Allen Yu, LEDinside analyst in Shenzhen talks about Chinese LED display manufacturers shift into the media sector in this article. Yu gives insights about the pros and cons for manufacturers transiting into the media sector.

|

|

Allen Yu, LEDinside Analyst in China. (LEDinside) |

AAfter a decade of development, the LED display industry is entering a phase of large scale restructure. In July 2013, Shenzhen Everlight Technology Co. became insolvent after reports revealed the company owed suppliers RMB millions. Another company Shenzhen Ten-Lighting Technology Co. also declared bankruptcy the following month after it maliciously defrauded suppliers RMB 80 million (US$ 13.13 million) and delayed salary payments to 220 employees for two months. By September Shenzhen Barck Technology Co. was mortgaged because of bad management. The industries restructure dates back to 2011, when Shenzhen Junduoli Industrial Co. and Shenzhen Bright Optoelectronics Science and Technology Co. announced insolvency and exited the market. By the end of 2012, ShenZhen Sinolight Optoelectronics Co., Topvision, HiboLED and Dongguan Jia Hao Optoelectronics Technology Co. all joined the wave of bankruptcy. This indicates the ongoing restructure of the LED display market.

Arrival of acquisition age amidst bankruptcy wave

From July-Sept., 2013, three merges occurred in the LED display industry including Jiangmen Keheng Industry Co. acquisition of 51 percent of Linkupper stock; Furi Electronics purchase of 93 percent of Shenzhen MR Photoelectricity Co. stocks (MR Photoelectricity); Hong Kong listed company Seamless Green China procurement of 51 percent of Shenzhen San Shen Gao Enterprises Co. stock. The bad market condition is causing the industry to enter over competition. Continual decline in industry profitability has led to the use of poor quality materials to guarantee profitability, which has in turn led to product quality issues. As a result, companies are unable to collect product revenue which has led to growing accounts receivable. The market demand is also lower than production capacity growth, which has led to rising company inventory. Cash flow risks mainly caused by lowered profitability, and increasing accounts receivable and inventory are contributing to a new wave of acquisitions.

Table 1: Lienteng Optoelectronic recent revenue situation

Source: Public information organized by LEDinside.

Lienteng Technology’s 2010 revenue reached RMB 45.48 million and operating profit was RMB 2.14 million. In 2011, the company’s revenue soared 129% compared to the previous year to RMB 104 million. However, operating profits was only up five percent to RMB 2.24 million, while gross profit declined 10 percent. By 2012, the company began to lose money with decreased net profit of RMB 16 million. The company losses continued throughout Jan.-May, 2013.

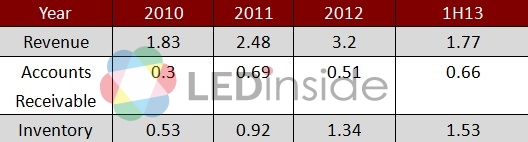

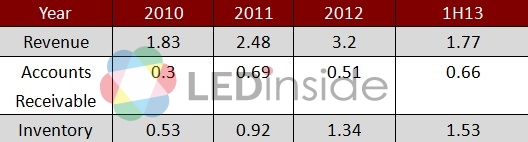

Table 2: MR Photoelectricity Co. financial performance in recent years (Unit: RMB 100 million)

Source: public information organized by LEDinside

In the first half of 2013, MR Photoelectricity’s revenue reached RMB 177 million, accounts receivable was about RMB 66 million and its inventory valued RMB 153 million. The high inventory levels took up most of the operating cash flow. In addition, as LED display features improve and prices fall, overtly high inventory levels contribute to higher depreciation risks. Rising accounts receivable is also aggravating the company’s cash flow tension situation.

Close observations of the 2011 LED bankruptcy wave reveal most companies shutdown due to disrupted capital flow. The cruel market condition has caused small-mid sized enterprises (SME) to use low pricing strategy to enter the market, or abnormally use goods on credit methods to expand product volume. All these factors will add onto the company’s operation risks.

Increasingly polarized developments, industry focuses on improvements

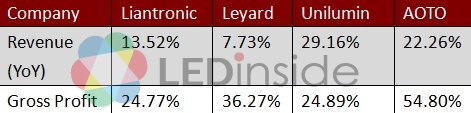

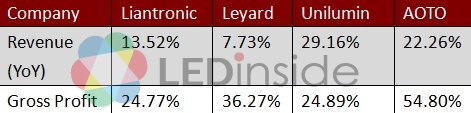

Although, 1H13 was marked by the wave of LED display SMEs bankruptcy and acquisitions, listed company financial performance continued to grow. Unilumin revenue from 1H13 grew nearly 30 percent, while Shenzhen AOTO net profit soared 54.8 percent. Large LED display component manufacturers targeting big manufacturers’ revenue continued to grow in 2013, such as Foshan Nationstar Optoelectronics Co. (Nationstar), Shenzhen Kinglight Optoelectronics Co. (Kinglight), and Shenzhen Lanke Electronics Co. (Lanke Electronics). Kinglight production capacity has reached 1,300 KK/month and has continued expanding its production.

In reality, on average upstream LED display chip suppliers’ sales performance dropped, such as HC Semitek Corp. and Hangzhou Silan Azuire Co. Although, the overall LED display market demands continued to grow, the total value has decreased due to lowered product prices. The industry/s current condition is either experiencing incremental growth or stagnant. Large manufacturers ability to maintain high profitability and sales growth under these market conditions proves the industry is becoming increasingly concentrated.

Table 3: Major LED display manufacturers profit situation in 1H13

Source: public information organized by LEDinside.

Post LED Display Era: Is media advertisment sector the next frontier?

In the face of faster LED display industry restructure, companies are starting to consider changing their LED supply chain business model to either horizontal or vertical integration to seek out new business opportunities. A classical horizontal supply chain transition example is Unilumin’s shift into LED lighting. In 1H13, the company’s LED lighting application revenue reached RMB 46.99 million. In addition, LED display manufacturers including Ledman Optoelectronics Co. and MR Photoelectricity have launched LED lighting products. However, LED lighting industry also faces intense competition, and huge investments are required during the initial phase to build company brand and distribution channels. LED display manufacturers do not have many competition advantages in the lighting field.

There are no advantages in horizontal integration developments. Vertical integration developments include media advertisement or new markets. In the media advertisement sector, companies with the large market shares include Phoenix Publishing and Media Inc., Tulip Media, Media AD Vision, and Focus Media Holding Inc. Although, the advertisement market is increasingly focused and entering a phase of gradual growth, the four large media companies do not have particularly large market shares. This provides potential opportunities for LED display manufacturers.

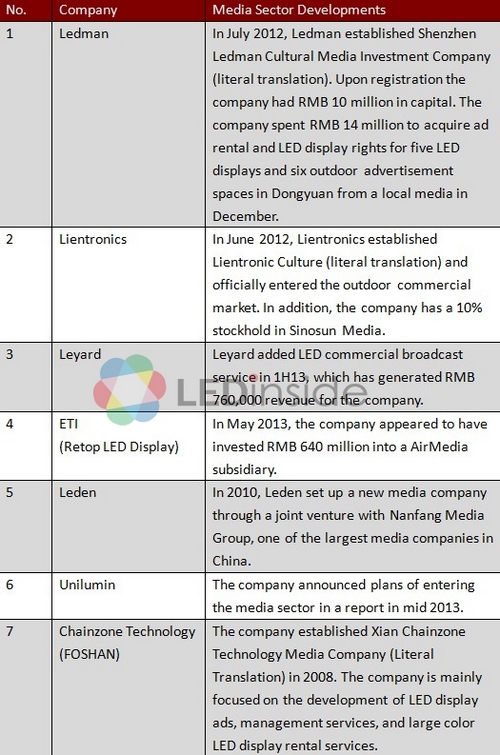

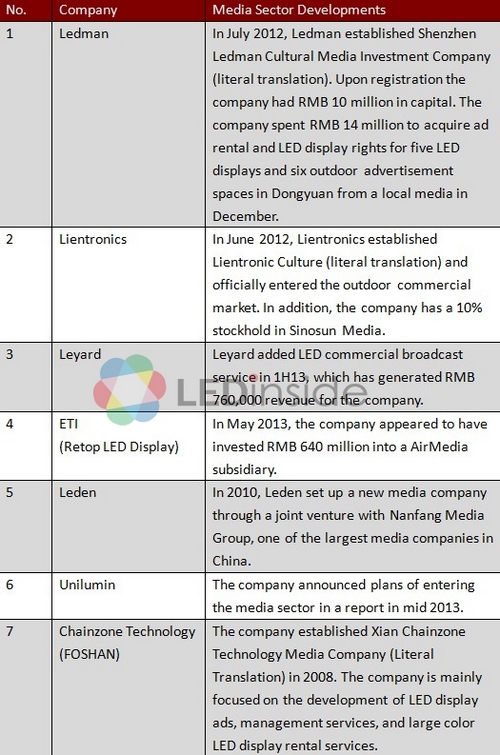

Moreover, prices have been forced down as media company expansions have led to tighter capital, and over competitiveness in the LED display industry. Many LED display manufacturers and media companies have no choice but to cooperate. LED manufacturers will usually invest in display production first, before using revenue from ads to compensate display costs or media companies will sell advertisement time to LED display manufacturers. These partnership models have transferred cost risks to LED display manufacturers. Therefore, LED display manufacturers might as well set up their own media company and manage their own media services. In fact, some Chinese LED display manufacturers have begun to take this path including Shenzhen Liantronics Co., Leyard, Elec-Tech International Co. (ETI), Ledman and Unilumin.

Table 4: Chinese LED display manufacturers that have already entered media sector

Source: Organized by LEDinside

LED outdoor display advertisement are very effective, but have limited coverage. Traditional media companies need to undergo industry integration, due to ad clients strong nationwide “simultaneous broadcast” demands. Conventional media have underwent industry integration including direct acquisition and agent models, but these require huge capital investments and are difficult to maintain in later phases. For instance, Focus Media Holding is trying to replicate the successful case of hallway advertisements, but due to finance pressure the progress of the whole plan has been average. While “DIY display models” display manufacturers can solve the above issues, and is a major advantage for LED display manufacturers entering the media market. In addition, media service profits are much higher than the display itself. LED display commercial broadcast prices are expected to increase at a rate of 5 to 10 percent per year, according to estimations by Guotai Junan Securities.

Liantronics transition into the media industry

The most typical case of LED display manufacturer turning to media industry has been Liantronics. The company announced in May 2012 that it will be using Shenzhen Liantronic Cultural Investment Co. (literal translation) as a platform to invest and establish Liantronic Cultural Inc. (literal translation). It appears that the company plans to use part of Liantronic advertisement and media clients to acquire 10 to 30 percent of LED display advertisement time in major Chinese cities to build a simultaneous outdoor LED display broadcasting network; and benefit from selling advertisement periods. One of Liantronic Cultural partners that have gained most attention has been Liang Qinjiang, the current China Advertisement Association Executive Director. Considering Liang’s position and influence, Liantronic might be able to try out the emerging LED display market.

Table 5: Liantronic and Phoenix Metropolis Media Display Distribution

Source: Liantronic website

Liantronic announced in mid 2013, that the company has already acquired the operation rights of 72 LED display locations, which is lower than the company’s original plan. However, the company has entered the top three spot for Chinese LED display advertisement operation. Currently there are two types of partnership models: the cooperating company buys display construction sites from Liantronic, and Liantronic Culture buys from the commercial client advertisement period at the cost price. Another model has been Liantronic Culture invests in the display, and the partner helps find a location. Liantronic Culture then takes a part of commercial time. In the two models, the partner covers electricity and venue rental costs, while Liantronic is responsible for the display’s maintenance and after sales services. The business is currently being managed by Liantronic’s chairman, and its sales team and sales strategy has gradually matured.

In addition, the company has proposed a “1,000 display cooperation plan”, which aims to establish 1,000 outdoor LED displays in 300 cities in China. This will become the company’s new business highlight and growth drive. However, there are still risks involved in the company’s expansion into the outdoor advertisement media. When cooperating with media companies, in general most media will not change advertisements in good locations, and are more inclined to swap commercial ads in remote areas. If these sites have low profitability than initial investments cannot be recovered. Liantronic’s advantages lies in it has been a leader in China’s LED display industry, and has through understanding of downstream advertisement media and management. By exploring second and third tier cities commercial ad markets and combining Liantronic Culture’s advantages, the company is likely to succeed in its transition into the field of outdoor LED display media.

In the face of intense industry competition, restructure of the LED display industry is inevitable and increasingly faster. In the short term, LED display industry still faces cutthroat market competition hence LED display manufacturers must search for new profit markets. The advertisement media field might be a new market for LED display manufacturers.