The LED package market value reached US $13 billion in 2013, in which LEDs for TV backlight amounted to 20 percent, according to LEDinside’s latest “LED Residential Lighting and Backlight Market Trend” report. LED backlighting have almost completely replaced all CCFL light sources in TV backlight, however, with market penetration rates reaching a pinnacle the market faces threats of market saturation. Below are five major trends in the LED backlighting market:

Trend one: direct-type LED TV goes mainstream

Direct-type LED TV has a market share of 60 percent in 2014, according to LEDinside survey. The TV type offers better C/P ratio for panel and TV manufacturers that have continued lowering price trends. Since direct-type LED technology can reduce LED usage volume, LED backlighting costs have dropped, but the TV’s has a flaw of being thicker. The main TV models shipped feature Optical Distance (OD) of 25-35 mm. Direct-type LED TV costs can be further lowered in the future, as the TV type uses higher wattage LEDs.

|

|

Second generation Xiaomi smart LED TVs come in an array of candy colors. (Photo Courtesy of Xiaomi) |

Trend two: edge-type LED TV technology will still be around in future thin TVs

Despite direct-type LED TV’s lower costs, there has been few advancements in making the chubby TV thinner. In general, most LED manufacturers face production shortages for optical lenses with wider beam angles. Slimming direct-type LED TVs with these lenses could raise productions costs, and cause the TV to lose cost advantages. LEDinside found manufacturers have been unable to lower costs for OD 15 LED TV, with some direct-type LED TV costs even higher than edge-type LED TV. LED manufacturers might be raising edge-type LED light bar shipments in 2015. In 2014, edge-type LED TV on average had a luminous efficacy of 110 lm/W, and has better cost competiveness when employed in thin high-end TVs.

Trend three: rise of 4K2K TV to spur LED usage in TV backlight market

LEDinside estimates the 4K2K TV penetration rate in 2014 is 5-6%. TV sales have not reached estimations due to the higher price tag, for instance a 55 inch 4K2K panel usually costs 1.6-1.7 times the price of a same sized Full HD panel. Further sales growth is only likely if 4K2K TV prices can be lowered to 1.3 times the price of a Full HD panel.

Trend four: The rise of Chinese package manufacturers

Whether it is TV brand image or market share, Chinese TV manufacturers have started to make their mark on the market. Based on global TV shipment estimations, leading six Chinese TV vendors have already made it into the top 15 rankings. Among these TCL and Hisense have 137 million sets and 115 million sets respectively, both surpassed Japanese TV vendor Panasonic to take 5th and the 6th place respectively. Chinese manufacturers Skyworth and Konka also ranked in 8th and 10th place.

The emergence of Chinese panel and TV manufacturers led to Chinese packagers maturing technologies and price competitiveness. These have caused changes in the supply chain, and allowed Refond, MTC and Dongshan Precision Manufacturing (DSBJ) to enter the TV backlight supply chain.

Trend five: Chinese manufacturers follow Xiaomi’s lead in the smart TV market

Chinese consumer electronics manufacturer Xiaomi is about to release its second generation TVs, which will be mass produced in 2Q14. The TV size has expanded from 47-inch to 49-inch and 55-inch TVs. Main resolution specs in narrow bezel 3D LCD panels has been 1,920x 1,080 pixels and retailed at RMB 2,999 (US $ 488.38). Within a few months, Xiaomi has quickly distributed the second generation TVs. To claim smart TV market shares in China, the company’s strategy has been offering high quality products at low prices. Xiaomi has been using a total of 128 PCS 7020 LEDs in smart TVs, while U.S. and Taiwanese TV brands have only been using two light bars. It is believed other Chinese TV manufacturers will also follow Xiaomi in launching their own smart TV products.

3Q14 Silver+ Member Report-

Global Residential Lighting Market Trend

Executive Summaries

-

Ten Key Factors in Residential Lighting Market

-

Top Three Growth Drivers and Restraints- Demand Side

-

Top Three Growth Drivers and Restraints- Supply Side

Exploration of market and products

-

Global residential lighting market analysis

-

Analysis of China’s residential lighting market

-

Analysis of Europe’s residential lighting market

-

Analysis of Japan’s residential lighting market

-

Analysis of North America’s residential lighting market

-

Analysis of Taiwan’s residential lighting market

Key Companies Activities

-

Analysis of Chinese manufacturers activities

-

Analysis of European manufacturers activities

-

Analysis of Japanese manufacturers activities

-

Analysis of North American manufacturers activities

-

Analysis of Taiwanese manufacturers activities

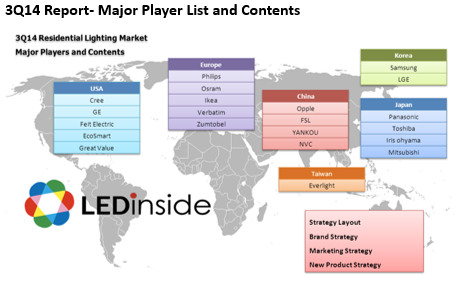

3Q14 Report- Major Player List and Contents

Backlight Market Trend

-

Smartphone Application- Top Four Market Trends

-

Smartphone Application- Top Three Market Technologies

-

Tablet Application- Two Market Trends

-

TV Application- Top Seven Market Trends

-

TV Application- Top Five Market Technologies

If you would like to know more details , please contact:

Joanne Wu +886-2-7702-6888 ext. 972 joannewu@trendforce.com