According to the latest “2013 Global Sapphire Substrate Market Report” published by the LEDinside, a research department of TrendForce, sapphire ingot manufacturers have been in the state of “the big gets bigger” such that first-tier manufacturers with cost competitiveness have accounted for 80% of market share.

The main reason is that the oversupply in sapphire substrate market has led to continuous price decline for the past two years, such that current prices of sapphire substrate for LED applications have been lower than the production costs of numerous manufacturers. Therefore, most second-tier manufacturers without cost competitiveness have stopped ingot production and began to purchase low cost ingots from first-tier manufacturers to be processed into sapphire substrates. So far only first-tier manufacturers with cost competitiveness have production expansion plans.

In addition to the supply for LED market applications, they also hope to explore business in non-LED application fields. Currently the top ten sapphire ingot manufacturers have accounted for 80% of total market share. Since sapphire ingot price has stayed at a low level, in the future only sapphire substrate manufacturers with cost management advantages, production capacities meeting the economy of scale, and stable sales channels can survive.

The sapphire substrate industry for LED application can be generally divided into three segments of ingot growth, cutting and grinding (CSS), and PSS. Currently there are many enterprises involved in this sapphire substrate industry with different business models. Some of them are based on ingot growth with downward extension to CSS or PSS, while others are focusing on their fields of specializations. Therefore, in general there are two business models: professional specialization and vertical integration. Each company have different core competences and target customers, which will eventually determine their positioning in the sapphire substrate industry.

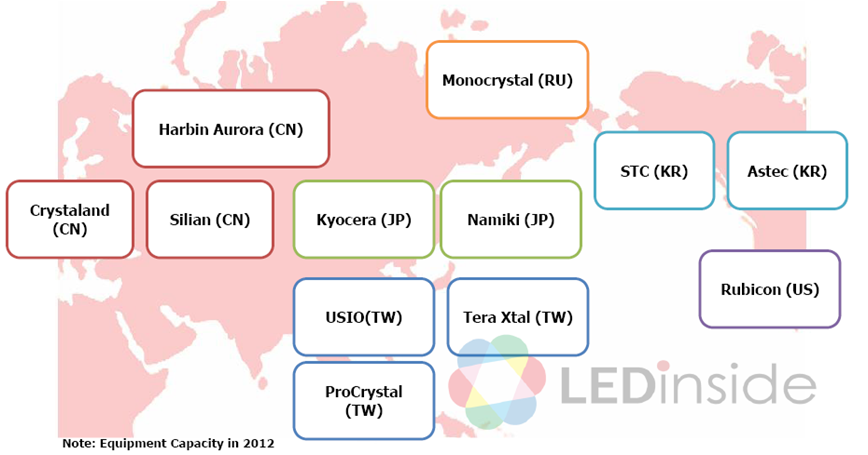

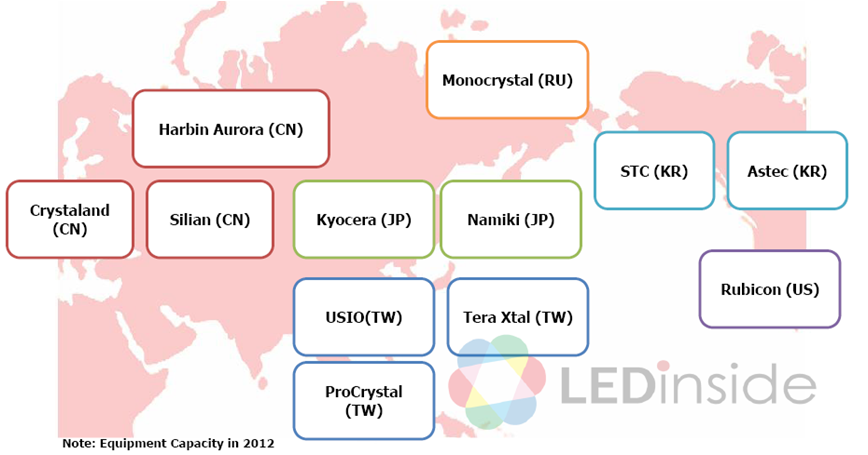

In early days the applications of sapphire substrate were mainly for aerospace industry such that they were mostly in Russia and US. With the emergence of LED applications, manufacturers in Japan, Korea, Taiwan, and China have begun to invest in this material field. In the next few years, the oversupply of sapphire substrate industry will remain difficult to solve with the prices dropping below the production costs of most manufacturers. This is why currently there are only several major manufacturers with cost competitiveness sticking to their mass production plans, leading to the situation of “the big gets bigger”.

Looking ahead to 2013, according to the investigation by LEDinside, those with ingot production expansion plans are mostly first-tier manufacturers such as Monocrystal, Rubicon, and STC. With the sales prices of sapphire ingots in LED market lower than the costs of most manufacturers, most second-tier manufacturers have stopped ingot production and began to purchase low cost ingots from first-tier manufacturers to be processed into sapphire substrates. So far only the first–tier manufacturers with cost competitiveness are still actively planning for production expansions. In addition to the supply for LED market applications, they also hope to explore business in non-LED application fields.

[Figure] Overview of production capacities of all sapphire ingot manufacturers

Source : LEDinside

Chapter One Overview of sapphire substrate industry

-

Section 1 History of Technology Development in Sapphire Substrate industry

-

Section 2 Sapphire Substrate Production Process Flow

-

Section 3 Investigation of Mainstream Sapphire Ingot Technology

Chapter Two Analysis of supply-side of global sapphire substrate industry

-

Section 1 Supply chain distribution of sapphire substrate industry – overview of vertical integration manufacturers, overview of professional specialization manufacturers

-

Section 2 Sapphire ingot manufacturers’ production capacities

-

Section 3 Sapphire Substrate manufacturers’ production capacities

-

Section 4 Patten Sapphire Substrate manufacturers’ production capacities

Highlight: industry category, TIE monthly production capacity, product dimension, major customer

Chapter Three Demand analysis of sapphire substrate industry

-

Section 1 MOCVD Installation Volume Forecast

-

Section 2 2011-2016 Worldwide LED Epi Wafer Production Volume Forecast

-

Section 3 CSS And PSS Supply Chain For LED Chip Manufacturers-Europe and the US, Japan, Korea, Taiwan, and China

-

Section 4 Major LED Chip Manufacturers Overview

Highlight:

-

Major Chip Manufacturer’s Wafer Size Development in 2013

-

CSS And PSS Supply Chain For LED Chip Manufacturers-Europe and the US, Japan, Korea, Taiwan, and China

-

Taiwanese Manufacturers – Business Income, Product Mix, Company Overview, Operating Status, Investment Status in China, Product Technology, SWOT Analysis, and MOCVD Installation Volume.

-

Chinese Manufacturers - Business Income, Product Mix, Company Overview, Operating Status, and MOCVD Installation Volume

Chapter Four Supply-Demand Analysis of Global Sapphire Substrate Market

-

Section 1 Sapphire Substrate Price And Pattern Sapphire Substrate Price

-

Section 2 Supply and Demand of Sapphire Substrate For LED Industry

-

Section 3 Market Value Of Sapphire Substrate and PSS

Highlight:

-

Sapphire Substrate Price (2” & 4” & 6”) And Pattern Sapphire Substrate Price (2” & 4”):

-

Sapphire Substrate Capacity And Shipment (LED & Non-LED) / URT Analysis

-

Sapphire Substrate Market Value And Pattern Sapphire Substrate Market Value / PSS Penetration Rate Analysis

Chapter Five Investigation of Supply Chain Related To Global Sapphire Substrate

-

Section 1 Overview of Raw Materials Of Sapphire Substrate

-

Section 2 Overview of Sapphire Crystal Growth Furnace

Chapter Six Investigation of Alternative Technology And Emerging Application Of Sapphire Substrate

-

Section 1 Investigation of Alternative Material of Sapphire Substrate

-

Section 2 Investigation of Emerging Application of Sapphire Substrate

-

Section 3 Sapphire Substrate Market Value For Non-LED Applications

Highlight:

-

Investigation of Alternative Material of Sapphire Substrate: GaN on GaN、GaN on Si

-

Sapphire Substrate Market Demand Forecast For Window Film And SoS Applications

-

Sapphire Substrate Market Demand Forecast For Smartphone Application

Published Date: June 30, 2013

Language: English

Format: Electronic File

Page: 161

LEDinside provide customized report and consulting service, please call or email to us.

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@trendforce.com