MOCVD orders are placed just to maintain capacity, not add, and high utilization rates are only at the top LED makers including Epistar, ForEpi, and Genesis Photonics , according to Maxim Group LLC.

Based on analyzing MOCVD utilization and revenues at LED makers in Taiwan, Maxim pointed out that, the next uptick in MOCVD spending is likely to “fall far short” of the peak seen in 2010-2011. The analysts expect H2 2012 MOCVD orders at about 130 tools.

Higher MOCVD utilization rates are not the norm across all LED makers, but rather at sector leaders. Large LED players like Sanan are expanding in H2 2012. Epistar is planning new LED fabs (Miaoli and Fujian) by 2014. Still, near-term spending doesn’t signifies a return to growth, but instead what is needed to maintain spending levels in 2H 2012 and 2013.

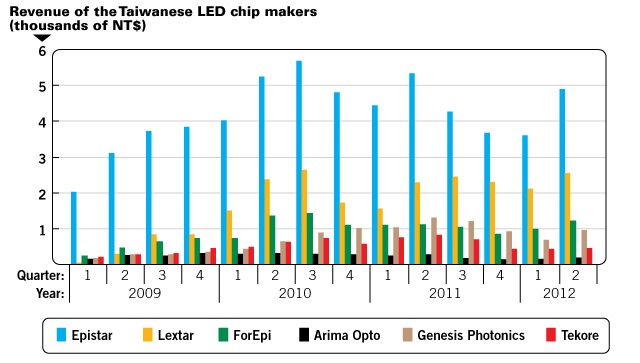

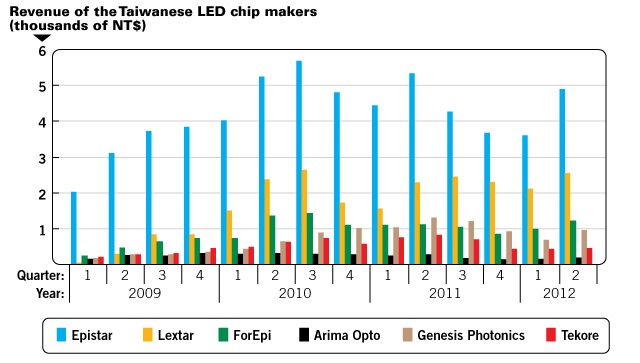

Figure. Revenue Rebound Points to High Utilization at Epistar and Genesis Photonics but Not Others

After falling three quarters in a row, revenue at seven Taiwanese LED chip makers jumped 29% Q/Q in Q2 2012 on a rebound in display backlighting applications. While this has driven utilization at high-quality vendors with exposure to general lighting like Epistar to >95%, Maxim estimated small, lower-quality players remain at ~70%. With Taiwan’s TV subsidy ending and Europe entering a recession, Maxim does not expect backlighting to drive a new wave of MOCVD spending.

Lower subsidies and lower profitability will keep MOCVD spending in check, unlike 2010-2011. Maxim does not see a traditional cyclical downturn/boom, despite some pick up once general lighting adopts LEDs. In 2013-2014, expect MOCVD tool orders to hit about 300 systems, far below the peak numbers of 700+.