Philips Lighting just announced the company's fourth quarter and full year results 2017. "In line with our objectives, Philips Lighting returned to comparable sales growth in 2017 driven by the growth of LED and connected lighting Systems & Services, which demonstrates the successful execution of our strategy," said CEO Eric Rondolat.

"We also further increased our operational profitability with significant improvements in LED, Professional and Home and we delivered a solid free cash flow. This will enable us to continue to invest in growth opportunities, provide a return to shareholders and optimize our balance sheet. Our team remains focused on achieving our medium-term outlook," he commented.

|

|

(Source: Philips Lighting) |

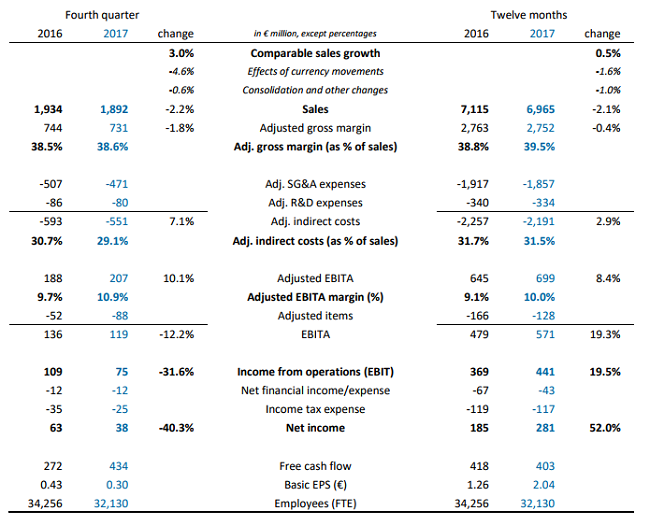

Fourth quarter

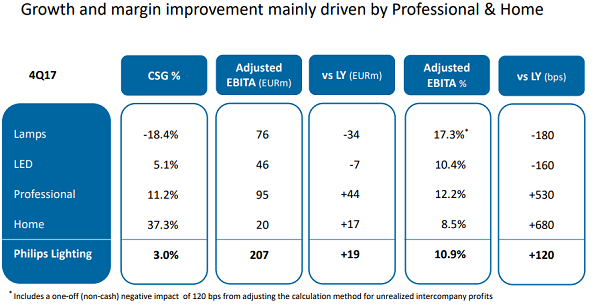

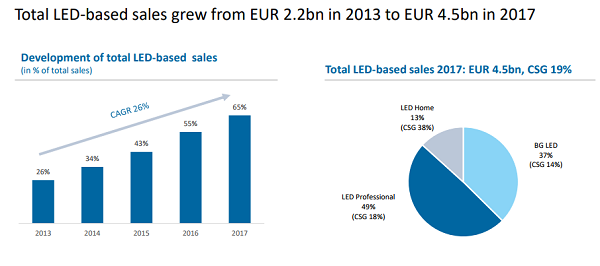

Sales amounted to EUR 1,892 million. On a comparable basis, the increase was 3.0%, driven by LED, Professional and Home, driving total LED-based comparable sales growth of 19%. Total LED-based sales now represent 68% of total sales compared with 59% in the same quarter a year earlier. Europe, the Americas and Greater China contributed to the growth, while market conditions in the Middle East & Turkey, most notably Saudi Arabia, remained challenging.

|

|

(Source: Philips Lighting) |

The adjusted gross margin improved by 10 basis points to 38.6%, largely driven by procurement savings and increased productivity, partly offset by price erosion. Adjusted indirect costs as a percentage of sales decreased by 160 basis points to 29.1%, as a result of the company's cost reduction initiatives.

Adjusted EBITA increased to EUR 207 million, resulting in a 120 basis points improvement of the Adjusted EBITA margin to 10.9%. Restructuring and incidental items amounted to EUR 88 million. Restructuring costs were EUR 75 million and incidental items were EUR 12 million.

Net income decreased from EUR 63 million to EUR 38 million, due to higher restructuring costs and an impairment of other intangible assets related to business group Professional. Free cash flow reached EUR 434 million compared to EUR 272 million in the same period last year, mainly driven by working capital improvements, in particular the reduction of inventories and receivables.

Full year

Comparable sales increased by 0.5%, which is a significant improvement compared to the comparable sales decline of 2.4% in full year 2016. Total comparable LED-based sales grew by 19%, now representing 65% of total sales compared with 55% last year.

Connected Systems & Services, for both consumers and professionals, continued to grow significantly and represented more than EUR 900 million of sales in 2017. The adjusted gross margin as a percentage of sales improved by 70 basis points to 39.5%, driven by procurement and productivity savings, partly offset by price erosion.

Adjusted indirect costs decreased by EUR 66 million, or by 20 basis points to 31.5% as a percentage of sales. Adjusted EBITA increased to EUR 699 million, or 10.0% of sales, driven by significant margin improvements in LED, Professional and Home. Adjusted items amounted to EUR 128 million, mostly related to restructuring costs of EUR 125 million.

Net income reached EUR 281 million, a EUR 96 million increase from a year ago, mainly driven by higher profit and lower financial expenses. Free cash flow reached EUR 403 million.

Outlook

|

|

(Source: Philips Lighting) |

In 2018, the company aims to improve its Adjusted EBITA margin to 10.0-10.5%, in line with its medium-term outlook. It will continue to focus on cost reduction initiatives, and expect to benefit from higher savings as of the second half of 2018. It also aims to deliver positive comparable sales growth for the full year, with a soft start in the first quarter. Philips Lighting expects to generate solid free cash flow in 2018, which is, however, expected to be somewhat lower than the level in 2017 due to higher restructuring payments.

To read the full presentation, visit here.