As the electric and hybrid vehicle industry surges forward and automotive intelligence accelerates, the smart cabin has emerged as a central battleground for automakers. Acting as the primary interface for human-vehicle interaction, in-car displays have become essential for elevating cabin intelligence, enhancing technological appeal, and delivering immersive driving experiences. These screens now serve as a benchmark for evaluating the modern smart cabin.

Today, automotive displays are integrated into dashboards, center consoles, rearview mirrors, head-up displays (HUDs), and rear-seat entertainment systems. With automakers exploring increasingly diverse display solutions, these screens are evolving towards larger dimensions, wider aspect ratios, multi-screen configurations, and more adaptable installations—all tailored to meet the growing demand for richer and more dynamic smart cabin interactions in vehicles.

Mini/Micro LED Drives Automotive Display Upgrades

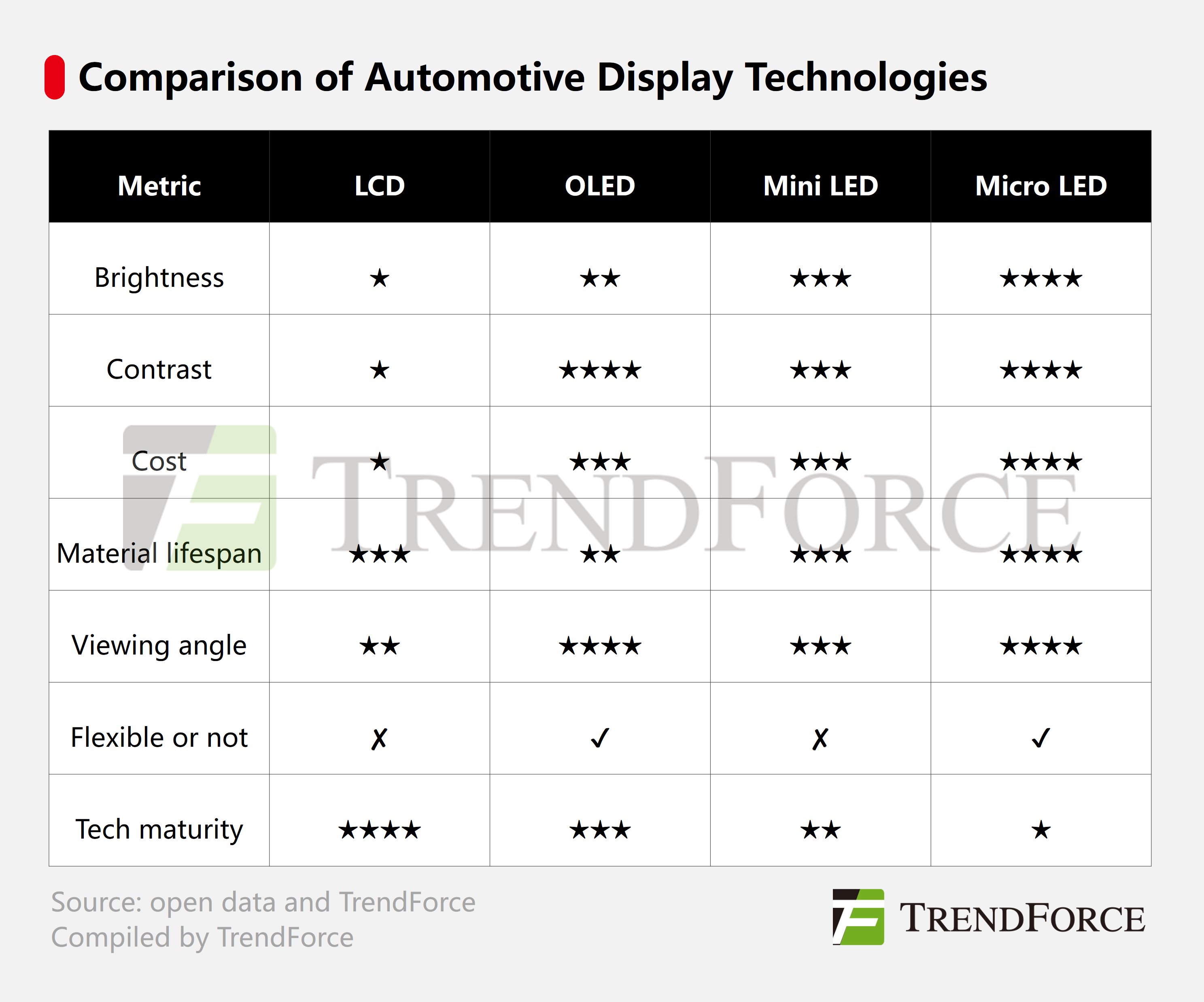

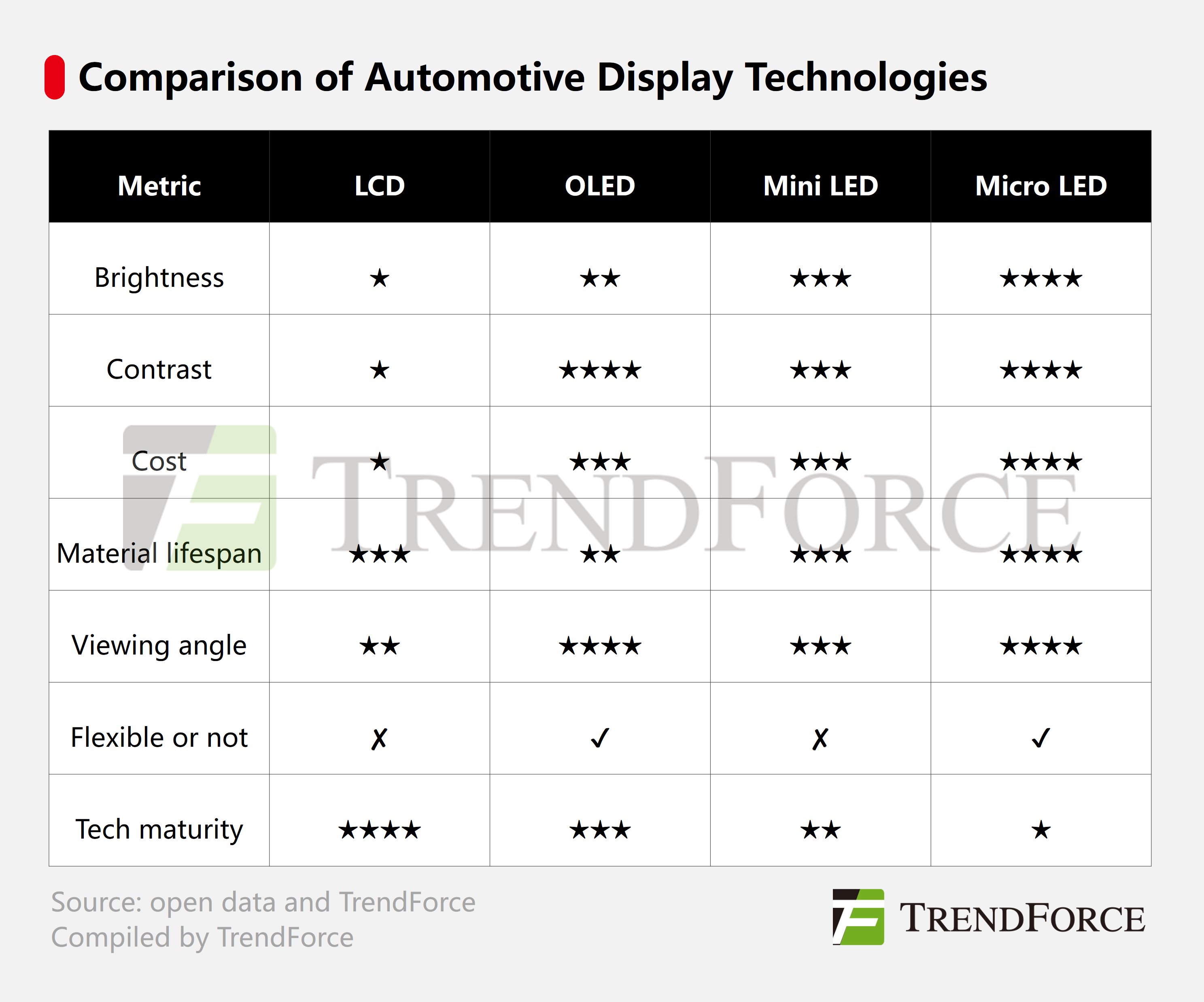

Currently, automotive display technologies mainly include LCD, OLED, Mini LED, and Micro LED. While LCD remains the dominant choice, as the automotive industry undergoes a transformation called “C.A.S.E (connected, autonomous, shared & service, and electric),” the demand for advanced display technologies continues to grow. OLED and Mini/Micro LED are gradually emerging in the automotive display sector, meeting the industry’s requirements for higher image quality.

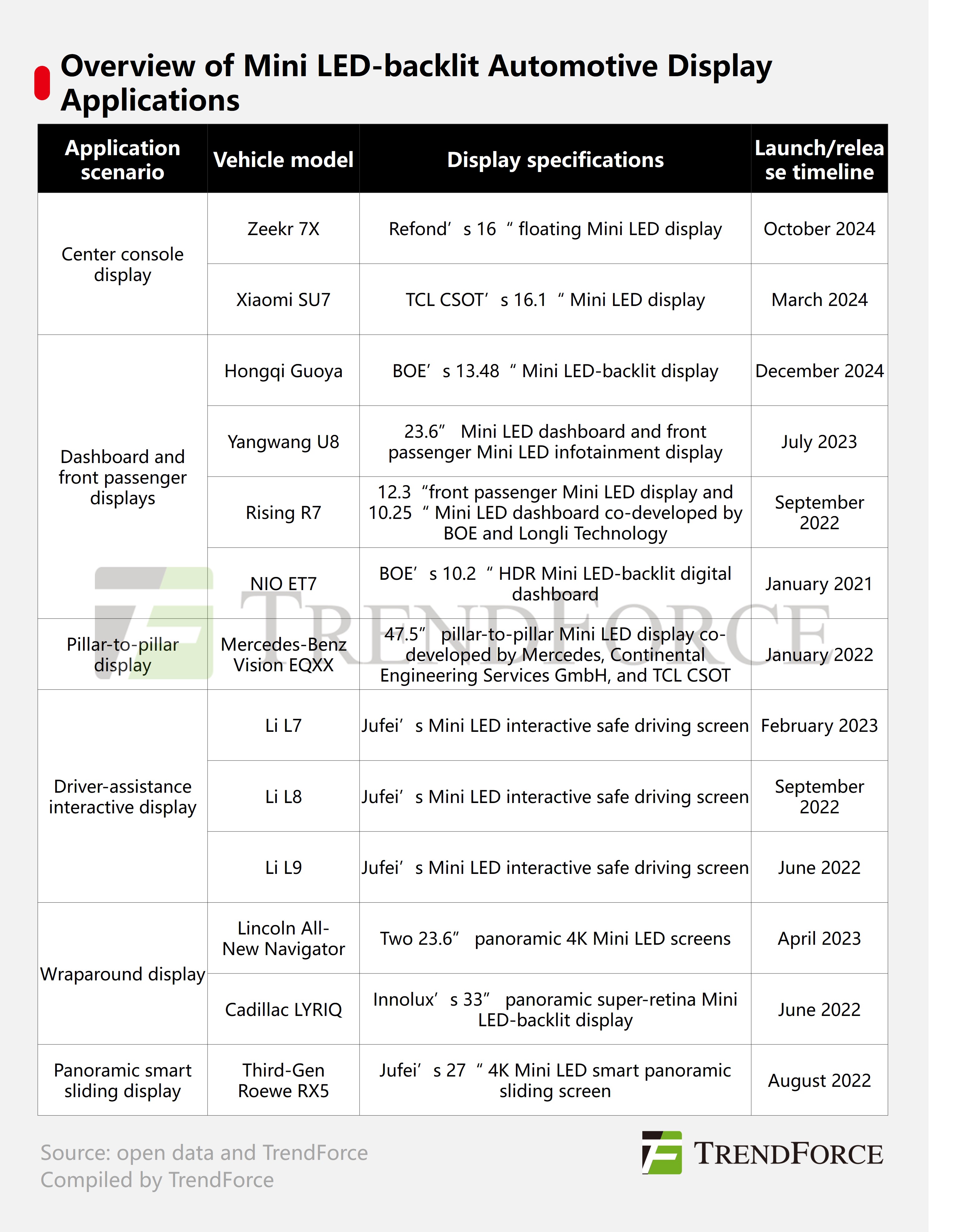

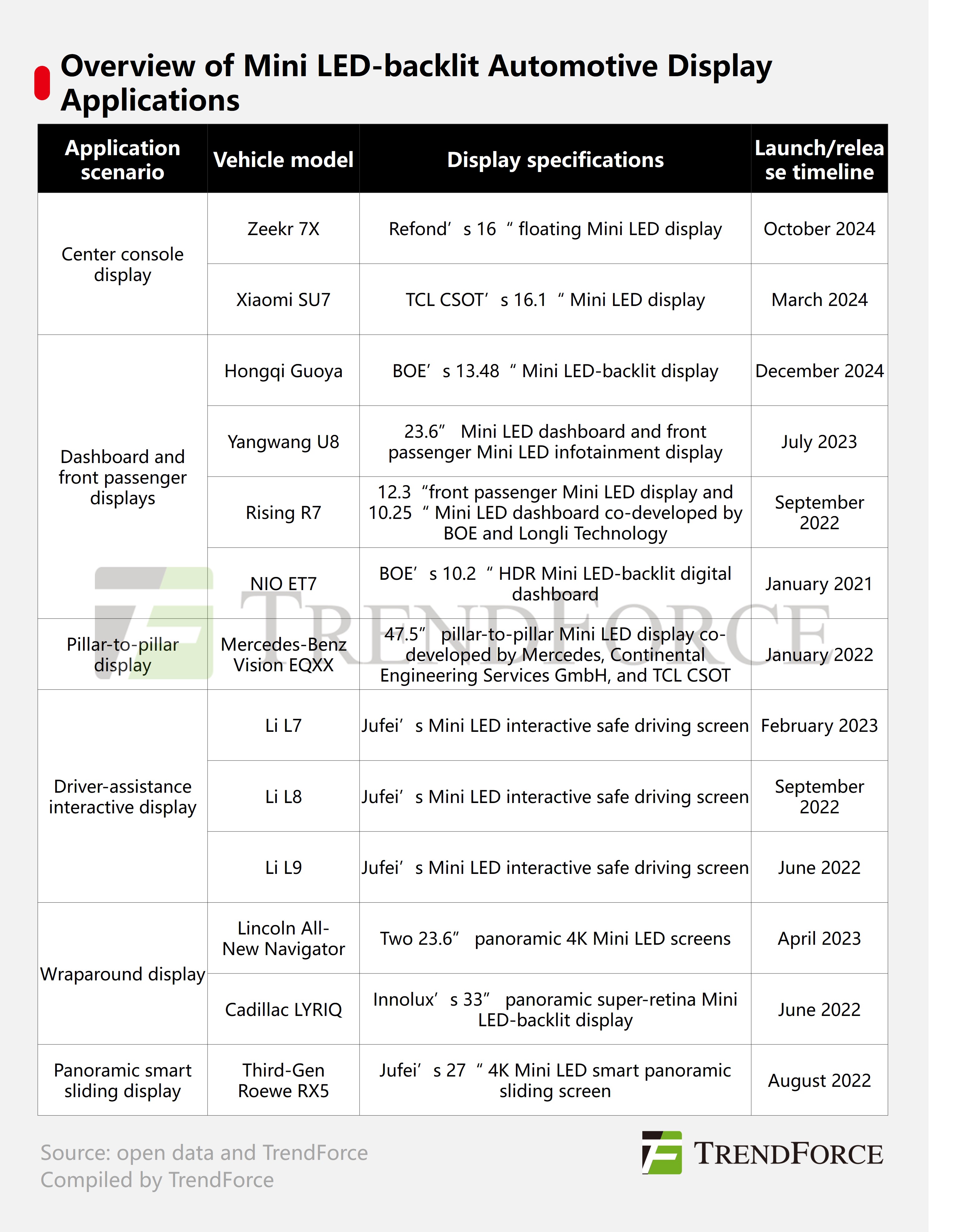

Mini LED technology, known for its high brightness, high contrast, and wide color gamut, has been adopted by numerous automakers for mass-produced models worldwide. Chinese brands such as Hongqi, Zeekr, Xiaomi, Yangwang, Rising Auto, NIO, Li Auto, and SAIC Roewe have already adopted the technology. International brands, including Mercedes-Benz, Lincoln, and Cadillac, have also integrated this technology to enhance the display performance of their premium models.

Mini LED backlighting is now being deployed across a variety of in-car interfaces, including center consoles, dashboards, passenger screens, pillar-to-pillar displays, driver-assistance screens, wraparound screens, and panoramic interactive smart sliding displays. Key supply chain players include LED providers Refond and Jufei, as well as panel giants TCL CSOT, BOE, and Innolux.

Mini LED backlighting offers higher contrast, increased brightness, and supports high dynamic range (HDR) displays. These features were showcased in the flagship "Guoya" series launched by Hongqi in November 2024, equipped with a 13.48-inch Mini LED-backlit display provided by BOE MLED. Additionally, the display module boasts long lifespan and strong vibration resistance.

The Hongqi Guoya equipped with a 13.48" Mini LED display (credit: Hongqi Auto)

Beyond enhancing display performance, Mini LED backlighting also meets the demand for thinner and lighter automotive display designs. The Zeekr 7X, launched in October 2024, features a 16-inch Mini LED floating screen utilizing Refond’s COB backlighting solution, delivering a lighter and sleeker display.

The Zeekr 7X equipped with a 16" floating Mini LED display (credit: Refond Optoelectronics)

Smart cabins are also seeing a premium boost with Mini LED backlighting. In March 2024, Xiaomi announced its SU7 sedan. The car is equipped with a TCL CSOT 16.1-inch Mini LED display featuring 3K resolution, ultra-slim bezels, and an expansive screen-to-body ratio. This display serves as the central hub for controlling driving modes, seat configurations, and cabin environments, enhancing the smart experience.

The Xiaomi SU7 equipped with a 16.1" Mini LED center console display (credit: Xiaomi)

According to TrendForce, while Mini LED backlight adoption in automotive displays remained relatively low in 2024, widespread recognition by automakers is expected to drive the penetration rate of Mini LED-backlit displays to 6% by 2028, with shipments reaching 15 million units—approximately ten times the volume of 2024.

As the demand for in-car displays increases, Mini LED has expanded its capabilities beyond backlighting. Mini LED RGB direct-view technology, with advantages such as high brightness, wide color gamut, high contrast, and low power consumption, is gaining traction in innovative automotive applications, including interactive displays and dynamic car logos.

In October, Changan Auto’s Qiyuan E07 launched global pre-sales, showcasing Jufei's Mini COB full-color interactive display—a milestone in commercial automotive display production. Previously, Jufei pioneered the industry's first exterior Mini COB direct-view interactive display, installed in Geely’s LEVC TX5.

The Changan Qiyuan E07 equipped with a Mini COB full-color smart interactive display (credit: Changan Qiyuan)

In contrast, Micro LED is still in its infancy in the automotive display sector, with no mass-produced models currently featuring the technology. Challenges such as lengthy automotive-grade validation cycles, technical hurdles, and high production costs have slowed its path to commercialization.

Despite these challenges, the outlook for Micro LED remains promising. According to TrendForce, Micro LED can be integrated with transparent displays and car windows and can be implemented in augmented reality HUDs (AR-HUDs) and panoramic HUDs (P-HUDs) to merge virtual and real-world information for drivers and passengers.

As technical bottlenecks are gradually overcome, the potential applications of Micro LEDs in automotive displays are expected to expand. TrendForce forecasts that by 2028, the global market value of Micro LED chips will reach $489 million. At that point, Micro LED technology will inject new vitality into the high-end automotive display market.

TrendForce 2024 Global Automotive LED Market- Lighting and Display Product Trend

Release Date:

1. PDF (180 Pages)- 30 June 2024

2. EXCEL- 30 June 2024 and 31 December 2024

Languages: Traditional Chinese / English

|

If you would like to know more details , please contact:

|