Spurred by LED lighting and mobile device market demands, sapphire substrate manufacturers have been actively expanding their production capacity, according to TrendForce subsidiary LEDinside’s “Global Sapphire Substrate Market 2013” research report. The top five sapphire ingot manufacturers for instance, have seen 2-inch equiv. sapphire substrate monthly production capacity grow by 75% to 7800Kmm compared to 2012.

LED industry development has been driven by LED lighting market’s high demands, especially for LED bulbs, LED tubes and MR16. To meet the above demands, major LED chip manufacturers still have expansion plans for 2013-2014, including Korean manufacturer Seoul Viosys, Taiwanese manufacturer Epistar, and Chinese manufacturers San’an Opto and HC Semitek. Major chip manufacturers are also continually raising 4-inch wafer production capacity, which has led to 40% production share in 2013, and is expected to reach 43% in 2014.

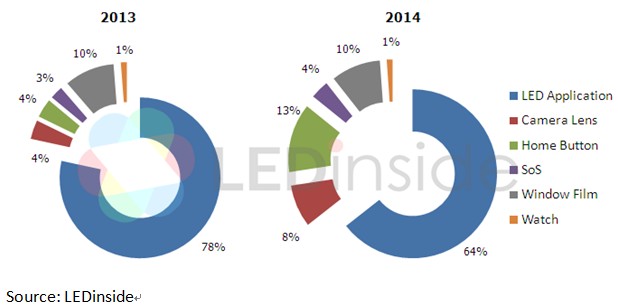

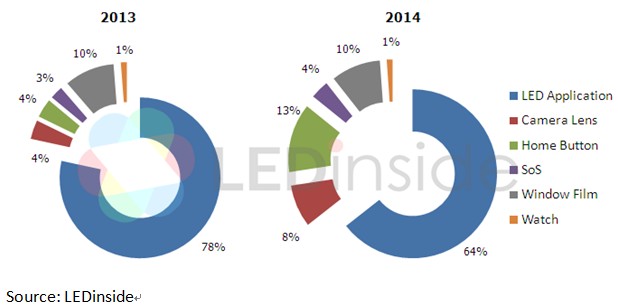

Handheld device applications have the strongest demands among non-LED application market demands. Since Apple introduced sapphire substrate material into the iPhone5 and iPhone 5S camera lens, and into the 5S home buttons with the entry of fingerprint identification feature. LG is also following this latest technology trend and introduced sapphire camera lens in its newest smartphone LG G2. This will hopefully drive other smartphone manufacturers to use this material. LEDinside estimates the non-LED market application market share will reach 36% in 2014, with handheld device application demands even reaching 31%.

[Chart] Sapphire Substrate Demand Market Share

LEDinside 2013 Global Sapphire Substrate Market Report

Chapter One Overview of sapphire substrate industry

Section 1 History of Technology Development in Sapphire Substrate industry

Section 2 Sapphire Substrate Production Process Flow

Section 3 Investigation of Mainstream Sapphire Ingot Technology

Chapter Two Analysis of supply-side of global sapphire substrate industry

Section 1 Supply chain distribution of sapphire substrate industry – overview of vertical integration manufacturers, overview of professional specialization manufacturers

Section 2 Sapphire ingot manufacturers’ production capacities

Section 3 Sapphire Substrate manufacturers’ production capacities

Section 4 Patten Sapphire Substrate manufacturers’ production capacities

Highlight: industry category, TIE monthly production capacity, product dimension, major customer

Chapter Three Demand analysis of sapphire substrate industry

-

MOCVD Installation Volume Forecast

-

2011-2016 Worldwide LED Epi Wafer Production Volume Forecast

-

CSS And PSS Supply Chain For LED Chip Manufacturers-Europe and the US, Japan, Korea, Taiwan, and China

-

Major LED Chip Manufacturers Overview

Highlight:

-

Major Chip Manufacturer’s Wafer Size Development in 2013

-

CSS And PSS Supply Chain For LED Chip Manufacturers-Europe and the US, Japan, Korea, Taiwan, and China

-

Taiwanese Manufacturers – Business Income, Product Mix, Company Overview, Operating Status, Investment Status in China, Product Technology, SWOT Analysis, and MOCVD Installation Volume.

-

Chinese Manufacturers - Business Income, Product Mix, Company Overview, Operating Status, and MOCVD Installation Volume

Chapter Four Supply-Demand Analysis of Global Sapphire Substrate Market

Section 1 Sapphire Substrate Price And Pattern Sapphire Substrate Price

Section 2 Supply and Demand of Sapphire Substrate For LED Industry

Section 3 Market Value Of Sapphire Substrate and PSS

Highlight:

-

Sapphire Substrate Price (2” & 4” & 6”) And Pattern Sapphire Substrate Price (2” & 4”):

-

Sapphire Substrate Capacity And Shipment (LED & Non-LED) / URT Analysis

-

Sapphire Substrate Market Value And Pattern Sapphire Substrate Market Value / PSS Penetration Rate Analysis

Chapter Five Investigation of Supply Chain Related To Global Sapphire Substrate

Section 1 Overview of Raw Materials Of Sapphire Substrate

Section 2 Overview of Sapphire Crystal Growth Furnace

Chapter Six Investigation of Alternative Technology And Emerging Application Of Sapphire Substrate

Section 1 Investigation of Alternative Material of Sapphire Substrate

Section 2 Investigation of Emerging Application of Sapphire Substrate

Section 3 Sapphire Substrate Market Value For Non-LED Applications

Highlight:

-

Investigation of Alternative Material of Sapphire Substrate: GaN on GaN、GaN on Si

-

Sapphire Substrate Market Demand Forecast For Window Film And SoS Applications

-

Sapphire Substrate Market Demand Forecast For Smartphone Application

Published Date: October 10, 2013

Language: English

Format: Electronic File

Page: 165

If you would like to know more details , please click here or contact :

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

Terrence Lin (Taipei)

TerrenceLin@trendforce.com

+886-2-7702-6888 ext. 655 |

|

|

|

Sara Fan (ShenZhen)

sarafan@sz.dramexchange.com

+86-755-8283-8931 |

Allen Li (Shanghai)

AllenLi@trendforce.com

+86-21-6439-9830 ext. 608 |