LED EPI wafer and chip manufacturer Genesis Photonics Inc. (GPI) Chairman David Chung upheld a positive outlook for the flip chip industry at a company shareholders meeting on June 18, 2014.

“The year of the flip chip is 2014,” said Chung at the meeting. “Our company will be raising flip chip production proportion to around 20 percent to 25 percent, which will in turn increase our gross profit margin. The company’s profitability will also obviously increase.”

As LED lighting becomes increasingly popular, prices throughout the supply chain have dropped, even for more profitable upstream manufacturers. Although, there were market rumors of price upticks, most were misinformation. Industry insiders in general believe, LED chip prices will not grow for a very long period. LED chip manufacturers’ common goal will be advancing manufacturing technology by making smaller chips to acquire higher profit margins. In recent years, flip chip’s features and cost advantages has attracted many LED and lighting manufacturers.

GPI was one of the earliest manufacturers to enter LED EPI wafer and chip industry. The company first released flip chip technology at the 2012 Guangzhou International Lighting Exhibition (GILE) and made related patent applications. The company has continued to release new flip chip products and are promoting these on the market. Based on sales situation during 2Q of 2014, flip chip LED product series revenue share has grown exponentially from single digits in 2013 to 15 percent in 2014, and is expected to grow in the near future.

Arrival of flip chip year

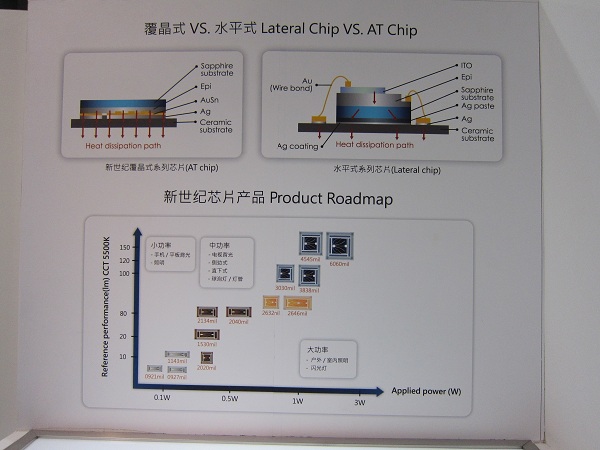

Flip chip LED has five major advantages: 1) Electrodes on the flip chip directly contact the ceramic substrate, and omits the need for sapphire substrate used in heat dissipation. Therefore, the chip can be driven by high current. 2) Optical design is made easier, but flip chip sizes are smaller. 3) Improvements in heat dissipation, which in turn extends chip lifetime. 4) The wire-bonding free (without wire-bond) flip chip can reduce defect risks during packaging and operations. 5) Flip chip has laid the foundation for future packaging developments.

Many LED chip manufacturers in recent years are focused on developing related products because of the many advantages flip chips have over traditional wire bonding chips. Early flip chip LED product developers include Philips Lumileds and Cree. GPI has also been strongly promoting the technology, while other manufacturers have kept a relatively low key in this field.

But things started to change in 2014. Manufacturers that previously “froze” flip chip LED technology and put it on the backburner are now actively developing related products in 2014. Lextar’s flip chip products include the newly released flip chip COB and White Chip. Epistar and Lighting Optotechnology’s latest products have also introduced Flip Chip Bonding (FCB) technology.

Flip chip’s important status was emphasized by industry expert Guoqing Tang, General Manager and Sr. Vice President, Samsung LED China. “Flip chip will be a major trend in 2014,” said Tang at international LEDforum Guangzhou 2014 at GILE this year. One of Samsung’s clients even insisted on using flip chip LEDs, and abandoning all other types LEDs, added Tang.

Flip chip LED has an opportunity to be applied in large volumes into LED-backlight LCD TV, analyzed Roger Chu, Chief Analyst and Research Director of LEDinside. As more manufacturers invest in flip chip LED technology is gradually forming an economies of scale, which can further lower costs. The flip chip LED market has an opportunity to soar from US $1.5 billion in 2013 to US $5.5 billion in 2017, estimated Chu.

|

|

GPI Chairman David Chung (right), and the company’s President & CEO Mark Chen (left). (LEDinside) |

“The flip chip market this year has improved a lot, and this can be seen from the 2014 lighting shows,” said GPI’s President & CEO Mark Chen. “Many manufacturers have released related concept products, and this also explains GPI’s leading advantage in promoting flip chip technology.” The company acquired certain U.S. flip chip patents after years of dedication in the field, said Chen. The company has developed flip chip LED products ranging from small to large sizes, including AT CHIP product series AT2020, AT2040, AT3838, AT4545, and AT5555.GPI is an innovator and leader with its comprehensive flip chip LED product portfolio.

GPI’s flip chip component “MATCH LED” was launched in 2013. After that, the representative MA3-3 from the product line passed a third party LM80 test (reaching 6,000 hours of luminous maintenance) in 2014, with the condition of increased current to 700mA, and self-imposed stringent high temperature standards of 105 degrees C. As a result, the component has been successfully introduced in many high reliability-demanded applications such as outdoor lighting products.

“MATCH LED has mainly be sold in the Chinese market, and MATCH LED inside luminaires products have been sold globally,” said Chen. “MATCH LED revenue share currently is about 5 to 8 percent of the company’s total revenue.” To concentrate R&D resources, MATCH LED in the future will be categorized into a few major divisions especially for outdoor lightings, commercial COB light sources, automotive lighting and other application fields, explained Chen. The company will be releasing a few representative products for each application field.

Worth noting is flip chip LED products currently released by LED manufacturers require eutectic bonding in backend chip processing stages. However, investments in a single eutectic bonding equipment can go up to nearly US $0.33 million, and is unaffordable for many traditional LED package manufacturers. “Our latest flip chip product AT CHIP optimizes chip design, so manufacturers can use traditional soldering equipment to carry out packaging,” said Chen. The new technology will allow GPI and package manufacturers to cooperate closely.

“There are already very good flip chip applications in the TV backlight and mobile flash light market, and the general lighting market also holds huge future market potential,” said Chen. Currently, half of GPI’s revenue comes from LED backlight, and the other half from lighting.

In the future, GPI will not be increasing the proportion of backlight products, and the company’s major growth momentum will be relying on flip chip LEDs in the lighting market, said Chen. The company has not expanded production capacity for two years, but has set new revenue records. “This is mainly because of the product portfolio, in which we have adjusted the product mix and enhanced pricing flexibility over the last two years,” explained Chen. “Increase in revenue has mainly come from raising manufacturing volume for higher-gross-profit products.”

The company’s flip chip LED technology is being introduced into outdoor lighting, commercial COB light sources, automotive lighting and other applications, Chen further explained. Next generation lighting component products will be made into “white chips.” “In other words, once our LED chip factory completes white chip manufacturing, it can be directly made into a wafer-level packaging component,” continued Chen.

|

|

Comparison between flip chip and traditional LED chip. (LEDinside) |

Small size, high lumens trends in LED chip industry

Designs of LED chip and package types vary on the market. Chen believes “high current density under high current input/drive, high lumens output from small sizes,” will become a definite LED chip development trend in the future.

Chen’s observations are mirrored by market technology developments shifting towards smaller LED chips, higher driving currents, higher luminous flux and other features. GPI has also lead this strategic development.

“Earlier on our over-drive technology was only applied in our flip chip products AT CHIP,” noted Chen. “We have now applied the technology onto our Great Performance lateral chips, named GP CHIP in 2014.”Over-Drive-Ready technology enables chips to endure high current input, and has been applied in the company’s lateral chips and flip chips. This enabled these products to achieve same level of luminous efficacy at smaller sizes, or higher luminous efficacy for same sized products.

Since lateral chip have achieved Over-Drive-Ready Technology, all GP CHIP clients that turned up at GILE 2014 have been able to reap benefits. Especially, GP-M series 2632, 2134 and 2020 chips have been welcomed by COB package clients. “The 2632, 2134 product has been popular among COB package clients, as well as PCT and EMC package clients,” said Chen. “We are confident of over 20 percent growth of new clients.”

(Author: Sophie Liu, Editor, LEDinside Chinahttp://Translator: Judy Lin, Chief Editor, LEDinside)

CN

TW

EN

CN

TW

EN