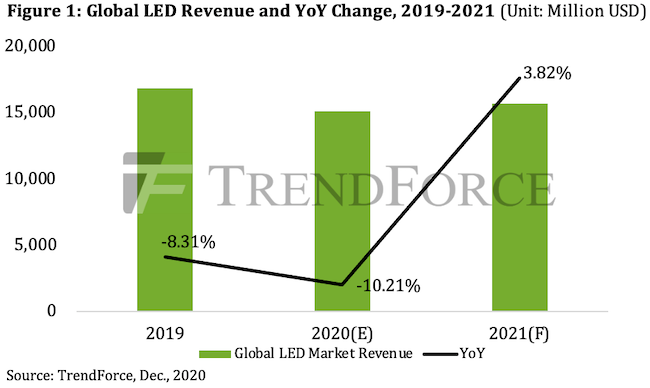

The COVID-19 pandemic has had a substantial impact on the LED industry in 2020, resulting in a considerable drop in market demand and a projected yearly revenue of merely US$15.127 billion, a 10% decrease YoY, according to TrendForce’s latest investigations. Although the YoY decline in 2020 represents a magnitude of historic proportions, as COVID vaccines become more widely available in 2021, long-term pent-up market demand will likely rebound from rock-bottom levels, resulting in a forecasted yearly revenue of $15.7 billion for the global LED industry next year, a 3.8% increase YoY.

TrendForce indicates that, due to the wide variety of LED applications, the degree of recovery in each application-specific industry varies as well. With regards to traditional backlighting applications, demand for consumer electronics, such as tablets and notebook computers, has skyrocketed on the back of the “new normal” brought about by the pandemic, which involves the proliferation of WFH and distance education. Given the resultant high demand for display panels, LED backlighting suppliers have seen remarkable performances across the board this year. However, in light of the possibility that most consumers have already purchased the needed electronics products ahead of time in 2020, TrendForce therefore holds a conservative attitude towards whether the strong market demand in 2020 will persist in 2021.

On the other hand, with regards to the long-anticipated Mini LED backlights, various new products are expected to be released in 2021, spearheaded by major brands including Apple and Samsung. As such, Mini LED backlighting demand will see a substantial growth, with a forecasted $131 million in yearly revenue for 2021, a 900% YoY increase.

With regards to display applications, LED displays are primarily used within the commercial space. Similar to general lighting applications, the cutbacks in live performances this year caused a corresponding 9.3% YoY decrease in LED display revenue. However, looking ahead to 2021, TrendForce expects LED display revenue to return to the pre-pandemic level of about $1.48 billion due to the gradual recovery of live performances and the rising demand for high-resolution, small-pixel-pitch LED displays.

With regards to general-use lighting, LED lighting applications have suffered massive declines due to the pandemic’s impacts. As commercial activities dwindled this year, the declines in commercial lighting and outdoor landscape lighting have been the most noticeable among various LED lighting applications. Conversely, the gradual legalization of marijuana and the pandemic-generated skyrocketing market for medical and recreational marijuana in North America have galvanized a substantial increase in horticultural LED demand. Furthermore, the pandemic has also gradually affected the food supply chain, in turn leading to a resurging CAPEX for indoor agricultural infrastructure. As a result, certain LED lighting applications will see recovery in 2021. Finally, with regards to automotive lighting, the decline in auto sales in 2020 has also stagnated the automotive lighting market. Automotive LED lighting revenue is expected to return to the level of $2.6 billion as the pandemic slows down in 2021.

Gold+ Member Report

-

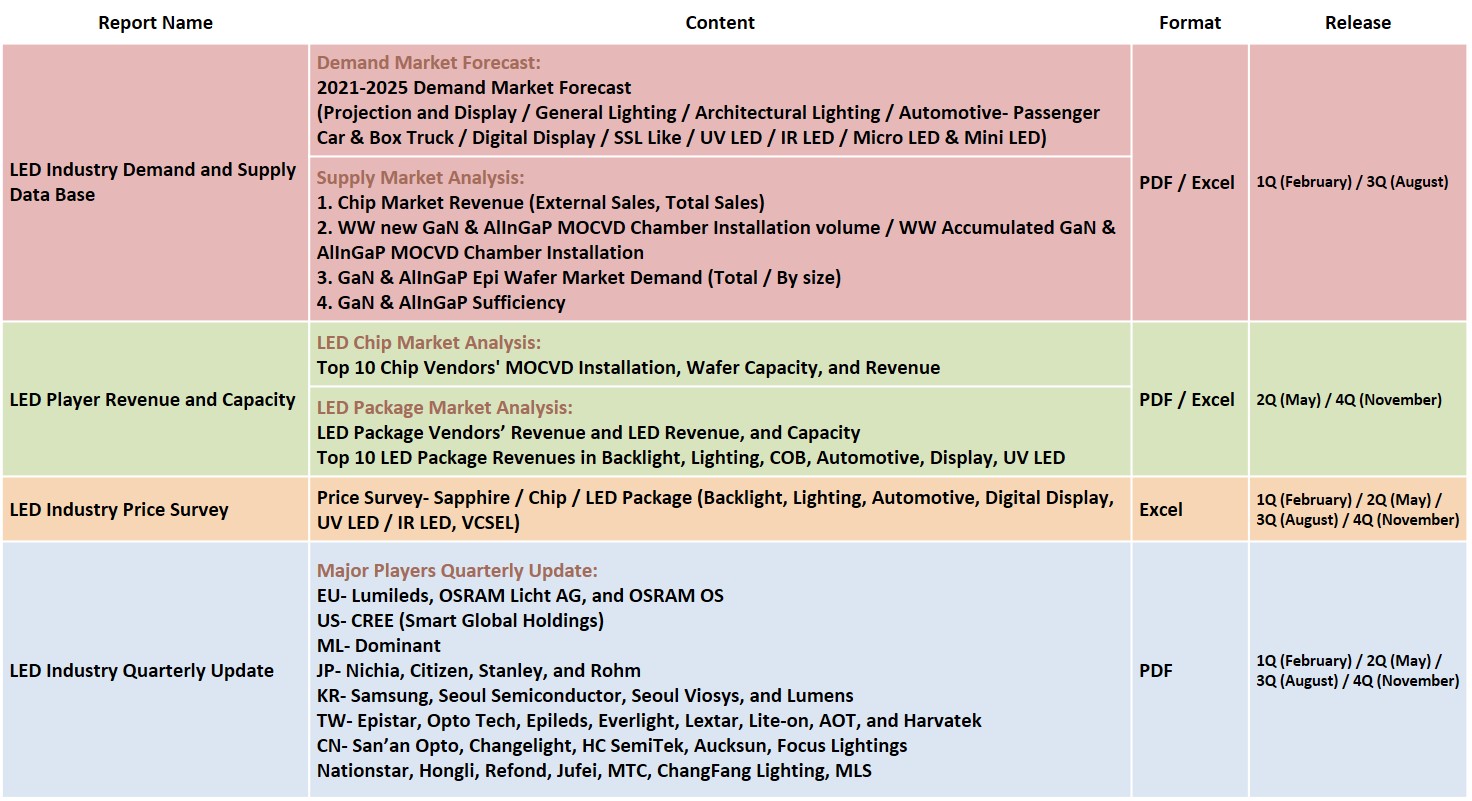

LED Industry Demand and Supply Data Base- Backlight / General Lighting / Architectural Lighting / Automotive Lighting / Digital Display / Projection & Horticultural Lighting / UV LED / IR LED / μLED Mini LED Applications

-

LED Player Revenue and Capacity- Chip Market and Player Capacity & Revenue / Package Market and Player Capacity & Revenue / LED Player Revenue Ranking in Each Application

-

LED Industry Price Survey- Sapphire / Chip / LED Package (Backlight / Lighting / Automotive / Digital Display / UV LED / IR LED)

-

LED Industry Quarterly Update- Major LED Player Quarterly Update (EU, US, Japan, Korea, Taiwan, China)

|

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|