Upholding a positive outlook on smartphone optical and LED application markets large demands, Taiwanese sapphire substrate manufacturer Crystal Applied has kicked off production expansion projects in Yancheng City located in Jiangsu Province in China. As more manufacturers expand production capacity in the industry, finding methods to increase profits will be key to survival, said Chang Chien-ming, Chairman of the company’s Yancheng City branch.

The company’s business management model has always “focused on its expertise, and trusted experts.” Crystal Applied has concentrated on its polishing and sapphire cutting process, which has been key to its success in becoming the world’s largest sapphire substrate manufacturer.

|

|

Chang Chien-ming, Chairman of Crystal Applied's Yancheng branch in China. (LEDinside) |

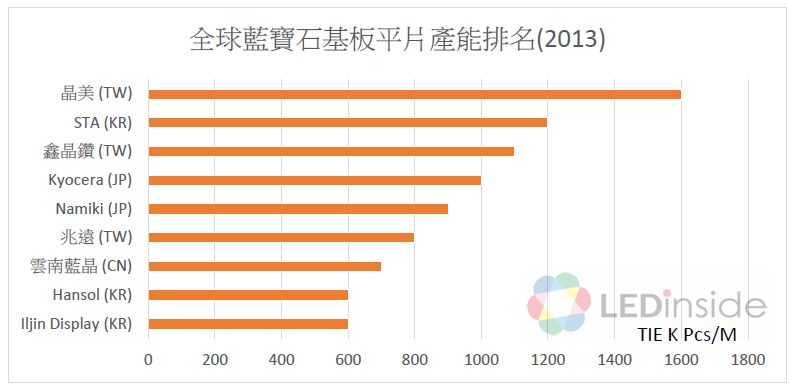

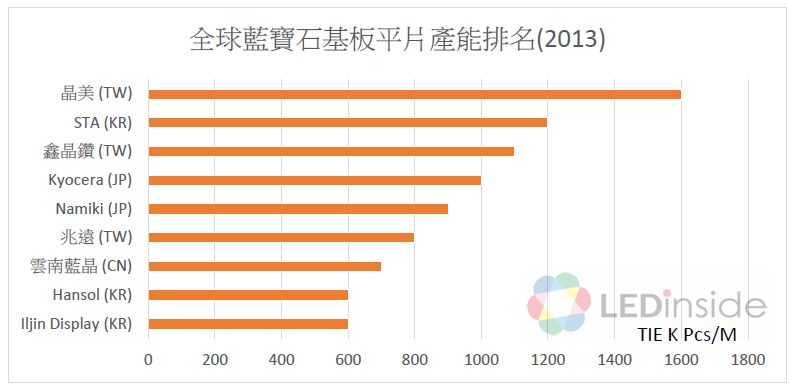

Crystal Applied ranks as world’s top manufacturer for polished sapphire substrate production capacity

Crystal Applied’s current polished sapphire substrate production capacity in its factory in Yangmei, Taiwan is about 600,000 PCS per month, while its factory in Yanchen City in China is about 1 million PCS per month. In 2013, the company’s combined monthly production capacity reached 1.60 million PCS making it the world’s largest polished sapphire substrate manufacturer.

The company’s main goal in 2014 is to expand PSS production capacity to acquire larger market share in the LED application market. To enter the PSS market, Crystal Applied acquired Giant Bright Services, an optoelectronic subsidiary of Walsin Lihwa in 2013. The company’s current PSS technology team comprises of members mostly from Walsin Lihwa, who have considerable understanding of the LED industry. Crystal Applied has also invested in expanding PSS production by shifting production lines from Taiwan to China. The company’s PSS monthly production capacity is expected to reach 360,000 by the end of September 2014. The company aims to raise production capacity to 600,000 by the end this year. As Taiwanese and Chinese LED manufacturers 4-inch sapphire substrate usage volume increases, Crystal Applied’s 2-inch and 4-inch PSS production ratio is expected to reach 50-50.

|

|

Global sapphire substrate production capacity rankings for 2013 measured in TIE K PCS/M. From top to bottom: Crystal Applied, STA, Tera X Tal Technology, Kyocera, Namiki, Crystalwise Technology, Crystaland, Hansol, Iljin Display. (Source: LEDinside) |

Crystal Applied becomes one of the few certified Apple sapphire substrate suppliers

Sapphire substrate demands have soared since Apple introduced sapphire cover glass into the Home button in 2013, causing suppliers including Lens Technology and Biel Crystal to procure large volumes of sapphire substrates from other manufacturers on the market, according to observations by LEDinside. The two companies, however, have large in-house sapphire substrate production capacity, which will gradually diminish their sapphire substrate orders.

Responding to changes in the current sapphire substrate supply chain, Crystal Applied and Korean manufacturer Sapphire Technology Co. (STC) are the only Apple certified sapphire substrate manufacturers, said Crystal Applied General Manager Chen Yan-Ren. Future sapphire orders will be increasingly focused on Apple supply chain.

|

|

Crystal Applied factory. (LEDinside) |

Most 2-inch sapphire substrate optical applications have been in protective camera cover lenses and fingerprint recognition in Home buttons, explained Chen. With Apple’s new iPhone 6 launch date scheduled around second half of 2014, Crystal Applied has observed soaring optical application demands for smartphones, tablets and other applications since July this year.

As for sapphire glass covers for smartphones, Chen noted the market has continued to report yield rate issues. Sapphire glass covers might be released before the end of 2014, but the issue will be stock up volumes. Once sapphire cover glass becomes extremely popular among consumers, competing smartphone manufacturers will also start introducing the material into their phones. There are already market rumors that Chinese smartphone manufacturers including Xiaomi and Coolpad Group have intentions of using the material, as well as knock off smartphone manufacturers, who are closely following Apple’s iPhone 6 developments.

Crystal Applied’s positive outlook also spreads to supply chain opportunities in the none-Apple smartphone sector. The company will continue to improve manufacturing process and expand production capacity to meet large market demands to maintain its leading position as the world’s largest sapphire substrate manufacturer.

(Author: Roger Chu, Research Director, LEDinside/Translator: Judy Lin, Chief Editor, LEDinside)