Chip Scale Package (CSP) has been in the LED industry for some time, and many manufacturers have followed in Lumileds footsteps and launched CSP LED products. Even LED package manufacturers are entering the field, but CSP applications are rarely seen in lighting applications.

CSP’s popularity in the industry is being fueled by more than just cost reduction and improving C/P ratio, its main mission in the LED industry is to “uproot the LED package industry.” Yet, it is still far from directly competing with LED products.

Rising C/P ratio wars highlight CSP advantages

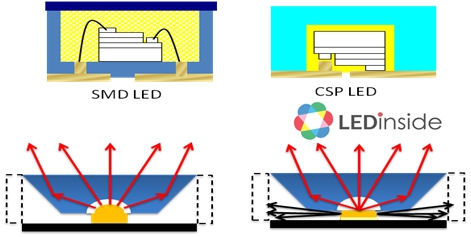

Traditionally a CSP LED is defined as a LED package with a size equivalent to a LED chip, or no larger than 20%. The package product also has comprehensive component features.

CSP has been in the industry for several years, and based on developments in the traditional semiconductor package structure development history, the technology evolved from TO technology before moving on to Dual In-line Package (DIP), Leadless Chip Carrier (LCC), Quad Flat Package (QFP), Ball Grid Array (BGA) before reaching CSP. The CSP technology emerged mainly to shrink the LED package size, improve chip reliability and improve LED chip thermal dissipation.

|

|

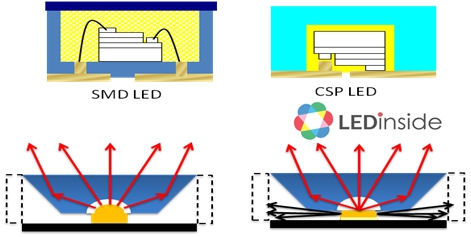

Comparison between CSP LED (right) and conventional SMD LED (left) chip structure. (LEDinside) |

The LED industry gradually matured in early 2015. Standard LED package product competitiveness gradually escalated into a showdown between C/P ratios. The 2835 LED products prices in China’s lighting market dropped 10% to 17% in 2Q15, while 0.5W LED prices fell 17%. These developments reflect the LED industry’s C/P ratio competition has entered a large scale competition.

Following the large scale C/P ratio competitions, large listed manufacturers and SMEs investing in niche markets are all facing different kinds of competition. In the current lighting market, manufacturers have all turned to price wars, and many package component manufacturers are being pressured to promote their products to acquire larger LED lighting market share. CSP stemmed from this demand to mostly meet client’s product requirements.

Most manufacturers ultimate goal is to develop CSPs that can be directly used on PCB substrates, but this technology is still in the initial phase. However, once CSP technology achieves this target, it can greatly shorten the period of heat dissipation from the substrates and lower the light source’s thermal resistance. Eventually the CSP products C/P ratio and reliability will be better than current LED.

CSP maturation is spurred by its features of using fewer LED components resulting in lowered production costs, such as substrate-free, no need for wire bonding, smaller size, and high lighting density. All these have greatly reduced costs, and eliminated some uncertainties in the production process. Additionally, since current semiconductor technology is fairly mature, when reapplied in LED field it can naturally shorten the technology maturation cycle.

Differentiating between CSP package and traditional package

Technically, CSP was used in backlight and flash lighting fairly early, and there were few technology issues. However, CSP LED costs remain high, due to its low yield rates during mass production. Following technology and equipment upgrades, CSP might be completely replaced, and its applications will be broadened and not be exclusive to special application fields, especially in the lighting industry.

Yield rates key to technology maturation

Industry insiders are aware that CSP has very high technology requirements, choosing the right point of entry to acquire a leading position in a short time frame is especially important. If the manufacturer’s CSP technology becomes too advanced, it is also vulnerable to greater risks, such as the inability to recover investments made in the technology. CSP is also insufficient to support market demands, the technology might be there, but there are no market applications to support it. Or the market might be relatively smaller and create a vacuum. In comparison, if the technology lags behind it might put greater distance between the global LED industry technology and waste unnecessary resources. This would also go against the market’s mainstream demands.

By using the International Technology Roadmap for Semiconductors (ITRS) as a roadmap, manufacturers will find the technology concept should be defined as “an important advancement in current LED technology.”

Another reason behind the few CSP lighting applications in the market is its low C/P ratio, which is still largely determined by LED chip technology. Due to CSP’s small size, it lacks mechanical strength, there are also greater difficulties in choosing and testing product material. SMT LED technology has a much higher technology barrier, which has led to low yield rates. Hence, package free CSP in lighting applications is a new challenge that manufacturers need to solve, and there are still many issues that need to be solved.

Although, CSP LED has many attributes that manufacturers find attractive in many LED applications, its frameless structure also makes it more vulnerable than conventional LEDs and will delay its development in certain lighting application fields, said Lattice Power Chief Technology Officer Hanming Zhao. CSP LED technology has lowered package costs by reducing the LED size and even removing leadframes. Additionally, it emits a specific beam angle and has better thermal dissipation. Yet, its smaller chip size also requires highly precise surface mounting technology. Moreover, without a leadframe structure for protection it is more vulnerable than traditional SMT package, which will limit its applications.

Compared to traditional white LED developments, CSP technology’s maturation cycle is much shorter than LED.

LED manufacturers investing in CSP technology are applying it in mature LED products. Even though CSP is still in the R&D phase, LED manufacturers are no longer those that have just come in contact with the technology. These manufacturers have been in the industry for years, and are experienced veterans in acquiring related patents through absorbing foreign companies.

From this it can be seen that even though CSP LED’s C/P ratio is not mature enough to compete with mature LED products, the time frame required for it to reach the same maturation stage will be much shorter.

(Author: Skavy Cheng, Editor, LEDinsidehttp://Translator: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN