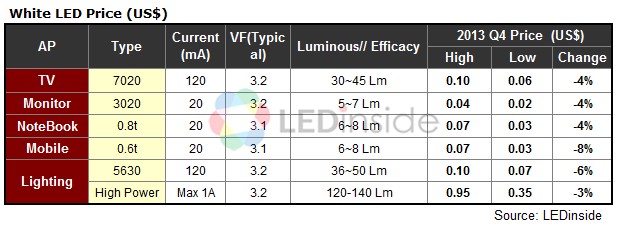

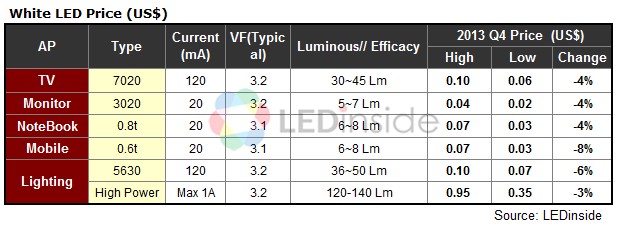

Although, mid and large sized LED backlight market was affected by the economic downturn, LED prices for backlight applications overall declined stably at 3-6% in 4Q13, according to LEDinside’s 4Q13 LED price trend report. LED prices for lighting applications also maintained a slow downward slide. The extent of price falls varied among different product specs.

TV backlight market eases, but price quotes remain relatively stable

Annual TV shipment volume was lowered to 203 million sets in 2013 with Year-On-Year (YOY) -1.6%, said LEDinside. This is the first time in recent years that TV shipment volumes have experienced negative growth. However, LED for backlight applications 4Q13 price quotes remained stable, with a range of decline between 3-6%.

Worth noting, LED for TV backlight has begun integrating specs including 7030 LED for edge- type LED TV; 7020 LED for ultra-slim bezel type LED TV; for direct-type LED TV applications the 3528 LED plus 3030 and 3535 LEDs that have recently sold well in China. LEDinside pointed out, while LED packager manufacturers cannot avoid the continual LED price slides, manufacturers production can reach economies of scale and optimize cost control and luminous efficacy as LED specs are simplified and integrated. LED package manufacturers no longer need to launch brand new specs annually.

Weak smartphone Christmas orders cause LEDs for smartphones to fall 6-8% in 4Q13

Mid and large sized backlight market is not the only anemic market. Smartphone shipments have been lower than expected in 3Q13, and 4Q13 Christmas order pull also appeared rather weak. In 4Q13, global smartphone shipment volume reached 7% Quarter-on- Quarter (QOQ) to about 260 million. LED prices for smartphone applications dropped 6-8% in 4Q13. In the field of current smartphone, tablet, and laptop specs, the major package has been 0.6t LED with brightness between 6-8 lumens (lm). This is due to smartphones aggressive replacement of feature phones and continual growth in Chinese white-box smartphone shipment volumes. Tablets and laptops have started to replace 3014 package specs with 0.6t LED. On the other hand, ultrabook brands have also begun introducing low voltage and high brightness 0.6t LED.

LED lighting prices fall at different rates

In the lighting segment, many package manufacturers were able to keep price levels or experienced only slight price declines for mid and high power products in 4Q13. Price fluctuations were considerably limited this quarter for high-power LEDs. The rate of price falls has slowed since top brands including Philips Lumileds, Osram and others still rely on loyal customers to maintain market share and order visibility. , Fewer manufacturers have lowered prices for new products. On the other hand, the market is increasing its emphasis on 1W 3030 spec products. As a result, LED manufacturers have released similar products specs, and price drops have exceeded 10%. As for mid-power 5630 LED product prices, impact from manufacturers release of second generation products has led to slowly declined.

4Q13 Silver+ Member Report- Outline

Lighting Market Development Trend-Outline

Lighting Level Package Market Trend- Product Development and Strategy

Trend One: Rising Commercial, Industrial And Outdoor Lighting Markets

Trend Two: Mid Power LED Market Value To Surpass High Power LED For The First Time in 2013

Trend Three: Emerging LED Specs For Backlight And General Lighting Applications; 3030 and 2835 have An Opportunity To Replace 5630

-

3030 LED Has Highest lm/$ And Is Widely Distributed In The Market And Most Preferred

-

5630 LED: High Current Spec Applied in Bulbs And Downlight Products

-

5630 LED: Limited Room For Further Price Cuts As 5630 LED Price Closes To Production Costs

Trend Four: LED Manufacturers Speed Up COB Product Development

Source: LEDinside

LED Lighting Market Trend- Worldwide LED Lighting Market

Global LED Lighting Market Trend

Regional LED Lighting Market Trend- Americas

Regional LED Lighting Market Trend- Europe

-

EU: New Eco-design Requirements For LED Lights

Regional LED Lighting Market Trend- China

Global LED Lighting Penetration Rate Generally Increases

2012~2014 Global LED Lighting Market Revenue Forecast

2012~2014 Global LED Lighting Market Value Forecast- By Regions

2012~2014 Global LED Lighting Market Value Forecast- By Products

2012 Global LED Lighting Market Value: Regions vs. Products

2013~2014 Global Lighting Fixtures Demand Rapidly Growing

Source: LEDinside

2013~2014 Lighting Manufacturers' Development Strategies

-

Global Lighting Market: Major Manufacturers Only Have A 38.2% Market Share

-

Global LED Lighting Market: Major LED Luminaire Manufacturers Only Have a 50.6% Market Share

-

Japanese Manufacturers Way Ahead Competition in LED Penetration Rate in 2012

-

2013 European, U.S. and China Luminaire Manufacturers Penetration Rates Take A Big Leap Forward

2013~2014 Lighting Manufacturers' Development Strategies

-

Strategy One: Price Strategy

-

Lighting Manufacturers Actively Cut Prices to Stimulate Market Demand

-

Global LED Bulb Prices Gradually Approach To Conventional Lighting Product Prices

-

Wal-Mart Introduces Low-priced Product, 60W Equiv. LED Lamp Has Come To Sweet Point

-

The Introduction of New Technologies and Materials Will Also Be The Focus For Manufacturers in The Future

-

Strategy Two: Bidding And Subsidy

LED Manufacturers Actively Seek Project Bidding and Subsidies in All Regions

In North America, LED Lamps Obtaining Energy Star Rebate Grow Rapidly With Subsidies Intensified

74% Of the United States Is Covered By An Active Lighting Rebate Program in 2013

Cree LED Bulbs Obtained Energy Star Rebate And Had Substantial Growth in Shipments

-

Lighting Manufacturers Acquiring Channels And Related Technology Companies

-

Lighting Manufacturers Rapidly Enhance Competitiveness By Acquiring Channels and Technology- Philips / Acuity Brands

-

Strategy Four: Intelligence System

-

Intelligent Lighting Enhances The Products' Added Value

-

Intelligent Products Development And Total Lighting Solutions

-

LED Residential Lighting: Promoting Intelligent Lamps And Wireless Control

-

LED Outdoor Lighting: Promoting Street Lamps Central Control System

-

Strategy Five: Brand Image

-

Lighting Manufacturers Actively Promote Their Brands

-

Analysis of European Desk Lamps: VIBIA & Foscarini Have Higher Premium From Brand Image

-

Lighting Manufacturers Actively Develop Channels

-

Electrical Wholesalers Account For 64% Of North America Lighting Market Sales Channel

2014 Backlight Market Trend-Outline

2014 LED TV Market Forecast And Technology Development

-

TV Brands Shipment Forecast And 2014 Market Outlook

-

2009~2017 LED TV Penetration Rate Trend

-

2013 And 2014 LED Specification For TV Application

-

New Lead Frame To Raise LED Power And Reduce LED Usage Volume

-

QD Phosphor With Better Color Saturation Helps Manufacturers To Do Product Differentiation

-

LED Market Value And Volume For TV Application Trend

Tablet Shipment Forecast And 2014 LED Market Outlook

-

Tablet Shipment Forecast And 2014 Market Outlook

-

LED Market Value For Tablet Application Trend

-

Tablets Gradually Increasing Its Share In M/L-Sized LED Backlight Market Value

-

Smartphone Shipment Forecast And 2014 LED Market Outlook

Smartphone Shipment Forecast And 2014 Market Outlook

-

LED Market Value For Smartphone Application Trend

-

Flash LED: iPhone 5S Dual-LED Flash Design To Stimulate Market Demand

If you would like to know more details , please click here or contact :

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972 |

Terrence Lin (Taipei)

TerrenceLin@trendforce.com

+886-2-7702-6888 ext. 655 |

|

|

|

Sara Fan (ShenZhen)

sarafan@sz.dramexchange.com

+86-755-8283-8931 |

Allen Li (Shanghai)

AllenLi@trendforce.com

+86-21-6439-9830 ext. 608 |