Japan-based Yano Research Institute issued on 4th September a research report projecting the market value of Micro LED in 2017 to be USD 7 million following Sony’s launch of CLEDIS display that features Micro LED technology. The market is slowly shaping up.

In addition to Sony, the institute indicated, Apple and Foxconn also foresaw the potential of Micro LED. Apple plans to equip its smartwatch products with Micro LED displays in 2018-2019, while Foxconn acquires a startup specializing in Micro LED display technology in the States, suggesting the market is enlarging rather fast. Yano expects Micro LED will reach a market value of USD 14 million by 2018, twice the volume in 2017.

|

|

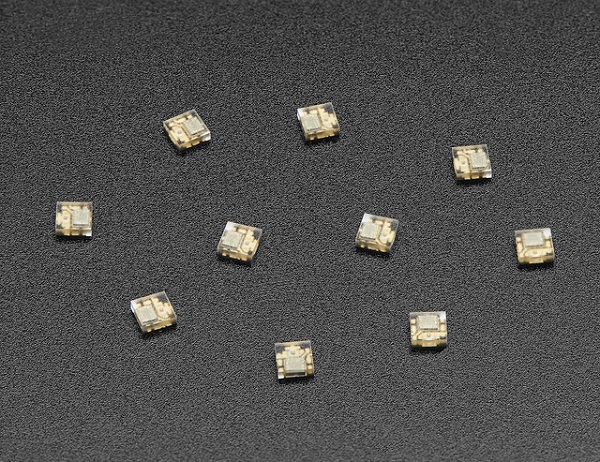

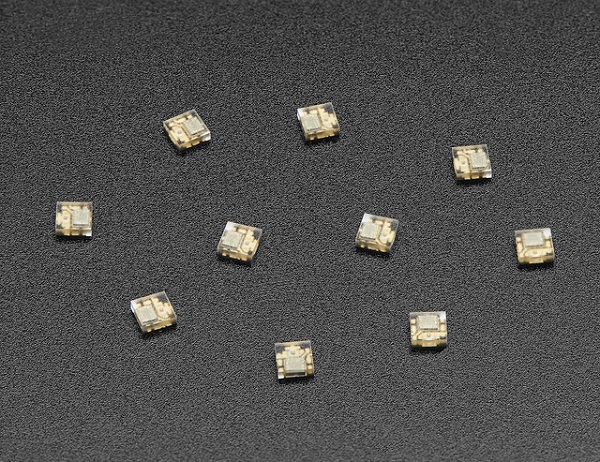

(Image: Micro LED Adafruit Industries via Flickr CC2.0) |

Micro LED is to be used to manufacture displays after 2017 and also likely to be seen in fields such as automotive headlamps, intelligent fibres, Li-Fi, and biomedical applications in 2020, said Yano. Yet, those applications would only contribute to a small proportion of Micro LED’s market value considering challenges in manufacturing technology and cost structure of the applications.

Yano expresses its faith in Micro LED’s performance in the display market, with a forecast anticipating Micro LED’s market value to hit a whopping 224 million by 2020 (3,100%), and to even rocket by 65,371% to USD 4.583 billion by 2025.

However, as technology and equipment required to manufacture Micro LED is yet to mature, whether Micro LED will be able to go head-to-head with LCD and OLED display technologies in the display market currently remains unknown, according to Yano.

Foxconn-owned LCD maker Sharp announced earlier in May to partner with Foxconn’s another subsidiary CyberNet, Innolux, and AOT to complete procuring US-based startup eLux in October to accelerate the development and commercialization of Micro LED.

Once the acquisition closes, Sharp, CyberNet, Innolux, an AOT will own share of 31.82%, 45.45%, 13.64%, and 9.09% respectively from eLux.

In April, Business Korea reported Apple also began the development of Micro LED in a plant in Taoyuan, Taiwan, and planned to start the mass production at the end of 2017. Apple’s Micro LED displays would be see on the next generation Apple Watch. Micro LED consumes less production cost than OLED does, and can be much brighter and more energy-efficient.

LEDinside, a research division of the global market research firm TrendForce, points out companies are currently working on solutions to overcome the high production cost to speed up the development of Micro LED. It assumes a potential market size of around USD 300-400 billion for Micro LED if this next generation display technology wholly replaced a part of LCD display chain including manufacturing of backlight modules, liquid crystal, and polarizers.

CN

TW

EN

CN

TW

EN