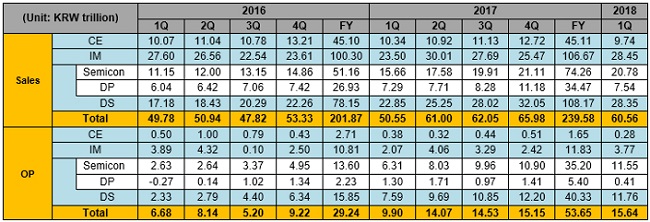

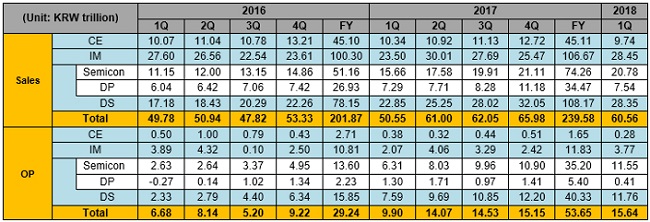

Samsung Electronics posted KRW 60.56 trillion in consolidated revenue and KRW 15.64 trillion in operating profit for the first quarter of 2018.

First quarter revenue was primarily led by Samsung’s Memory Business and increased sales of its flagship mobile products, including the Galaxy S9.

Total revenue grew approximately 20 percent YoY to KRW 60.6 trillion. Operating profit for the quarter was a record high, posting an increase of KRW 5.7 trillion YoY. Profitability improved significantly in the quarter thanks to the Semiconductor Business and the early global launch of the Galaxy S9. All in all, the operating margin in the first quarter was 25.8 percent, up 6.2 percentage points YoY.

By business unit, the Display Panel segment, which manufactures OLED and LCD screens, profits were affected by slow demand for flexible OLED panels and greater competition between rigid OLED and LTPS LCD. An imbalance between supply and demand in the LCD market, brought on by competitors’ increased production capacity, also weighed on earnings.

As for the Consumer Electronics Division, earnings by the Visual Display Business slid YoY following an adjustment in its TV lineup where some mid-range to low-end products were removed. As for the Digital Appliances Business, rising raw material prices and other factors impacted profitability.

For the second quarter, Samsung expects the Memory Business to maintain its strong performance, but generating overall earnings growth across the company will be a challenge due to weakness in the Display Panel segment and a decline in profitability in the Mobile Business amid rising competition in the high-end segment.

The Display Panel segment will seek profitability in OLED by cutting costs and improving yield, amid the weak demand for flexible products. As for LCD panels, oversupply is anticipated despite an expected boon in TV sales in time with an upcoming major global soccer event.

Meanwhile, earnings for the Consumer Electronics Division are projected to improve due to increased shipments of new products such as QLED TVs and strong seasonal demand for air conditioners.

The overall business outlook for the second half regarding components is positive, as the company looks forward to increased sales of OLED panels.

Total capital expenditure in the first quarter was KRW 8.6 trillion including KRW 7.2 trillion for the Semiconductor Business and KRW 0.8 trillion for the Display Panel segment.

Samsung has not yet finalized its capex plan for 2018, but the company expects it to decline YoY. Capex rose substantially in 2017 due to efforts to respond to market growth and emerging technologies, which included expanding the production capacity for flexible OLED panels.

Display to Improve Production Efficiency

The Display Panel business posted KRW 7.54 trillion in consolidated revenue and KRW 0.41 trillion in operating profit for the quarter.

For the OLED business, QoQ earnings declined due to a slowdown in demand and intensified competition between rigid OLED and LTPS LCD panels.

For the LCD business, despite a decrease in shipments under weak seasonality and a continued decline in LCD panel ASPs, earnings remained flat QoQ thanks to cost reductions and an expansion in the sales portion of value-added LCD products, boosted particularly by UHD and large-sized panels.

Looking ahead to the second quarter, amid forecasts for weak demand for OLED panels, Samsung will strive to secure profitability by reducing costs and improving production efficiency. For LCD, under unfavorable supply-demand conditions due to capacity expansions in the industry, the company will focus on developing value-added and differentiated products as well as reducing costs.

For the second half, OLED panels in the smartphone industry are expected to see a rebound in demand, especially as demand for flexible panels remains strong in the high-end segment. Under these circumstances, Samsung will strengthen cost competitiveness and diversify its customer base through new products and technologies in order to increase market share. The company will also aim to secure new growth engines by applying its competencies in new applications on top of smartphones.

For LCD in the second half, while the company foresees market uncertainties due to growing competition and capacity expansions, Samsung will continue to strengthen its strategic partnerships with major business partners and differentiate its value-added products, including large-sized and high resolution TV panels.

Consumer Electronics to Focus on Premium Products

The Consumer Electronics Division posted KRW 9.74 trillion in consolidated revenue and KRW 0.28 trillion in operating profit for the quarter.

Overall, the TV market decreased QoQ due to slow seasonality following the year-end holiday, but grew YoY due to increased demand in emerging markets such as the CIS, the Middle East, and Latin America.

Although earnings were slightly down YoY, due to a restructuring of the sales mix with a defocus on the entry lineup, the company maintained its leading position in the premium TV market by continuing to achieve high market share in the USD 2,500 and above premium segment, thanks to expanded sales of flagship models, including QLED and ultra-large screen TVs.

Looking to the second quarter, TV market demand is projected to deliver YoY growth, driven mainly by demand momentum from the major global soccer event and growth in emerging markets. Samsung will aim to improve results by expanding sales of new models, particularly during the soccer competition. For 2018, the market is forecast to slightly grow. With the addition of the company’s launch of 8K and Micro LED TVs in the second half, Samsung will seek to solidify its premium leadership and focus on ensuring sustainable and profitable growth in the mid to long term.

|

|

(Source: Samsung Electronics) |

CN

TW

EN

CN

TW

EN