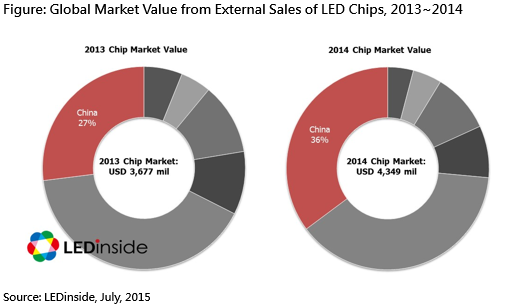

“LED chip manufacturers benefitted from the lighting market’s demands and saw their revenues soared in 2014,” said Joanne Wu, assistant research manager for LEDinside.

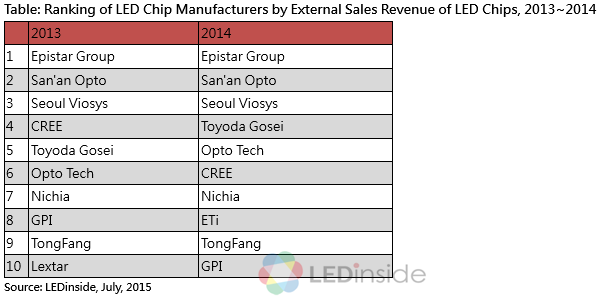

Epistar led in the external sales revenue of LED chips for both 2013 and 2014 due to its technological advantages and stability in customer management. Epistar’s rival San’an Opto increased its MOCVD equipment capacity during 2013~2014 as well as exploiting the lowering price trend in the Chinese lighting market. San’an Opto therefore took second place in 2014 with its revenue reaching US$565 million. Owing to their capacity expansion efforts, China-based manufacturers ETi and TongFang entered the list of top 10 LED chip manufacturers in 2014, respectively taking $161 million and US$145 million in LED chip revenue.

Wu furthermore sees demands in the LED end market will weaken during 2015. However, Chinese and Taiwanese LED chip manufacturers are still actively increasing their production capacities before the end of LED subsidy programs in China. Consequently, the current oversupply situation will become more severe when the additional capacities become available in the second half of this year. On the other hand, the industry’s long-term development may gain from the intensifying price war since the competition will eliminate second-tier manufacturers that are without competitive advantages.

LEDinside 2015 Global Sapphire and LED Chip Market Report

Chapter 3: PSS specification trend, major equipment vendors in LED and handheld industries

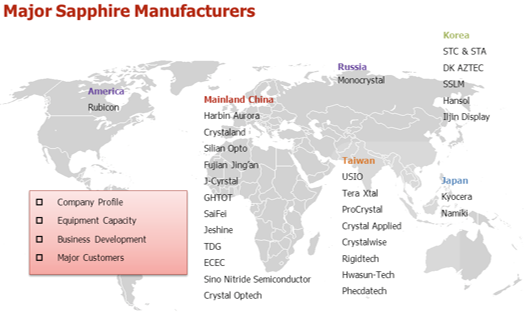

Chapter 4: Major 29 sapphire manufacturers movement are stressed, covering capacity, major customers, business status. Amongst, 12 Chinese sapphire manufacturers are covered.

Chapter 5: imprint PSS price trend are included

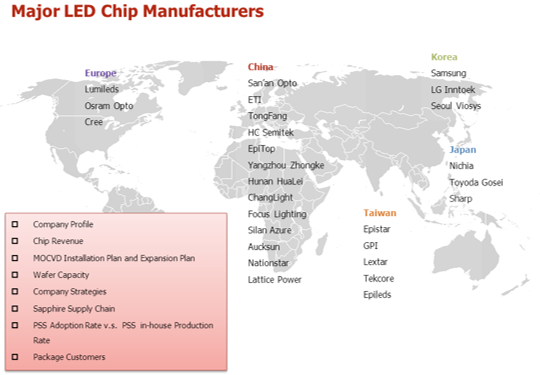

Chapter 6: Major 27 LED chip manufacturers are emphasized, covering MOCVD installation plan, wafer capacity, wafer production plan, sapphire supply chain, PSS adoption rate, PSS in-house production rate, business status, and package customers. Amongst, 13 Chinese chip manufacturers are listed in the report.

Chapter 7: Sapphire market trend in handheld industry, including sapphire material requirement, market trend, opportunities and challenges. Furthermore, sapphire market trend in applications are analyzed.

Language: English

Date of Publication: May 28, 2015

Page: 255

Format : E-file

Chapter I Sapphire Industry Overview

1.1 Sapphire Technology Development

1.2 Sapphire Production Process

Chapter II Advanced Technology in Sapphire Industry

2.1 Mainstream Sapphire Ingot Technology

2.2 Mainstream Sapphire Wafer Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

Chapter III Global Sapphire Equipment

3.1 Sapphire Ingot Furnace

3.2 Overview of Sapphire Sawing, Lapping, Grinding and Polishing Machine, Chamfering Machine, Printing, and Coating Machine

3.3 PSS Equipment

Chapter IV Supply-Side Analysis of Global Sapphire Industry

4.1 Sapphire Industry Supply Chain Trend

4.2 Sapphire Ingot Manufacturer Capacity and Market Value Analysis

4.3 Sapphire Wafer Manufacturer Capacity and Market Value Analysis

4.4 Pattern Sapphire Substrate Manufacturer Capacity and Market Value Analysis

4.5 Major Sapphire Manufacturer’s Business Performance and Market Development

4.6 Sapphire Industry Development Strategies

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Chapter V Global Sapphire Market Price Trend

Sapphire Ingot Market Price

2” Sapphire Wafer and PSS Market Price

4” Sapphire Wafer and PSS / mPSS Market Price

6” Sapphire Wafer and PSS Market Price

Conclusion

Chapter VI Sapphire Market Demand in LED Industry

6.1 LED Market Outlook and Perspective

6.2 MOCVD Installation Volume Forecast and LED Epi Wafer Market Trend

6.3 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.4 Major LED Chip Manufacturer Profile

6.5 Chip House PSS Introduction Rate and PSS in-house Production Rate

6.6 Chip Manufacturers' Sapphire Substrate and PSS Supply Chain

6.7 Cost Analysis of Sapphire Substrate in LED Chip

6.8 Pros and Cons on Four-inch and Six-inch Wafer Production

6.9 Alternative Materials in LED Application Market

Chapter VII Sapphire Market Trend in Mobile Device Industry

7.1 Sapphire Requirement in Mobile Device Applications

7.2 Major Suppliers and Supply Chain Development

7.3 Sapphire Market Perspective in Applications

For further information please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972