Apple supplier Lumentum on Wednesday reported financial results for its fiscal 1Q18 ended September 30. Revenue from its 3D sensing business made a massive ramp in the company’s overall performance.

|

|

(Image: Lumentum) |

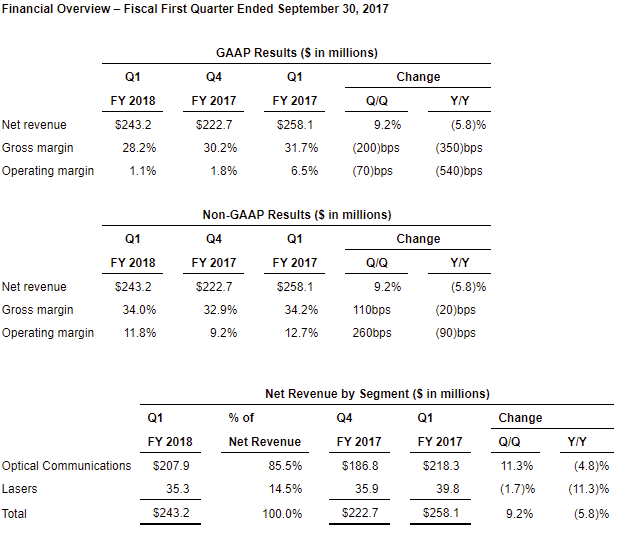

The company’s 1Q18 net revenue stood at USD 243.2 million, up 9.2 QoQ yet down 5.8% YoY, with a USD 0.11 per diluted share. Its GAAP net income bounced back to USD 7.1 million, compared to a net loss of USD 54.9 million in 4Q17 and that of USD 3.4 million in 1Q17.

Lumentum’s optical communication segment contributed USD 207.9 million, 85.5% of the overall number; while revenue of the laser segment took the other 14.5%. It came at USD 35.3 million, sliding by 1.7% QoQ and 11.3% YoY.

“Despite the headwinds in the telecom and datacom markets in the first quarter, we returned to strong sequential revenue growth,” explained Alan Lowe, CEO of Lumentum. “We rapidly ramped our 3D sensing revenue, received significant new orders for these products and made excellent progress on next generation design-ins at numerous customers with our VCSEL and edge-emitting lasers.”

According to Lowe, Lumentum received orders for 3D sensors totally worth USD 300 million earlier in April of this year and has shipped its supply over the past few months.

Seeing the trend of 3D sensing having a positive impact on the company’s revenue, the CEO confidently addressed the revenue for the second quarter will accelerate significantly. He also revealed that Lumentum received a high volume order for edge-emitting lasers (EELs) from a consumer electronics manufacturer based in Asia.

Lumentum concluded the report with a business outlook expecting the net revenue for 2Q18 to be in the range of USD 345 million to USD 375 million.

|

|

(Source: Lumentum) |

CN

TW

EN

CN

TW

EN