetration Rate (Installed Based Volume)

2.7 General Lighting LED Market-Value & Volume-by Application

2.8 General Lighting LED Market-Value & Volume & ASP-by Power

2.9 General Lighting LED Market-Value & Volume & ASP-by Package Type

2.10 General Lighting LED Market-Value-by CCT

2.11 General Lighting LED Market-Value & Volume-by CRI

2.12 General Lighting LED Price

PART 3 Smart Lighting Market Forecast (2025-2029)

3.1 Smart LED Lighting Market Scale-Demand Market Value-by Application

3.2 Smart LED Lighting Market Scale-Demand Market Value-by Region

PART 4 Agricultural Lighting Market Forecast (2025-2029)

4.1 Horticultural LED Lighting Market Scale-Demand Market Value-by Application

4.2 Horticultural LED Lighting Market Scale-Demand Market Value-by Region

4.3 Agricultural Lighting LED Market-Value & Volume-by Chip Type

4.4 Agricultural Lighting LED Market-Value & Volume-by Power

4.5 Agricultural Lighting LED Price

4.6 Horticultural Lighting LED Player Revenue Ranking (2023-2025E)

PART 5 Lighting Player Revenue Ranking and Estimated

5.1 Top 20 Lighting Player Revenue (2023-2025E)

5.2 Top 10 Lighting Player Revenue Ranking by Application (2023-2024)

5.3 Lighting LED Player Revenue (2023-2024)

PART 6 LED Lighting Product Specification and Price

6.1 Product & Price- Filament Lamp-by Region

6.2 Product & Price- Street Light-by Region

6.3 Product & Price- Panel Light-by Region

6.4 Product & Price- Troffer-by Region

6.5 Product & Price- High/Low Bay-by Region

6.6 Product & Price- Explosion Proof Light-by Region

6.7 Product & Price- Horticultural Light- by Application

【PDF】2025 Global LED Lighting Market Trend- Player Strategies

1.Lighting Player Revenue and Market Strategies Analysis

-

Signify: Revenue Analysis by Product and Application

-

Signify: Revenue Analysis by Region

-

Signify: Product Strategy Analysis

-

Signify: Product Strategy Analysis- Smart Residential Lighting

-

Zumtobel Group: Revenue Analysis

-

Zumtobel Group: Product Strategy

-

Fagerhult: Revenue by Application and Region

-

Fagerhult: Revenue from Other Categories

-

Fagerhult: Product Strategies

-

Acuity: Revenue Analysis by Product and Application

-

Acuity: Product Strategies

-

Acuity: Product Market Strategies

-

Panasonic: Revenue and Market Strategies

-

Panasonic: Product Strategies

-

Panasonic: Product Strategies- Residential Lighting

-

LEDVANCE / MLS: Revenue Analysis by Product and Application

-

LEDVANCE / MLS: Revenue Analysis by Region

-

LEDVANCE / MLS: Product Strategy Analysis

-

Opple Lighting: Revenue Analysis by Product and Application

-

Opple Lighting: Product Technology Analysis

-

Opple Lighting: SDL Lighting Product Application Analysis

-

Opple Lighting: Product Strategy Analysis- Residential Lighting

-

Yankon Lighting: Revenue Analysis by Product and Application

-

Yankon Lighting: Revenue Analysis by Region

-

Yankon Lighting: Product Strategy Analysis

-

Yankon Lighting: Market Strategy Analysis

2. LED Lighting Market Dynamics Monthly Report

-

Foreword

-

[TrendForce’s Prospective] Key Findings in Lighting Market

-

Updates on Statuses of LED Package Manufacturers

-

Updates on Statuses of Lighting Manufacturers

-

Updates on Statuses of Lighting Policies and Regulations

-

Updates on Niche Lighting Market Statuses

|

If you would like to know more details , please contact:

|