India’s lighting sector has enjoyed accelerated development recently. The scale of the country’s

LED lighting market in particular is projected to expand 47.1% year on year in 2016 to US$1.14 billion, according to the 2016 Indian Lighting Market Report by LEDinside, a division of TrendForce. The government of India intends to turn itself into hub of lighting products across East Asia and countries along the coast. International firms include Osram and Toshiba have taken India as their manufacturing base of global market. India’s domestic and foreign

LED lighting demands are both high. It’s expected that the market will see explosive growth over the next two to three years. By 2020, the Indian

LED lighting market is forecast to grow to US$1.715 billion. In the current

LED industry, although China market is a big cake, developing new markets is still necessary, due to overcapacity and price competition. As a market with great potential, India attracts international enterprise to take it as the next manufacturing base. Aside from low tariff policies based on the Preferred Market Access Policy, other advantages of Indian market also attract investors.

The India LED lighting market is still in its early phase, with opportunities include growing internal demand, promotion of Make in India, zero tariff in Indian market, lighting manufacturers see business potential in Indian lighting market. Meanwhile, product specification improvement can be seen in the market. Moreover, diverse and unique market channels, and differences between the environments of each segment in the lighting industry should be considered carefully when entering the market.

Basic Products with High Cost Performance is Preferred in the Market

Bulb: Divided by light efficacy, products in Indian light bulb market can be divided into two main categories in terms of specifications, including 200lm to 950lm and 1,200lm to 1,800lm with prices separately range from USD 2 to USD 6 and USD 4.5 to USD 10. Indian market tends to use B22 bayonet holders. India-based manufacturers provide LED bulb at 100lm/W. Aside from taking into account varied lumen per watt performance, products with high performance-price ratio is also an advantage of entering the market.

Streetlight: The main specifications of Indian streetlight market mainly have products that deliver 100lm/W at a range of color temperature from 4,000K to 6,500K, 70 CRI and IP 65 and above. Local manufacturers mainly provide LED streetlights with wide voltage range at 90W and below. To better expand the market presence of products, manufacturers should cater to demand by tailoring streetlights for tenders and biddings.

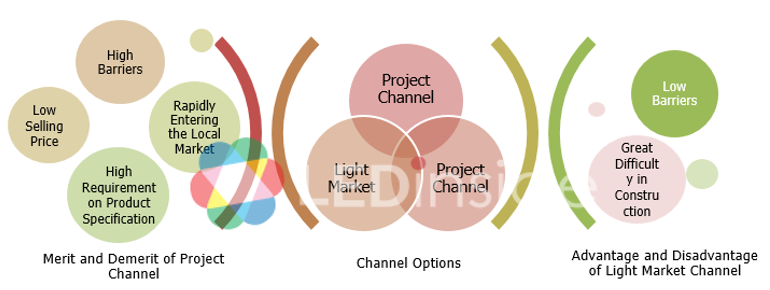

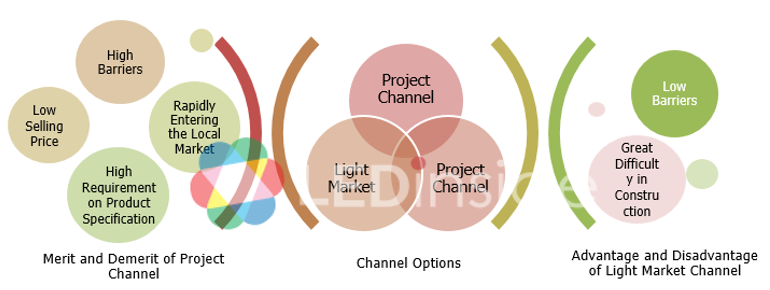

Engineering Project and Luminaire Market are the Major Lighting Distribution ChannelsChoosing proper distribution channels is also a key factor when entering the market. Among major India lighting distribution channels, engineering project accounts for the greatest share, which results from Indian government’s LED lighting replacement. In addition, luminaire market accounts for a greater percentage in LED lighting product sales. The distribution channel covers complete product types while providing varied brands at broad price range. Over the past few years, more and more Chinese lighting products can be found in Indian light market.

Choosing proper distribution channels is also a key factor when entering the market. Among major India lighting distribution channels, engineering project accounts for the greatest share, which results from Indian government’s LED lighting replacement. In addition, luminaire market accounts for a greater percentage in LED lighting product sales. The distribution channel covers complete product types while providing varied brands at broad price range. Over the past few years, more and more Chinese lighting products can be found in Indian light market

|

|

|

Compare the above two channels, it is available to enter the local market rapidly through government’s project bids, however, in order to develop the local LED industry, Indian government is biased toward local enterprises when choosing suppliers, so there is great difficulty in entering Indian market, it is suggested to cooperate with the local manufacturers, in addition, the products for government’s bids are in low price and high performance, and manufacturers need have special government-business relationship to enter Indian market, and enterprises can obtain limited profit in time and costs. The barrier for entering lamps market channel is low, but it costs much manpower, material and time to access.

Besides, due to the particularity of retail business in India, lighting channels with unique local feature also exist in the market. Manufacturers should consider the feasibility and impact of these channels, so as to distribute more precisely in the local lighting market.

Differentiate the Environments of Each Segment in the Industry, Select Strategies According to Own Market Position

Because of the difference in market environment, the strategies adopted by LED upstream, midstream and downstream manufacturers should be varied when entering Indian market.

As Indian LED industry lacks upstream and midstream industry chain, when overseas manufacturers enter Indian LED market, no local manufacturers will compete with whom, but also they can get policy support from local government, however, Indian market is sensitive to price, so the large enterprises with cost advantage are more suitable to enter.

Besides, in order to respond to government policy and meet huge LED lighting market demand, Indian traditional lighting enterprises are upgrading, and the local manufacturers owning large production base are in considerable scale and wealthy, which will bring great business opportunity for LED equipment manufacturers.

In terms of downstream lighting market, there are a few local lighting manufacturers with considerable scale in India, and who are shifting from traditional lighting to LED, Indian government offers great support to these manufacturers in policy and market opportunity. In addition to local manufacturers, the international makers like Philips, Osram and Panasonic have entered Indian market for a long time, so it is not easy for Chinese makers to enter Indian lighting market, given the above, manufacturers should focus on strategy analysis of entering Indian market from strategic choice, government relations strategy, channel strategy and product strategy, and figure out their own position, so as to successfully seize market share in the promising India lighting market.

Terri Wang, Analyst / LEDinside

LEDinside 2016 Indian Lighting Market Report

Release: 31 July 2016

Language: Chinese / English

Format: PDF

Page: 130

-

Chapter One: Methodology and Report Structure

-

Chapter Two: Market Macroeconomics and Key Factors

-

Chapter Three: Lighting Market Scale and Trend Analysis

-

Chapter Four: India’s LED Market Supply Chain

-

Chapter Five: Major Lighting Manufacturers and Strategy Analysis

-

Chapter Six: Indian LED Lighting Product Spec and Price

-

Chapter Seven: India’s LED Lighting Product Specs and Standards

-

Chapter Eight: Indian Lighting Market Channels

-

Chapter Nine: Suggestion and Analysis on Entering Indian Lighting Market

If you would like to know more details, please contact: