(Author: Terri Wang, Analyst, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)

China is one of the world’s largest automotive consumer market, by late 2015 car ownership in the country reached 172 million cars, and the volume is accelerating. It can be projected in the next few years, Chinese market demands for automotive components and after sales services will increase, the automotive lighting market possesses huge market potential.

Currently, international automotive lighting companies that have formed joint ventures with Chinese manufacturers have claimed the largest market shares for LED components, modules, and finished automotive lights. Local Chinese companies have fallen far behind.

Chinese LED package manufacturers still primarily entering lighting for the automotive aftermarket sector

The LED component market is mostly led by large international manufacturers including Osram, Nichia and Lumileds. Majority of headlight manufacturers are using these big LED brands components, additionally Everlight and Dominant Opto Technology are actively expanding their market shares in the taillight sector.

Automotive manufacturers high automotive lighting quality and technical certification standards has made core automotive lighting technologies a closed sector, hence only a few Chinese LED component companies have been able to enter automotive OEM. A strong contrast compared to top international competitors. Still, Chinese LED package manufacturers are trying to develop products to enter the automotive lighting market, and gradually break up the monopoly.

Anrui Opto, is a joint venture formed by San’an Opto and Chery in 2010. Anrui Opto and BAIC Yinxiang (Yinxiang), a subsidiary of Baic Motor Corporation, signed a partnership agreement. Yinxiang mostly manufactures automotive LED lights, including rear compound lights (RCL), signal lights, and interior decorative lights. Anrui Opto supplies about 70% of LEDs for the above listed lights to Yinxiang. Additionally, Anrui Opto’s main clients include Chery, Beiqi Foton Motor and Zotye Auto. In 2014, Anrui Opto’s revenue reached RMB 80 million.

FordaLite became a wholly owned subsidiary of Hongliopto in 2013, and entered the automotive LED market. FodaLite’s main product portfolio includes signal lights, headlights, where some of the products uses Hongliopto’s LED components. Currently, the company’s major clients are still oversea automotive aftermarket sector, and has not entered the entire automotive supply chain yet.

Additionally, Chinese component manufacturers including Refond and others are also gradually developing automotive LED products, but are still mostly focused in the aftermarket, and have relatively small market shares. It will take some time before the companies are able to enter automobile market’s OEM sector.

Chinese and local Taiwanese manufacturers grab automotive module market shares

There are only a few large Chinese LED module manufacturers, BYD Auto for instance has a comprehensive supply chain, enabling most of its automotive lighting modules to be manufactured in-house. Additionally, Felio Acoustic has more than 90% stake in automotive lighting manufacturer Shanghai Sunlight Enterprise, its wholly owned subsidiary Shanghai Sunlight Opto Device is one of the largest domestic automotive LED module manufacturers. The group’s lighting revenue reached RMB 442 million (US $67.12 million) in 2014.

Shanghai Sunlight Opto Device was founded in 2004 as a subsidiary of Shanghai Sunlight Enterprise, and currently all its products are supplied to the OEM market. It is closely collaborating with big automotive lighting clients include Guangzhou Automobile Group Component (GAC), Magna, Stanley, Automotive Lighting Wuhu, Changzhou Xingyu Automotive Lighting System, Hella, Tianchong Vehicle Lamp Group, Fuzhou Koito Lamp and others. The products are being applied in FAW-Volkswagen, SAIC Volkswagen, Audi, SAIC-GM, Guangqi Honda, Changan Ford Mazda, Chery, FAW Car Company, Chinese Motors Corporation (CMC), Great Wall Motor, JAC Motors and other car brands. Sunlight Opto Device main product portfolio include rear lights, stop lights, fog lights, turn lights, interior decorative automotive light modules. The company is also an OEM of Osram automotive LED bulbs, and has sold and manufactured more than 80 million bulbs since 2014.

|

|

Shanghai Sunlight Enterprise’s main automotive lighting clients. (LEDinside) |

Additionally, Taiwanese vendors have basically grabbed all the market shares for LED modules for automotive lighting in the aftermarket sector in China. LasterTech has been the most aggressive in its market strategies. Manufacturers producing LED modules for automotive lighting applications revenue reached RMB 510 million in 2015, where 90% of revenue was generated from China.

LasterTech was founded in 1999, and started to develop its LED automotive lighting business in 2005 by constructing an automotive lighting production and assembly line in Zhonghe, and by 2008 it started establishing manufacturing facilities in Shanghai to produce automotive LED modules to enter China’s OEM market.

The company’s main clients include domestic car brands, joint ventures set up between domestic and foreign automotive lighting manufacturers, including Shanghai Koito Automotive Lamp, Guangzhou Koito Automotive Lamp, Great Wall Motors, and BYD Auto. Great Wall Motors SUV car sales escalated over the last two years, all the new cars are equipped with LED Daylight Running Lamps (DRL), which has become the main revenue source for LaserTech, and makes up 40% of the company’s revenue shares. The Taiwanese company supplies all the automotive LED modules to vehicles manufactured by Great Wall Motors.

LaserTech also supplies 50% of LED modules to Shanghai Koito Automotive Lamp. The Taiwanese company started shipping large volumes of LED headlight modules to Shanghai Koito Automotive in 2016, and is indirectly supplying LED components to Great Wall Motors, Chery Jaguar and other automobile brands. The automotive LED lights are used in car models being sold in the Chinese market.

Aside from LaserTech, other Taiwanese companies including Optor and Stark Technology are also valuing the Chinese market and actively expanding production capacity. They are cooperating with local Chinese automotive manufacturers, automotive lighting companies, or large Chinese automotive LED lighting supply chains.

Chinese manufacturers seeking entry into automotive manufacturers supply chains

In the LED automotive lighting sector, joint ventures formed between international manufacturers and Chinese makers have acquired a lions share of the market, these include Koito, Hella, Valeo, Stanely and others. Most of these manufacturers have formed joint ventures with first tier Chinese automotive makers, such as SAIC Motor and BAIC Group. As a result, these companies have a more stable supply chain, which is harder for domestic lighting manufacturers to enter. Nevertheless, Chinese automotive lighting manufacturers are eagerly seeking opportunities to enter low entry level interior decorative LED lights, fog lights, rear lights and other applications to gradually develop highly profitable headlights.

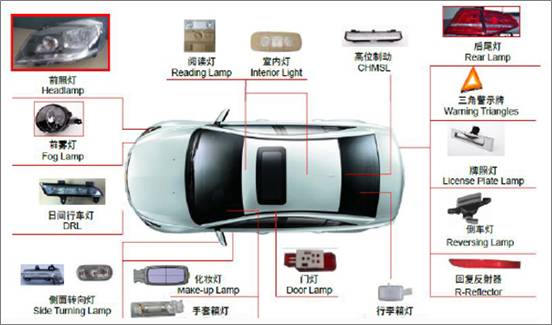

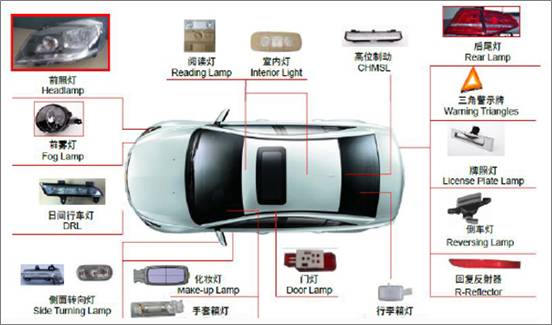

Xingyu automotive LED light product types

Xingyu automotive LED is currently one of the largest Chinese automotive lighting companies, that has tapped into automotive brands FAW-Volkswagen, Tianchong Vehicle Lamp Group, Chery and others supply chains. The joint venture automotive LED lighting brands revenues reached above 70%, and has a nearly 6% market share in the head light market.

Xingyu is an exception, since most Chinese manufacturers are mostly focused in the AM and performance market in the automotive lighting sector, which is smaller compared to Original Equipment. TChong, Zhejiang Jiali (浙江嘉利), Liaowang (南宁燎旺) and other automotive lighting manufacturers are all actively deploying their market strategies in the OEM market, becoming directly involved in new automobile and equipment R&D.

Automotive lighting makers should focus on automotive lighitng manufacturers demand to make new breakthroughs

In general, even though Chinese automotive lighting industry is controlled by a few international manufacturers, the automotive lighting industry’s high gross margin and large market potential remains their focus. Additionally, the company has made technology breakthroughs, and Chinese manufacturers continual developments which has given the market hope in overcoming the market monopolized by international players.

|

|

Xingyu Automotive Lighting System automotive LED products. |

Additionally, LED automotive lighting applications are spreading from high-end car models released by joint venture brands formed between Chinese and foreign automakers to domestic car brands that are actively testing LED lights. Even though most company’s focus is still on interior decorative lights, DRL, and rear lights, the proliferation of Chinese LED headlights is still highly anticipated. This trend has also given Chinese domestic automotive lighting manufacturers the chance to expand their reach on the market, as manufacturers strive to improve their technology they should also focus on automotive makers demands, form partnerships, and develop products that follow automotive manufacturing trends to acquire a spot in the intensely competitive market.